Five reasons to trade US share CFDs with Pepperstone

- Low commission at 2c a share

- No minimum commission – for scalpers, day traders and those trading smaller sizes this can be advantageous

- Never miss an opportunity – trade the pre and post-market sessions and of course the cash market trade

- Take short positions on any US share CFD with ease and without fear of recall

- Trade the full extensive range of US share CFDs on MT5 and the trader favourites on MT4, cTrader and TradingView.

It’s not often that a macro thinker gets excited by US quarterly earnings, but this US Q2 earnings season promises to be influential not just for stock traders, but also for those trading Equity Indices, Commodities, and FX too.

While we're in confession season and 130 companies have already offered guidance, we see the ratio of those issuing negative guidance is 1.7 times that offering positive guidance. This is a slight improvement from Q1 but is still a poor number. It probably shouldn’t surprise given US corporates have had to deal with a rapid slowing in consumer confidence, rampant inflation and a higher cost of living, a huge sell-off in rates and bond market, and a stronger USD and an economic shock in China.

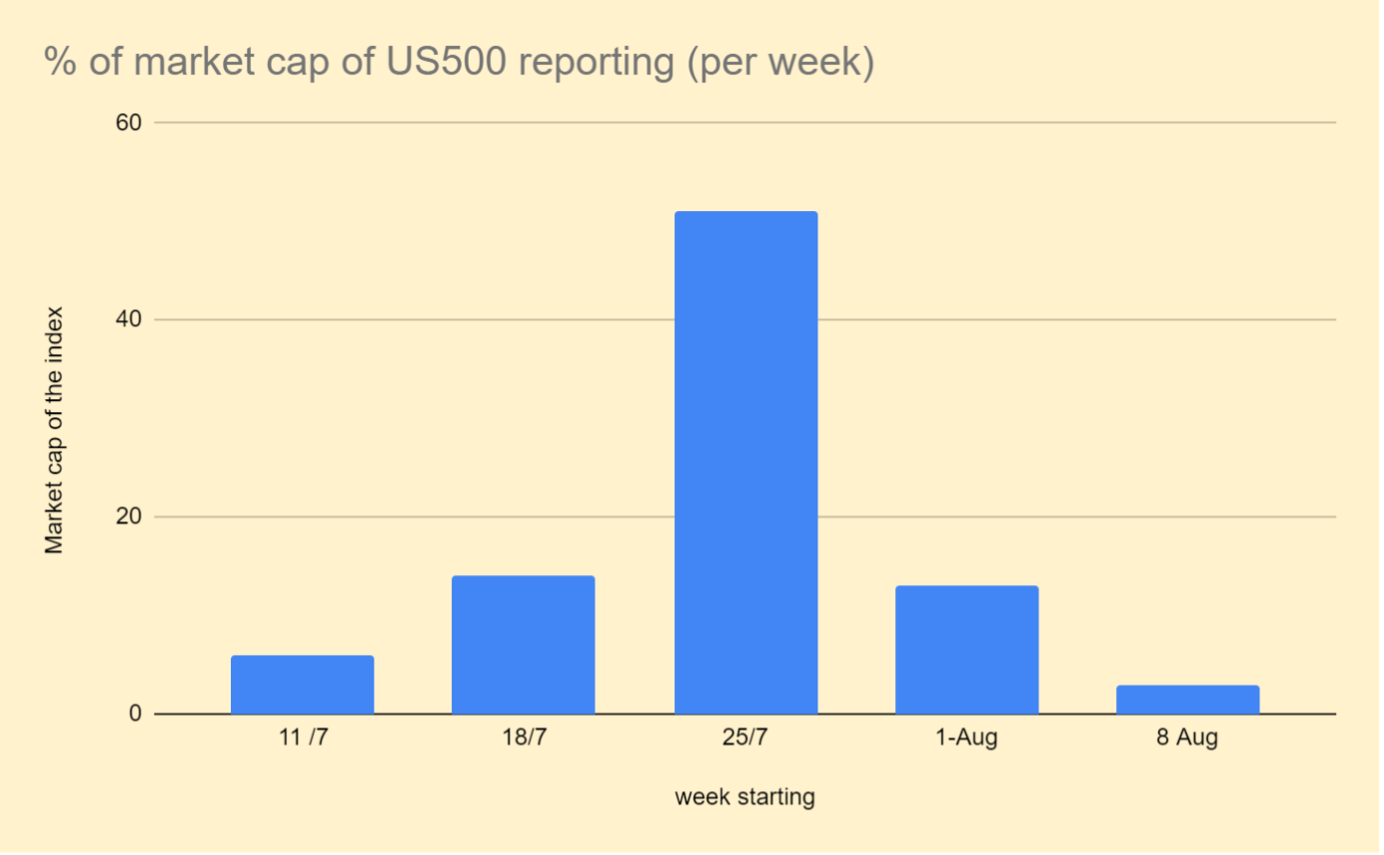

JP Morgan starts the ball rolling on 14 July 2022 and as we see it's the week of 25 July 2022 that the bulk of the S&P 500 market cap report. This should get the attention of clients as its mostly big tech hitting us with earnings.

(Source: Pepperstone - Past performance is not indicative of future performance.)

So, through July and August, we get to hear if they haven’t already pre-guided, from the movers and shakers and those who are trying to operate a business in these evolving conditions – this is where earnings announcements can influence the macro and the market will be sensitive to the level of optimism or pessimism from CEO’s on their perception of the consumer, on broad demand and how they are seeing inventory builds. There will also be a sharp focus on supply chains and if there is any easing that could feed into lower inflation – with the market trying to put a probability on a protected recession, any commentary which will help shape this view could influence markets too.

Earnings expectations must come down – what does this mean?

The market expects just over 4% YoY earnings growth (from S&P 500 companies), which would be the lowest growth since Q4 ’20 and if you strip out energy and industrials, both of which should see solid growth, then S&P 500 aggregate earnings would be in decline. The market lives in the future though and the more pertinent question is whether consensus EPS for this full year and $2.48 in 2023 at $2.28 and $2.48 respectively are just too high?

It seems whoever you talk to the same conclusion is made and that these estimates simply must come down – an outcome which would result in the consensus P/E multiple of the market rising from its current levels of 16.7x. One would subsequently expect this to result in the next leg lower in Equity markets.

The positive aspect is that once the downgrades are complete it should result in a low in equity markets and offer a compelling buying opportunity.

US500 daily chart

(Source: TradingView - Past performance is not indicative of future performance.)

CFD traders hold the power to react

For CFD traders, the more prudent tactic is to listen to what the market is saying and react dynamically to movement from those who are reporting. In this current sentiment regime, any company that doesn’t please the market will be punished and this is unlikely to be a one-day affair – naturally, this should lead to shorting opportunities.

Consider the average decline in S&P 500 companies from their 52-week high is 27%, so a sizeable element of bad news is in the price. However, we should consider the move lower has all been driven by price compression, impacted by rising bond yields and interest rates. As mentioned, earnings haven’t been revised down at all, so this has to be the next shoe to drop - so we can expect big volatility through earnings and that means opportunity.

While many take a negative bias there will be companies whose outlook is perhaps not as bad as feared and may even inspire – these names, especially any with high short interest could see substantial rallies – the job of the trader is to jump on that and look to see if it can develop into a multi-day affair and a momentum move. Big moves on the day of earnings play out as a result of positioning vs the reality and the job of the trader is to trade the reaction.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.