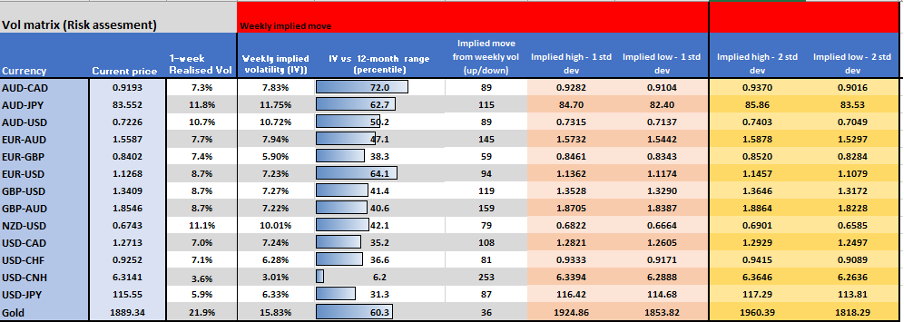

Implied vol matrix and trading range

(Source: Pepperstone - Past performance is not indicative of future performance.)

It’s been a defiant weekend from global nations, who've stepped up the sanctions on Russia in a coordinated and organised fashion – the futures open (mostly 10:00 AEDT) will be interesting and we should see European equity futures on Eurex (open 11:15 AEDT) under pressure (my guess is -2%) – EURUSD is already -1% (interbank) – XAU and Crude should find buyers and many will focus here, with NatGas also front and centre.

What have we seen – I'm sure I will miss a few, so please reach out and let me know:

- Removing a select number of Russian banks from SWIFT – Importantly, energy payments are still accepted – removing this aspect could have far unforeseen consequences on Western consumers – that said, it may well happen in the next week or so

- Stopping the Russian Central bank from using a decent chunk of its $630b FX reserves to support the Ruble – in fact, the EU have approved banning all transactions with Russian central bank– we will see a collapse in the RUB banks runs are happening in Russia and this could lead to massive inflationary pressure.

- S&P/Moody’s downgraded Russia’s debt to junk, not that the govt can go into the debt markets to fund anyhow (although it doesn’t need to right now), but Russia debt will be smashed.

- Personal sanctions on Putin and Lavrov

- Further sanctions on oligarchs

- BP divest its 20% stake in Rosneft – BP will take $25b charge on this – sign of more Western companies severing ties?

- EU to close airspace to all Russian aircrafts

- Norway starting a process to drop Russia from its sovereign wealth fund

- German govt is supplying arms to Ukraine, but they will also start to channel E100b into a fund to revamp the military – this is just over 2% of GDP – a massive change in pushing the budget – in the absence of a flight to quality, German bund yield would spike on this news (supporting the EUR)

How Putin responds to this from an energy perspective is yet to be seen – cutting oil supplies risks crippling the country even more. Public opinion on Putin at the helm seems key.

By way of looking ahead at the key risk drivers in the week ahead, we see:

- Geopolitics – new sanctions removing ‘some’ Russian banks from the SWIFT system need to be digested and should promote increased uncertainty in markets, undoing some of the options driven bullish flow seen on Friday. Measures to restrict the Russian central bank from using its FX reserves to support the domestic economy could really impact Russian assets (USDRUB should fly) – expect more sanctions to be seen this week, so this is a situation that will have many twists for traders to navigate.

- Watch crude, USDRUB, EUR, EU equities (notably banks), GER40, NatGas, XAUUSD, Wheat, Palladium.

- OPEC meeting (Wed) – Let's see what happens with Crude given the new sanctions placed on Russia, but the question is whether OPEC+ increase output by more than the agreed 400k barrels, or whether they increase by even more? With Russia part of the OPEC+ collective, one could easily see this being an event where the group turn a blind eye to the recent price pressures and simply maintain a 400k output hike.

- Expect a decent rally in Crude on the futures open – however, I question whether the gains hold, or will traders sell into the move? See the daily/weekly chart (for oversight on flow), however, the structure sees crude continuing to find supply above the March 2021 uptrend.

- Month-end flows – given the huge moves we’ve seen in February, if it hasn’t happened already, we may see some rebalancing flows that cause questionable price action.

- Fed chair Jay Powell’s testimony to the House and Senate Panel – with a 23% chance of a 50bp hike at the 17 March FOMC, Powell’s comments could position rate expectations and subsequently the USD, front-end yields, and XAU/NAS100.

- Traders hold a trading range in EURUSD of 1.1400 to 1.1100 – will flip bullish through 1.1400.

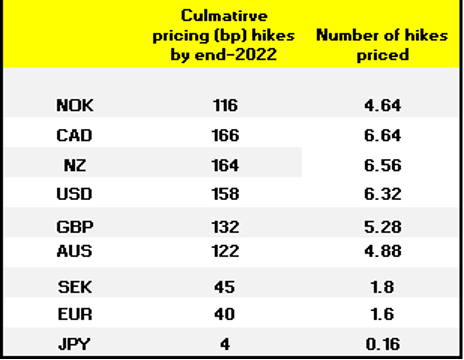

- Bank of Canada meeting (Thursday 02:00 AEDT) – interesting to see implied volatility in USDCAD at the 35th percentile of the 12-month range and pricing 108 pips (higher or lower) over the week (NY cut). Consider every economist (of 25 surveyed by Bloomberg) is calling for a 25bp hike, so there’s a universal view they hike by 25bp (and not 50bp), while the rates market also call for just over one hike –looking forward, the market is pricing in 6.6 hikes by year-end, will the statement share this view – as we reconcile the two, this is where we should see movement in the CAD should come from.

- USDCAD holds a 1.2800 to 1.2650 range – on the week, higher conviction preference to fade strength into 1.2950.

- RBA meeting (Tuesday 14:30 AEDT) – the market isn’t pricing any chance of action at this meeting, but traders will be watching for signs of nuance and subtle change in the statement – modest wage growth and a challenging macro backdrop should see the statement largely unchanged, and the bank should retain a patient stance. With rates lift-off (from the RBA) now priced for July and 4.8 hikes priced this year, the market will start to question this position in the next few weeks.

- Risk sentiment will impact the AUD, but with funds cautiously bullish on commodity currencies I’m keen to turn outright bullish AUDUSD through 0.7280. EURAUD shorts may be the better trade and work for a move to 1.5262 – add on a close through the Oct swing low.

- Aussie Q4 GDP (Wed 11:30 AEDT) is expected at 3.6% - should be a non-event for the AUD.

- US non-farm payrolls (Sat 00:30 AEDT) – the market expects 400k net jobs to be created in Feb, with the U/E rate to tick down to 3.9% - wages are key, so focus on average hourly earnings (consensus 5.8% from 5.7%) – the participation rate is expected to remain at 62.2%. Along with US Feb CPI (released 11 March), the NFP report has the potential to increase the prospect of a 50bp hike in March FOMC, although given the geopolitical backdrop one could argue 25bp hike is far more suitable.

- Good support in USDJPY below 114.78 – a weekly close through 114.78 targets 113.50 driven by US 2YR Treasury yields falling towards 1.45%.

- China manufacturing PMI (Tuesday 12:30 AEDT) – given the recent easing measure from the PBOC/govt this data point may see limited market movement - the market expects the diffusion index to drop to 49.8 (from 50.1). The CN50 index has solid support into 14,500 – shorts through here seem compelling although expect authorities to support the market into here.

- Key Central bank speakers from the BoE and ECB – Lagarde's meeting with German Chancellor Scholz (Wed 00:00 AEDT) could get some headlines.

- GBPUSD holds a 1.3640 to 1.3350 range – a break targets 1.3800 and 1.3170.

- EUR CPI (Wed 21:00 AEDT) – market expects core CPI to rise to 2.5% and the headline estimate to rise 30bp to 5.4%

Culminative rates pricing for yr-end 2022.

(Source: Pepperstone - Past performance is not indicative of future performance.)

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.