Our costs and fees

Transparent pricing. No surprises.

We always want to be fully clear on what you’ll pay to trade with us, with no hidden charges. This page covers all trading and non-trading fees across our range of platforms and instruments.

Standard spreads from 0.02 on oil CFDS and 0.1 on gold CFDs. ¹

Raw spreads from 0.0 on a Razor account ¹

0 commission on indices & commodities CFDs

0 fees for deposits or withdrawals ²

0 fees to open or close an account

Minimum deposit just $10

Direct costs

We use multiple liquidity providers from tier 1 banks and institutions, to give you the best possible prices on our wide range of markets.

Spreads*

The spread is the difference between the bid (sell) and ask (buy) price. It’s usually measured in pips - the smallest unit of price movement in trading.

We offer two main account types, with a slightly differing price structure:

- Standard account: All fees - apart from any overnight funding - are included in the spread. There is no commission to pay with the exception of equity CFDs, which are charged a commission rate dependent on the underlying exchange. This provides a straightforward fee structure for newer traders or those seeking an easy-to-manage account.

- Razor account: Offers identical trading conditions to our Standard account, but with commission-based pricing on margin FX. Clients can enjoy raw spreads from 0.0 points, alongside fixed, transparent commissions from $3.50 per lot, per side.

Our commissions

If you trade on a Razor account, you'll pay a commission on each margin FX trade. For MT4/5, these commissions are based on your chosen account currency and the lot size of your trade. Trading commissions for Razor accounts on the MT4 and MT5 platform are listed here

cTrader commissions are calculated as $6 USD roundtrip fixed per unit, and TradingView commissions are calculated as $7 USD round trip fixed per unit. If your trading account is not USD, it will be converted at spot rate in your account currency. Commissions on trades lower than 1 lot will be proportionally adjusted.

We don't charge commissions on margin FX trades made on our Standard account. There's a 1 pip markup on margin FX pairs. For single share equity CFDs, we charge a commission which is dependent on the market traded these are listed here.

Additional trading fees

These are charges that may apply, depending on the positions you hold.

Overnight funding (swap rates)

Rollover interest rates apply to positions held overnight and may result in interest being earned or paid. If you hold a position past 5pm New York time , an interest adjustment will be applied to reflect the cost of funding your position(s). The specific calculation varies depending on the instrument being traded. If you trade forex or CFDs on a spot basis, most trades settle two business days after they are opened (T+2). However, some currency pairs, such as USDCAD and USDTRY, settle on a one-business-day basis (T+1). Any positions that remain open at 5pm NY will be rolled over to a new value date and will therefore be subject to the swap adjustments outlined below. This timeline is impacted by both weekends and public holidays. [Tabbed swap charges]

Rollovers over weekends

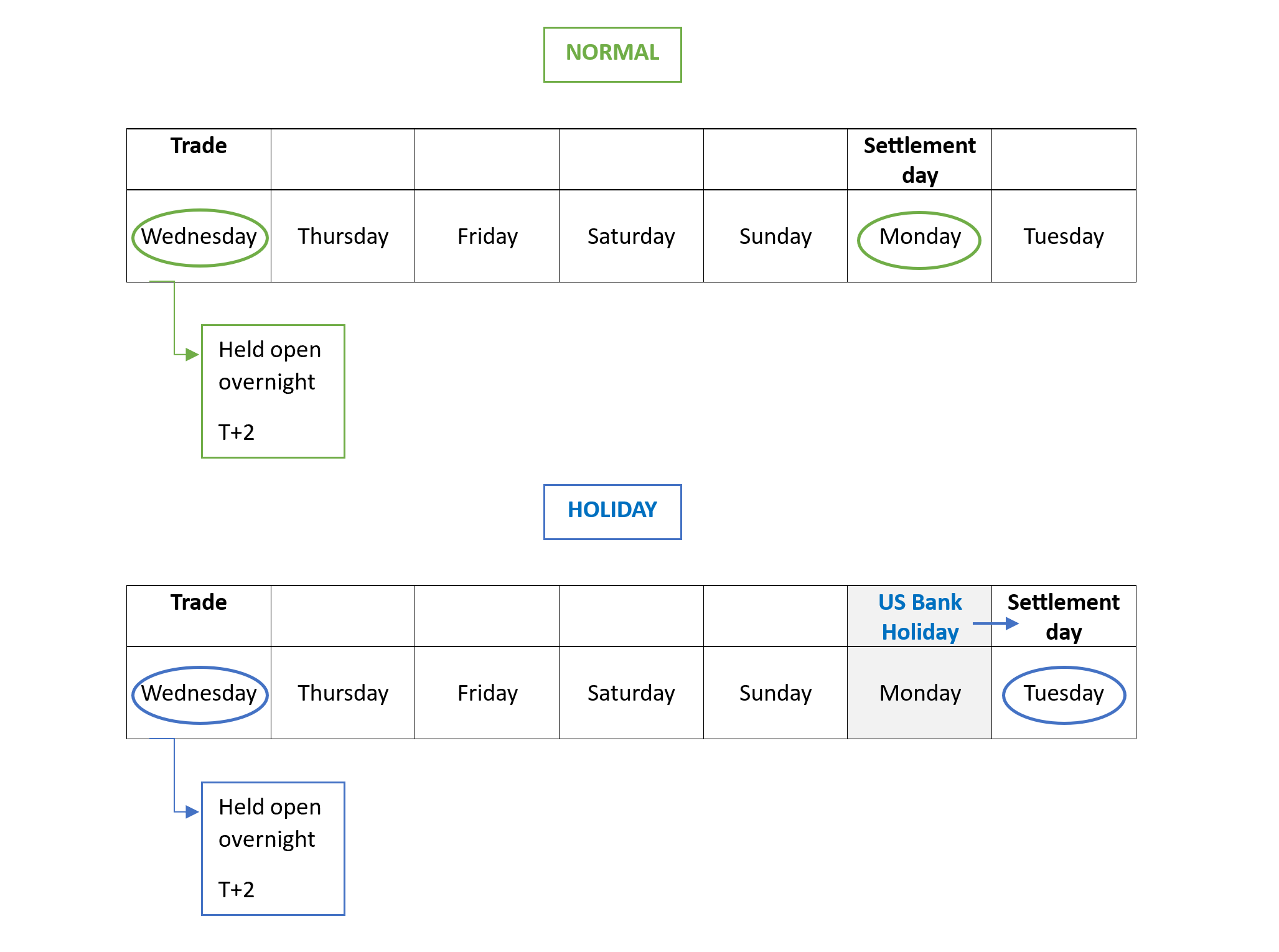

When an open position is rolled from Wednesday to Thursday for T+2 pairs on a trade-date basis, the new value date becomes the following Monday rather than Saturday. As a result, the swap/rollover applied on Wednesday evening will be three times the amount shown in the table. The same principle applies to T+1 pairs on a Thursday. This adjustment reflects how FX value dates roll over in the underlying market.

Indices and stocks typically factor in weekend financing on a Friday.

Rollovers over Holidays

When a holiday occurs, value dates roll forward following standard market conventions. A settlement date is valid for an FX transaction only if the central banks of both currencies are open. If either currency has a holiday on the intended settlement date, settlement is postponed to the next day when both central banks are open. For example, if today is Wednesday and the GBPUSD value date would normally be Friday, but there is a USD holiday on the following Monday, then at 5pm New York time on Wednesday, the value date will roll from Friday to Tuesday (instead of Monday). It cannot roll to Monday because Monday is a holiday and no USD settlements will take place on that day. This results in a four-calendar-day rollover (4-day roll). If the position remains open on Monday, that day counts as a 0-day roll. So the swap rate will be 0, meaning the position will neither earn nor incur a swap. The 0 day roll is variable and it may not always fall on the day of the bank holiday.

Daily swap charge / credit = one point x (trade size [or notional amount] x tom-next)

We source our tom-next rates from tier 1 global investment banks. These are updated daily to reflect the interest differential between the two currencies involved.

Note: Our commodity CFD metal swaps are also calculated in the same way.

Daily swap charge / credit = (market closing price x trade size x (our charge* +/- ARR) / 360

*Our charge is 2.5%. If you’re long, you pay ARR. If you’re short, you receive it.

For more information on ARR or other inter-bank reference rates, please see this link.

Daily swap charge / credit = (trade size x (basis* +/- our charge**))

*Formula for the basis = (P3 – P2) / (T2 – T1), where: P2 = price of front-month future P3 = price of next-month future T1 = expiry date of the previous front-month future T2 = expiry date of the front-month future

**Our charge = CFD mid price x 2.5% / 365. If you pay the basis on your trade, our charge is added; if you receive the basis, the charge is deducted.

If you hold a position on one of our index or share CFDs past the ex-dividend date, we will make a cash adjustment to your trading account to reflect the dividend payment. This means you’ll neither be advantaged or disadvantaged by the dividend.

Trading conditions

| Asset class | Max retail leverage |

| FX | 200:1 |

| Gold | 200:1 |

| Metals | 33:1 |

| Commodities (excluding gold) | 200:1 |

| Major indices | 200:1 |

| Stocks | 20:1 |

| BTC/USD | 20:1 |

The initial margin requirement for a trade depends on the leverage, the size of the trade, the instrument and your account currency. You can calculate this using our margin calculator in your secure client area.

Trade sizes vary depending on the characteristics of each instrument, including lot size and market conditions. While you can typically trade from as low as 0.01 lots, both the minimum and maximum trade sizes are not fixed and may differ across instruments.

Non-trading fees

We don’t charge any fees for deposits or withdrawals. Please note that you may incur fees on payments to and from some non-UK banks. You’ll be responsible for any external transfer fees charged by your bank, or our bank.

| Payment method | Minimum deposit | Deposit cost | Withdrawal cost | Deposit processing time | Withdrawal processing time |

| Apple Pay | $10 | Free | Free | Immediate | Up to 2 business days |

| Google Pay | $10 | Free | Free | Immediate | Up to 2 business days |

| Debit/credit cards | $10 | Free | Free | Immediate | Up to 2 business days |

| PayPal | $10 | Free | Free | Immediate | Up to 1 business day |

| Domestic bank transfer | No minimum | Free | Free | Up to 2 business days | Up to 2 business days |

| Neteller | $10 | Free | Free | Immediate | Up to 1 business day |

| Skrill | $10 | Free | Free | Immediate | Up to 1 business day |

| BPAY | $10 | Free | Free | Up to 1 business day | Up to 2 business days |

| PAYID | $10 | Free | Free | Immediate | Up to 2 business days |

We don’t charge any account keeping or inactivity fees. However, to free up space on our servers, we may archive accounts that hold less than ten units of currency and have not been used to trade for three or more months. This enables us to provide the best possible trading conditions for all active clients.

Archived accounts can be reactivated upon request, or you can create a new live account

FAQs

We do not charge additional fees for deposits or withdrawals unless you withdraw funds using a bank wire transaction to an international bank account. In this case, we’ll deduct 20 USD/15 GBP from your trading account balance.

Swap charges (or credits) are rollover interest rates that are earned or paid for holding positions overnight. We apply them on positions held past 5pm New York time (server time). The exact calculation depends on the instrument you are trading.

On both our account types, you’ll pay commission when trading CFDs on shares or ETFs, ranging from 0.07% to 0.20% per side. On a Razor account, you’ll also pay fixed, transparent commissions from $3.50 per lot, per side when trading FX CFDs.

If you hold a position on an ex-dividend date, your account will be adjusted to reflect the dividend amount. This means you’ll neither be advantaged or disadvantaged by the dividend.

Yes, negative balance protection is a regulatory protection for retail traders. If your account falls into a negative balance, we will return it to zero as soon as possible. Negative balance protection does not apply to Pepperstone Pro accounts.

Ready to trade better?

Switch to Pepperstone now and join our global community of over 830,000 traders.³ Apply in minutes with our online application process.

1

Register

Sign up with your email address and get a free demo.

2

Answer

We’ll check your suitability for our products.

3

Verify

Your safety is our top priority.

4

Fund

That’s it! You’re ready to trade.

*All spreads are generated from data between 01/12/2025 and 31/12/2025, covering all trading sessions, including rollover periods. (This will be updated regularly.)

1You may be charged for withdrawals to international banks.

2No minimum deposit for bank wire transfers

3Total number of accounts held with the Pepperstone Group globally, correct as at October 2025.