However, the Pfizer and BioNtech Phase 3 preliminary trials have caused markets to come alive, not that they needed much encouragement.

While several questions remain unanswered the market has turned to the experts and the reaction from those that know has been quite emphatic. Dr Fauci calling the 90% efficacy rate from the trial “extraordinary’, while most healthcare analysts suggest the results exceeded even the most optimistic market expectations. The vaccine should get FDA approval later this month and the market has treated this news release as a major breakthrough, with calls that at this efficacy rate governments would only need to vaccinate 60% of the country to reach herd immunity.

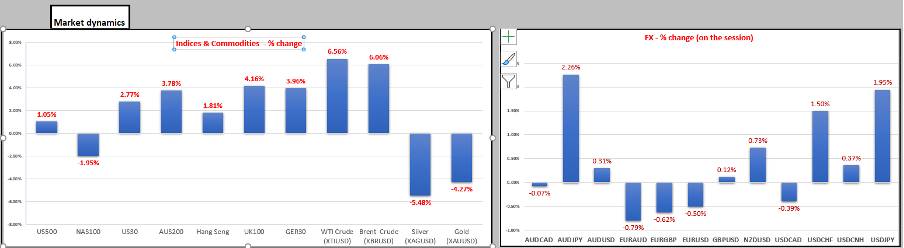

(Moves on the session)

Pfizer has gained 7.7% although well off its highs, but the real winners on the day have been energy and financials, followed with impressive gains in REITS, industrials and materials. Tech has been shunned partly because of the solid gains last week, but because it’s all about value areas of the market with the NAS100 selling accelerating into the close (closing -2.2%). Geographically, European equities have flown with France’s CAC 40 +7.5% and a cure simply can’t come quick enough here, as is the case in the US where case count is exponential and it is going to be a dark winter.

With the roll-out of a vaccine some way off we question if the market is still overlooking the near-term threats? In fact, the Fed mentioned this in its Financial Stability Report (realised in US trade), detailing they see risks that markets take a hit if the virus is not contained in the coming months.

As detailed, value has worked incredibly well with the under-loved sectors of the market playing catch-up, partly helped by US Treasuries getting hammered and with yields on 10 and 30-year Treasuries +11bp and 12bp respectively. Inflation expectations have gained 6bp, so in effect real Treasury yields are up 6bp – not a great breeding ground for gold and silver and when we see the USD up 0.6%, it’s here why we see a sizeable 4.3% move lower in gold and 5.4% in silver.

Consider gold as the anti-bond. If bond yields (especially when we inflation adjust) are moving higher then it subtracts from the attractiveness of yield-less assets and again traders are forced to look elsewhere for returns, especially when the USD is also reacting to moves higher in yield.

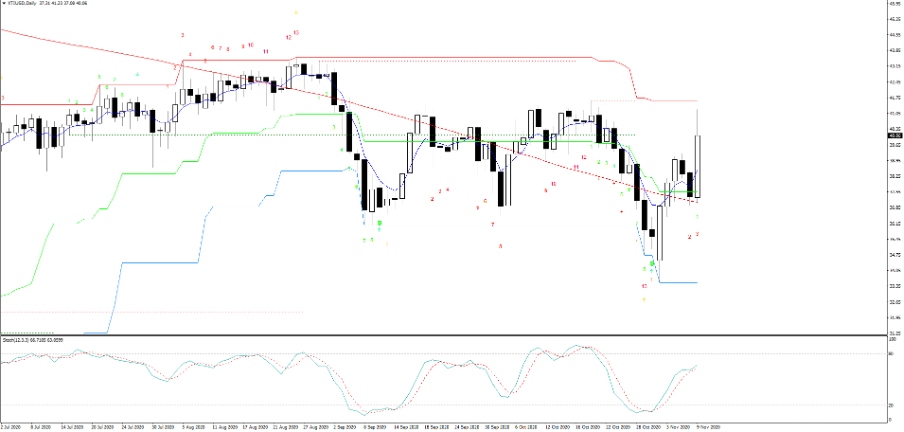

The steeper curve trade is back on and that tells a story of an expected recovery – a story we’ve been seeing for a while in industrial metals and cyclical over defensive areas of the stock market. Today we’ve also seen a monster 7.5% rally in crude and that is about pure demand, or at least the perception of it improving. It’s a tough one, as the US winter could see shutdowns as a more defined theme and that will impact demand, but yet as we look into 2021 the idea of a vaccine gives us hope of better times ahead for economics and earnings.

Our XTIUSD market sits with a 40-handle, but the real test comes in moves into $41.59 and there will be a few traders lining up to fade rallies into here.

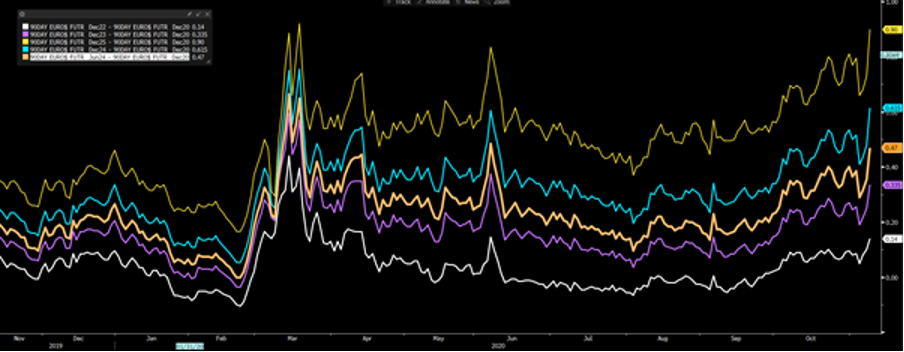

The move in Treasuries means buying value over growth and small caps over large. The long Russell 2000 and short NAS100 has worked well and if we want to express a cyclical recovery this is a trade to watch. In FX markets the moves in US bond yields have resonated in USDJPY and USDCNH moving higher. We’ve also seen EURUSD moving from 1.1920 into 1.1800 before buyers have supported and with it, interest rate markets have started to warm up a little here which is being seen as a USD positive.

Here we see the Eurodollar interest markets. By looking at difference in the yield on the December 2020 contract versus future contracts (I’ve looked at Dec 2022, 2023, 2024 and 2025), we can see the number of basis points of hikes priced for that period. Rates markets are on the move, but with just 14bp of hikes priced by end-2022 its hardly panic stations. However, if the market continues to look past COVID-19 issues and what 2021 could look like, the USD will turn from a sentiment vehicle to one that reassembles a cyclical currency again - even if the Fed will tolerate inflation under its new regime. This will support USDJPY and USDCHF above others.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.