What is gold trading and how do you trade it?

Gold is a highly valued commodity despite its limited industrial applications. It is widely regarded as a store of value and a hedge against inflation.

Gold's appeal is nearly universal, and its price fluctuates based on the dynamics of supply and demand. Additionally, external factors such as the strength of the US dollar and the overall health of the global economy significantly influence gold's market value.

Gold traders hope to benefit from those price fluctuations by having exposure to gold. Buying gold when the price is rising and selling when the gold price is falling.

What are the different gold types that can be traded?

Gold trades in a wide variety of formats, including coins, ingots, jewellery and paper certificates over gold. However, the most well-known trade is the market in gold bullion. Bullion is the name given to bars of almost pure gold that weigh 400 troy ounces or 12.40 kilos.

These are said to be “good delivery” meaning they are acceptable to traders and banks in the bullion markets. There is a cash, or spot market in gold bullion, but also a futures market in the yellow metal.

When trading gold CFDs, traders do not deal in physical gold. Instead, they trade cash-settled, non-deliverable contracts that provide economic exposure to the gold price without the need to physically handle or deliver gold bars. Gold is typically traded in US dollars per ounce but can also be priced in other currencies.

It is also possible to trade in ETFs, or exchange-traded funds, which track the price of gold. ETFs are listed on a stock exchange and are traded in the same manner as stocks and shares.

Why trade gold?

Gold is often in high demand and its price can be a barometer of wider market sentiment, and because of these, and other external factors, its price is rarely static. Trading gold means that you can potentially benefit from that dynamic price action.

Trading gold also allows for portfolio diversification into an asset that is largely uncorrelated with equities and bonds. Additionally, gold is often viewed as an inflation hedge and store of value due to its status as a relatively scarce commodity.

According to data from the industry body the World Gold Council just 212.50 thousand tonnes of gold have been produced in human history, and most of that since 1950.

What are the risks of trading gold CFDs?

Trading gold carries various risks. For example, going against a long-standing trend in price action can be detrimental. Overtrading by taking on too large or too many positions relative to your account size is also risky.

Additionally, poor risk management, such as setting excessively large stop losses or maintaining poor risk-reward ratios, can lead to significant losses. It is crucial to carefully manage these factors to minimise potential losses in gold trading.

Gold markets are often driven by changes in market sentiment, which can happen quickly and are therefore difficult to pre-empt.

The gold market operates on a wholesale level, with participants ranging from professional traders and institutions to central banks.

Gold CFDs are leveraged products, which are very effective at magnifying trading profits, but are equally adept at magnifying trading losses.

How do geopolitical events impact gold prices?

Geopolitical events, and, or economic instability can be a big influence on the gold price. Investors and traders typically sell risk assets in times of crisis and look to move their money into so-called safe havens, one of which is gold. These “risk-off” flows can push the price of gold higher.

Rising interest rates and bond yields can also depress the price of gold. This is primarily because gold does not provide an income, such as interest or dividends. When interest rates and bond yields rise, investors may prefer these income-generating assets over gold, leading to reduced demand for gold.

International capital tends to flow towards assets that offer the best returns for an acceptable level of risk. As such, gold often faces direct competition from interest-bearing, safe-haven assets like US Treasury bonds during periods of rising rates. Investors might move their capital to these assets, which offer returns through interest payments, thus impacting the demand and price of gold negatively.

How can I integrate macroeconomic analysis into my gold trading strategy?

Integrating macroeconomic analysis into gold trading involves understanding key relationships. Changes in the US dollar's value can directly affect gold prices, with the dollar influenced by various macroeconomic data.

High-impact releases, such as Non-Farm Payrolls, inflation data, and central bank interest rate decisions, typically have the most significant influence. Monitoring the macroeconomic calendar helps identify these events in advance.

Markets often react to new information, and significant deviations from trends and forecasts can lead to notable market movements.

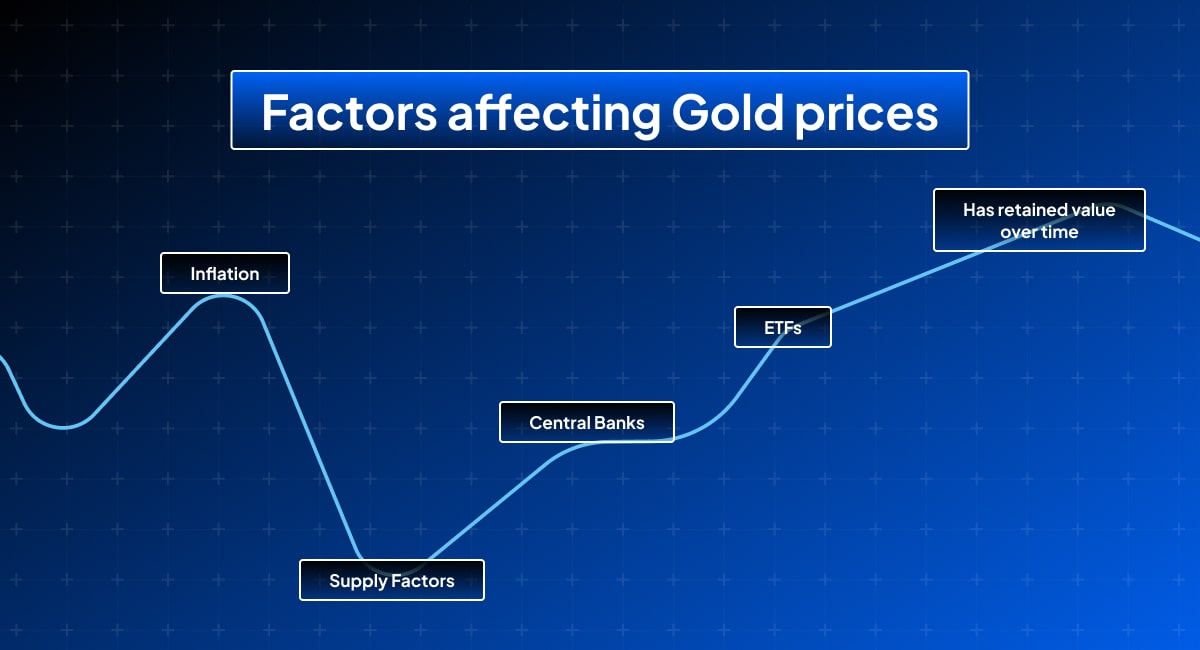

What factors influence the price of gold?

Gold prices are influenced by a wide variety of factors that may include market sentiment, economic data releases, production reports, mine closures, conflict, and natural disasters. Not to mention the supply and demand dynamics of the gold market itself. Perhaps the most significant and persistent influence, however, are changes in the value of the US dollar.

A stronger US dollar tends to push gold prices lower, while a weaker US dollar often causes gold prices to rise. Gold prices can also be affected by gold’s valuation relative to other precious metals and safe-haven assets.

For example, some gold traders pay close attention to the gold-silver ratio, which is the price of gold divided by the price of silver. Traders compare the current ratio and price trends to historical norms and performance to make predictions about future price movements.

What are the different ways to trade gold?

There are several methods for trading gold:

- Physical Gold: One option is to purchase physical gold. While Good Delivery bullion is available, smaller and more affordable ingots and gold coins are also suitable. However, this approach necessitates addressing the issues of storage and security, as a gold reserve requires proper safeguarding and cannot be left unsecured.

- Gold ETFs: Alternatively, you could trade ETFs that track the price of gold such as the SPDR Gold trust (Ticker GLD) which tracks the gold price by investing in physical gold.

- Gold CFDs: A common way to trade gold is through gold CFDs. CFDs have no fixed contract sizes or expiry dates and can be traded long or short with equal ease. These are cash-settled and non-deliverable contracts, which can be traded over a few minutes or several days, depending on your strategy and timescales.

How do I start trading gold?

To start trading gold CFDs there are just a few simple steps you need to take

- You’ll need to open an account with a CFD broker, such as Pepperstone, who will provide you with a choice of trading platforms, and access to gold CFD prices.

- Once your trading account is open you will need to fund it by making a deposit.

- The next step will be to download the trading platform and then you must familiarise yourself with how it works.

- New traders can get to grips with the trading platform and the markets by using a demo account which simulates live market conditions and trading without the need to risk any real money.

- Once you are confident about using the trading platform you will be ready to start trading gold CFDs.

- Pepperstone trades in what are known as gold CFDs, or Contracts For Differences, which are cash-settled and non-deliverable. This means you can trade long or short with equal ease, and don't have to worry about the ownership or delivery of the underlying commodity.

If you’re not ready to start trading and would like to explore further, check out Pepperstone’s guide on what is CFD trading and how does it work to find out more.

What is leverage and how is it used in gold trading?

Leverage allows you to amplify your trading deposit, enabling you to take larger positions in the gold market than your account balance would otherwise permit.

This leverage or gearing is applied through margin trading, where your broker leverages the money in your trading account.

For example, if you have $500.00 in your account and your broker offers 10 times leverage for gold trading, you could control a position worth up to $5000.00 in gold, which is 10 times the value of your $500.00 account balance.

To achieve this leverage, your broker funds the difference between your initial margin or deposit and the notional value of your trade.

If you keep the trade open overnight, you will incur funding or interest charges on the notional value of the trade. However, there are no funding charges on trades that are opened and closed on the same business day.

Please note that margin or leverage rates vary between products and regulatory jurisdictions.

How can I analyse gold market trends?

The price of gold is influenced by various factors, many of which are straightforward to monitor.

Key indicators include:

- Strength or Weakness of the US Dollar: Monitor currency fluctuations as gold is priced in US dollars.

- Macroeconomic Data Releases: Pay attention to key data releases and compare them to existing trends and forecasts.

- Demand for Gold and Futures Positioning: Track the weekly Commitment of Traders reports published by the US Commodity Futures Trading Commission (CFTC).

- World Gold Council: Utilise the resources and information available on the World Gold Council's website for insights into gold and market trends.

How can I choose a gold CFD trading strategy?

A gold CFD trading strategy is influenced by several factors, including the size of your account, your trading experience, the times of day you can trade, and the amount of time you can dedicate to monitoring the gold market.

Many gold CFD traders start with a straightforward strategy, such as buying or selling gold based on the strength or weakness of the US dollar or broader market risk sentiment (risk-on/risk-off behaviour). This can be supplemented with a trend-following approach.

For example, if the US dollar is weakening and gold prices are rising, buying gold may be appropriate. Conversely, if the US dollar is strengthening and gold prices are declining, selling gold may be the right move.

Traders often incorporate simple technical analysis into their strategy to confirm trends. One of the most straightforward methods is tracking the interaction between two simple moving averages, using a combination of faster and slower averages. If the shorter-term (faster-moving) average crosses above the slower-moving average, it indicates upward price momentum. Conversely, if the faster-moving average crosses below the slower-moving average, it suggests downward price momentum.

How can I better manage risk in gold CFD trading?

Effective gold CFD trading risk management involves adhering to several key principles:

- Avoid Over-Trading: Gold prices can be volatile and may not always move in a favourable direction. Limiting the number of trades helps manage risk.

- Correct Position Sizing: Ensure the position size or the number of open positions is appropriate relative to the size of the trading account. This helps mitigate risk exposure.

- Follow Established Trends: Long-standing trends in the gold market are often driven by sentiment and significant institutional activity, including central banks. Opposing these trends can be risky. It's prudent to wait for clear indications that a trend is fading before considering counter-trend positions.

- Use Stop Loss Orders: Implementing stop loss orders helps limit trading losses to a predefined amount. Careful consideration is needed to determine the optimal placement of stop loss orders, accounting for the possibility of slippage.

- Monitor the US Dollar and Macroeconomic Data: Gold prices are influenced by movements in the US dollar and major macroeconomic data releases. Studying the macroeconomic calendar and understanding market expectations for key data releases is essential for informed trading decisions.

By following these guidelines, traders can manage their gold trading risks more effectively.

How to use technical analysis more effectively in gold trading?

Technical analysis can indicate when a trend is weakening or changing. An uptrend is defined as a continuous series of higher highs and higher lows in the price of an instrument, while a downtrend is characterised by an ongoing series of lower highs and lower lows.

Analysing whether higher highs and higher lows or lower highs and lower lows are present in the price action provides insight into trend strength. Indicators such as the RSI (Relative Strength Index) with a 14-day period can signal when gold is overbought or oversold, suggesting a potential trend reversal.

Additionally, candlestick patterns such as "hammers" and "shooting stars" can indicate tops or bottoms in price action, offering further guidance on trend direction.

Gold CFD Trading FAQs

Why is gold considered a ‘safe-haven asset’?

- Gold is considered a 'safe-haven asset' due to its function as a form of money and a store of value with near-universal appeal.

- Historically, the price of gold served as the benchmark for determining the relative values of currencies in the foreign exchange market. Many central banks still hold substantial amounts of gold in their reserves.

- Gold's supply is scarce, and although it is not particularly hard-wearing, it is resistant to all but the strongest acids. It is believed that most of the gold ever mined is still in existence today.

What role do central banks play in the gold market?

- Central banks hold gold as an alternative to fiat or paper currency reserves.

- They buy and sell gold as part of their normal operations, adding to reserves when selling currencies and selling gold in favour of buying currencies or other assets. However, central banks are generally conservative and are predominantly long-term holders of gold.

- According to the World Gold Council, central banks in Europe hold approximately 11,774 tonnes of gold in their reserves.

What are gold CFDs and how do they work?

Gold CFDs are leveraged, cash-settled contracts on gold prices.

They enable traders to speculate on the rise and fall of gold prices without needing to take ownership or make delivery of the underlying asset, allowing for both long and short positions with equal ease.

CFDs are directly traded between counterparties, specifically the CFD broker and the trader.

The CFD broker leverages the trader's account balance, enabling the control of a larger position in gold than would otherwise be possible.

What are the key economic indicators that affect gold prices?

Major economic indicators from leading economies can significantly impact the price of gold.

These include:

- Unemployment and Job Creation Numbers: High unemployment can lead to economic uncertainty, increasing the demand for safe-haven assets like gold.

- Inflation Statistics: Inflation rates affect the purchasing power of money. As inflation rises, the value of currency typically falls, making gold a more attractive investment.

- Industrial Activity Surveys (e.g., -Purchasing Managers Indices or PMIs): These surveys measure the economic health of the manufacturing sector. Lower industrial activity can indicate a slowing economy, increasing gold demand.

- Interest Rates and Monetary Policy Changes at Leading Central Banks: Changes in interest rates by central banks influence the opportunity cost of holding gold. Higher interest rates generally make non-yielding assets like gold less attractive, while lower rates can boost gold prices

These indicators help investors gauge economic stability and make informed decisions about investing in gold.

How does the US dollar impact gold prices?

Gold is priced in US dollars, so fluctuations in the value of the US currency in the FX markets directly affect gold prices.

The relationship between the US dollar and gold prices is typically inverse, which can be summarised by the following rule of thumb:

- Stronger US Dollar: When the US dollar strengthens, gold prices tend to fall. This is because a stronger dollar makes gold more expensive in other currencies, reducing demand.

- Weaker US Dollar: Conversely, when the US dollar weakens, gold prices often rise. A weaker dollar makes gold cheaper in other currencies, increasing demand for the metal.

This inverse relationship between the US dollar and gold prices is influenced by various factors, including inflation, interest rates, and global economic stability.

Can it be profitable to trade gold CFDs?

Gold CFD trading can indeed be profitable, but this profitability depends on various factors, including the trader's skill, strategy, and discipline. Here are some key points to consider:

- Potential for Profit and Loss: Like all forms of trading, gold CFD trading offers the potential for significant profits. However, it also comes with substantial risks, and losses can occur just as quickly as gains.

- Importance of Discipline: Successful gold CFD trading requires a disciplined approach. Traders need to follow a well-defined strategy and adhere to risk management principles. Emotional trading, overtrading, or ignoring risk management rules can quickly deplete a trading account balance

- Role of Leverage: Leverage is a powerful tool in gold CFD trading, allowing traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it can equally magnify losses. Therefore, it must be used appropriately and with a full understanding of the risks involved.

- Risk Management: Effective risk management is crucial. This includes setting stop-loss orders to limit potential losses, maintaining appropriate position sizes relative to the account balance, and avoiding trading against long-standing market trends.

Gold CFD trading can be profitable, but it requires a disciplined approach, strong risk management, and a thorough understanding of leverage. Traders must be aware of the potential for both significant gains and substantial losses. Properly managing these risks is essential for long-term success in the gold market.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.