- English

Xi’s sudden visit to PBoC, supporting the issuance of RMB1 trillion CGB

.jpg)

This visit, which marked the first in his 11-year tenure as China's President, held special significance and garnered widespread attention. During the visit, President Xi expressed support for expanding the fiscal deficit and issuing new government bonds to stimulate the economy and enhance infrastructure development, injecting fresh vitality into the Chinese market. Before delving into the specific outcomes of this visit, it's important to briefly review the current economic situation in China.

Since March of last year, the United States has been implementing quantitative tightening measures to combat inflation, with 11 interest rate hikes that have raised the key federal funds rate target range to 5.25-5.5%. Meanwhile, due to the impact of the COVID-19 pandemic and persistent stringent public health policies, economic recovery remains a top priority for China. To achieve this, the central bank has cut reserve requirements and interest rates twice this year, reducing the cost of funds at the credit end of banks and promoting investment and employment. The divergent monetary policies of the Federal Reserve and the PBoC have put pressure on the Chinese yuan in the foreign exchange markets. To maintain the stability of the yuan's exchange rate, the Chinese central bank has made significant efforts in exchange rate adjustments.

Furthermore, China is grappling with significant capital outflows. In September, the northbound outflows reached $75 billion, marking the highest monthly outflow since 2016. At the same time, the situation in the equity markets does not look promising. Since August, the Chinese stock market has been in a downward trend, with the CN50 index falling by 15% over the past three months. In response, regulatory authorities in China have implemented several measures to rescue the stock market, including cutting the securities trading stamp tax by 50%, injecting funds into large state-owned banks, and restricting stockholders' sales of the listed companies’ shares. However, these measures seem to have limited effectiveness, as the market has shown little sensitivity to the central bank's liquidity injection, and micro-level conditions have not significantly improved. Over the past two weeks, the China 50 index has dropped by about 7%, hitting a new low since November of last year.

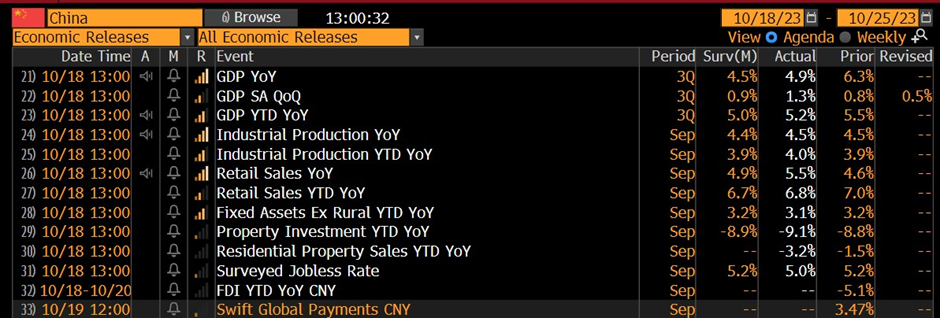

On the other hand, some positive signals can be captured in medium to long-term data releases, with improvements in GDP for the third quarter, industrial production, and retail sales data for September, among others. Despite the Chinese government's introduction of a series of stimulus measures for the real estate market, the situation in the housing market remains challenging, as some real estate developers, led by Country Garden, have faced severe debt defaults, and the public's willingness to purchase property remains subdued. In summary, the Chinese economy is still relatively weak, and against this backdrop, President Xi Jinping's visit plays a crucial role in boosting market confidence.

China's macroeconomic data conveys positive signals.

The outcomes of this visit are significant and offer fresh perspectives to the market. For the first time since the Asian financial crisis in 1998, the Standing Committee of the National People's Congress (NPC) approved mid-year expansion of the central government budget, a rather rare occurrence in history. The Ministry of Finance will expand the budget by issuing central government bonds, amounting to 1 trillion RMB (equivalent to 0.8% of GDP). This implies that the fiscal deficit will cross the 3% "red line," and the deficit-to-GDP ratio will rise to 3.8%. The 12-month rolling fiscal deficit will surge from 5.9% in September to 7.6% by year-end. Of this, 500 billion RMB will be allocated to the fourth quarter, and an additional 500 billion RMB will be earmarked for infrastructure development with an emphasis on flood control projects in 2024.

Meanwhile, the Standing Committee of the NPC has also granted authorization to issue special bonds of local governments prior to the National People's Congress meeting in March, which is expected to raise the total bond issuance to 1.8 trillion RMB in the fourth quarter (1 trillion RMB of central government bonds and 0.8 trillion RMB of local government bonds).

These decisions, surpassing market expectations, are seen as a crucial step towards driving the recovery of the Chinese economy.

CN50 Daily Chart

We can now observe the positive impact of these policy measures on the risk markets. The China 50 index rose by 1.6% yesterday, reaching a high of nearly 11,900 points. However, today's opening saw a retracement in prices, with trading currently around 100 points below yesterday's high. If the price continues to rise as it did yesterday, we will keep an eye on the 12,000 integer level, which corresponds to the 23.8% Fibonacci retracement level of the downtrend since August. Simultaneously, the Hong Kong 50 index increased by 2.6% on the same day, testing the support level at 17,544 points from the end of August. The China Enterprises Index in the Hang Seng rose by 2.8%, briefly touching the significant 6,000 points level. Just like the broader market, both of the Hong Kong stock indices experienced varying degrees of retracement today, giving up some of yesterday's gains.

Copper Daily Chart

Given China's strong demand for copper in its manufacturing and construction industries, the positive news from China had a favorable effect on copper prices. Copper rose by 1.4% yesterday and is up 0.2% today, now testifying the mid-August low of 3.64.

The current situation in China, with low bond yields and low interest expenses, enables the government to offset the deficit relatively easily, which objectively supports economic growth. Nevertheless, some uncertainties remain in the market. In the face of today's retracement, it remains to be seen whether investors will have sufficient confidence to invest in risk assets, whether the Chinese stock market can establish a sustained upward trend, and whether the improvement in macroeconomic data can be sustained. These are issues that we need to closely monitor.

In conclusion, the unexpected support from the Chinese government for the economy is undoubtedly positive news. In support of the new fiscal policy, we also have hopes of seeing another 25 basis points reduction in reserve requirements at the end of the year. Achieving a 5.3% GDP growth rate in China in 2023 does not seem unattainable, especially when considering that a substantial amount of funds will be injected into the market next year, keeping the deficit level relatively high by year-end, thus sustaining economic growth momentum.

However, China's official fiscal revenue and expenditure report for the first three quarters of the year showed that general public budget revenue increased by 8.9% year-on-year in the first nine months, slightly lower than the 10% growth in the first eight months. Combined with significant capital outflows and a weak risk market, all these factors suggest that China's economic recovery is still in its early stages.

President Xi Jinping's visit might be aimed at emphasizing the government's confidence in the economy, but we should remain vigilant to potential challenges. A healthy economic recovery requires ongoing policy support and reforms. We also need to closely follow the Central Economic Work Conference on 30th and 31st of October and the Politburo meeting at year-end to gain more insights.

There are promising signs, and this was a powerful message, but traders have seen a number of rallies of late. Yet each time there is no follow through, and the down trend continues - is this time different?

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420?quality=30)