A traders' week ahead playbook - the risk bulls starting to feel the love

Key event risks traders need to navigate in the week ahead:

- A huge week of US corporate earnings – we see 47% of S&P500 market cap reporting – Apple, Microsoft, Amazon, and Google among others

- The Tory Leadership battle – the bulk of recent betting capital is for a Sunak win

- ECB meeting (Thurs 23:15 AEDT) – a 75bp hike is fully expected – with Eurozone manufacturing, German IFO, and CPI it could be a lively week for the EUR/GER40

- Aussie Q3 CPI (Wed 11:30 AEDT) – the consensus estimate is for headline CPI to push to 7% (from 6.1%) – this could be influential on 1 Nov RBA pricing which expects a 25bp hike

- Bank of Canada meeting (Thurs 01:00 AEDT) – watch CAD exposures as the market prices 66bp of hikes – it could go either way; 50bp or 75bp?

- BoJ meeting (Friday, no set time) – no policy changes expected but the market continues to test the BoJ’s resolve and expects a policy change in 2023

- US consumer confidence (Wed 01:00 AEDT) – the market expects this to fall to 105.3 (from 108)

- US employment cost index / ECI (Friday 23:30 AEDT) – the Fed look at this data closely, so the market will too – the consensus is for 1.2%, in line with the 1.3% pace seen in Q2.

Like many who assess the event risks in the coming week to understand the potential distribution of outcomes, we also consider the platform that has been set, and how traders could act into the new week. As is so often the way in recent times, with such lively news flow and so many conflicting cross-currents, once again it’s a case of ‘where do I even start?’

One place I can start is how traders feel about a slower pace of Fed tightening – while options expiry may have played a hand in the upbeat/positive flow on Friday, the WSJ’s Nick Timiraos article has now been well-dissected by traders. It certainly puts a big emphasis on the importance of the 2 Nov FOMC meeting, where the Fed should signal a slower pace of hikes in the meetings ahead – a factor that was already priced in markets, but some feel this signal was an uber-soft ‘pivot’.

While we are certainly getting ever closer to a pause in the hiking cycle, the other big elephant in the room is Fed QT and for those modelling where the USD, NAS100 and US500 are headed, the Fed reducing the balance sheet by $95b p/m is still an important input…until Fed buybacks are rolled out, reduced liquidity should limit the US500 upside at the 200-day MA at 4134.

Comments from San Francisco Fed president Mary Daly had the market feeling confident that a Fed terminal rate above 5% is the likely ceiling on rates pricing. The combination of the WSJ/Daly news hitting the market saw pricing for the March FOMC meeting (100-ZQJ2023 on TradingView) fall 13bp, in turn causing a huge curve steepening. US 5yr real rates fell a massive 28bp to 1.57% and eye a test of the bottom of the range at 1.50% - this was good for a 130-handle rally in the US500, a 2% reversal lower in the DXY and a 3% reversal higher in AUDUSD and $38 in XAUUSD.

A positive bias to risky assets

It feels like there could be more positive flow in the tank, so the early view is the US500 tests the 5 Oct swing high of 3807, where a break could see 3895, possibly even 3915, come into play. With 47% of the US500 market cap reporting this week corporate outlooks collide with evolving macro. Names like Apple, Microsoft, Amazon, and Meta hit us with numbers.

The form guide says they’ll likely beat expectations for the reporting quarter, but the question is whether they’ll offer enough visibility in the outlooks for analysts to alter their 2023 earnings assumptions. With consensus 2023 EPS at $240, most feel this will be taken closer to $220 over time, but whether we get the downgrades in these numbers or in Q4 earnings is unlikely. In theory, moves in US rates should remain the dominant driver of equity returns.

If equities do push higher, the AUDUSD has scope for 0.6500, although Aussie Q3 CPI (Wed 11:30 AEDT) will influence that call. With 29bp of hikes priced for the 1 Nov RBA meeting we’d need to see something significantly above the consensus of 7% headline / 5.5% trimmed mean to see the market think a 50bp hike is on the cards – the AUD is more likely to focus on AUD terminal rate pricing, which sits above 4%.

A lively week for the EUR – the BTP- Bund spread could drive EUR flows

The need to hold USDs to hedge equity drawdown risk is reduced on a further equity rally and the USD index could push to 110, although EURUSD rallies may well be capped into 0.9950 and the bear channel highs.

EURUSD daily

The ECB meeting should see the central bank hike by 75bp and again the market is trying to understand how high the ECB could take the deposit rate in 2023 – the market prices a terminal deposit rate of 3%, which means they take rates around 100bp above the perceived 2% neutral rate – there will be focus on the outlook for QT, although if we get any colour on balance sheet reduction it will be very loose – keep an eye on the Italian 10yr BPT – German 10yr bund spread (TradingView code IT10Y-DE10Y), if this spread increases then EURUSD should fall and vice versa.

One can also add the BoJ’s actions to intervene causing USDJPY to trade 151.61 to 146.22 – while our client skew was long JPY on Friday as a mean reversion play, there would have been some pain in that move felt in the broader market – with so many leveraged funds short JPY for carry and rate differential trades.

The BoJ meeting in focus

The BoJ has been drawing down their US Treasury holdings, which partly explains the rise in US bond yields – at $20b a clip, FX intervention is not a cheap exercise to move one’s currency ¥5. However, with the market feeling more confident of nearing a ceiling in Fed terminal rates pricing and US real rates rolling over, this is the time the BoJ/MoF could act as momentum traders and come out again on Monday and intervene – that would truly scare off those core short JPY. Pepperstone clients agree, with 66% of open positions in USDJPY still held short.

The BoJ meeting on Friday will be worth putting on the radar – while the bank should lift their inflation forecasts for 2022 and 2023, it seems highly unlikely we see changes to the policy settings. Clearly, the market does not see the current framework as sustainable and every day last week the BoJ had to step in with special bond buying operations to keep the 10yr govt bond at 25bp. Japan's 10yr swaps trade at 65.5bp, and this tells a fitting picture.

Perhaps most ironic is that the Japanese govt will likely roll out a sizeable fiscal stimulus later this week, with some of this working to help households offset higher prices – with the BoJ perennially the most dovish central bank in G10 FX there is a clear feedback loop here. Do also consider we get Tokyo CPI 2 hours or so before the BoJ and the market expects this to rise from 2.8% to 3.3%.

Who will lead the Tory Party?

We watch the GBP closely given the Tory leadership race. I wrote about the timetable here - https://pepperstone.com/en-au/market-analysis/a-traders-guide-on-the-uk-tory-leadership-battle/ and why the real moves in GBP come on the perception of how next Monday’s fiscal statement is handed down – the situation is fluid and at this point, neither Boris Johnson nor Rishi Sunak has formally thrown their hat into the ring and there is still much conjecture that Boris will actually run even if he does get the 100 votes.

A Sunak victory is the market-friendly outcome and is good for a short-lived GBP relief rally, and potentially takes market pricing of the 3 Nov BoE meeting closer to 75bp. Speeches from BoE members Catherine Mann, Ramsden and Huw Pill and Sam Woods could influence that pricing.

China’s political influence

USDCNH could influence the broad US pairs, but there will be a focus on China equity markets – CN50, ChinaH and HK50 – the weekend visuals of former President Hu being escorted out of the closing ceremony have been widely discussed – whether it moves markets is another thing. A weaker USD would be welcomed though, so watch the moves early in the week, where our opening calls look constructive at this stage.

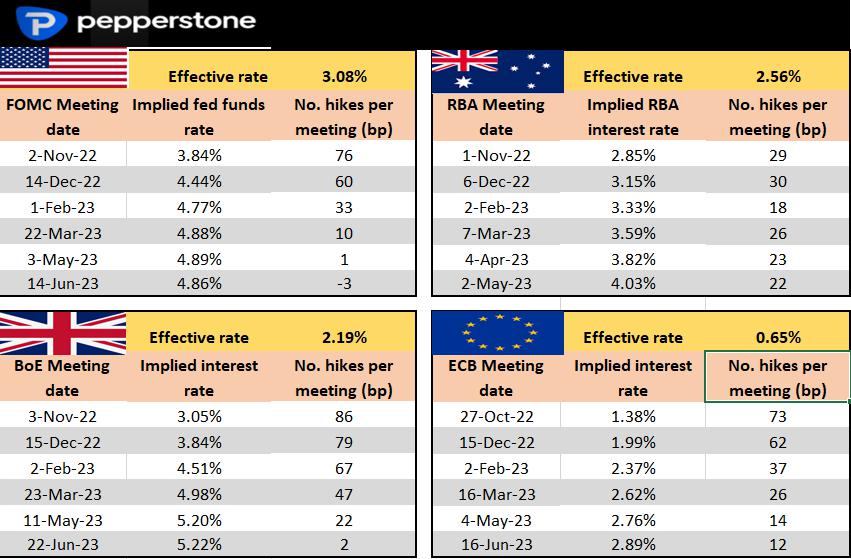

Rates Review - market pricing on the next central bank meeting, and the step up (in basis points) to the following meetings.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.