A traders week ahead playbook - can the bulls continue to gain a voice?

The JPY crosses are flying, where notably SEKJPY, NOKJPY and AUDJPY rallied 5.3%, 4.75 and 3.3% respectively on the week and have been huge momentum trades. The USD capped off five weeks of gains, falling 0.9% on the week and despite three days of consecutive gains, crude fell 3.7% on the week. XAUUSD lost 3.4% of the week, although with US yield curves flattening and growing expectations of inversion (i.e., longer-term bond yields trading with a lower yield than short rates) we may see renewed love for the yellow metal as a hedge against potentially increasing recessionary risk.

Fed chatter will dominate this coming week and so watch USD, XAU, and US equity exposures – the most significant part of the Fed meeting was the bank taking its terminal fed funds rate to 2.8% and 40bp above it neutral rate, as well as indicating balance sheet run-off (QT) may start in May – we’ll explore more here this week, notably if there is scope to take the 2023 fed funds projection (or the terminal rate) above 3%.

A huge defence of markets from multiple authorities in China has seen Chinese equity indices rebounding strongly – the CHINAH notably has rallied 27% off its lows - look for further policy easing this week, with cut to banks Reserve Ratio Requirement (RRR) on the cards, leading to increased credit into the economy. I take a bullish view on Chinese markets as a consequence.

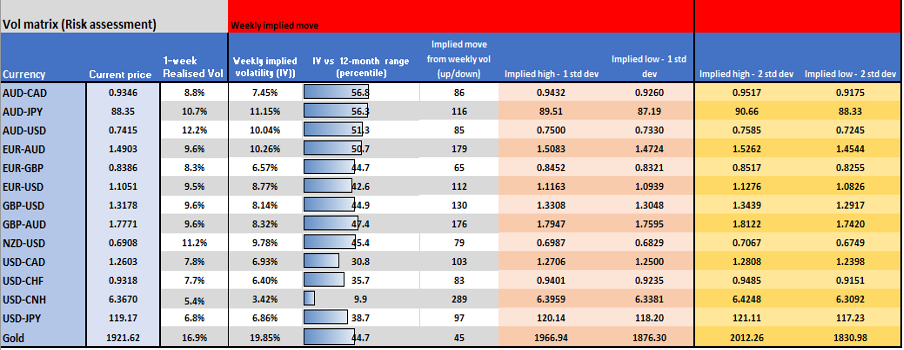

Implied volatility matrix

Looking at weekly implied volatility we can see expected movement is still elevated, albeit somewhat more sanguine than last week. This suggests stops can be taken closer to entry and position sizing modestly increased.

Here’s the weekly implied volatility matrix, offering the implied move (derived from options pricing) with a 68% and 95% level of confidence. Good for understanding the expected movement on the week which can be useful for risk management and/or mean reversion.

(Source: Pepperstone - Past performance is not indicative of future performance.)

What could drive this week?

- Russia/Ukraine headlines – While Turkey’s foreign minister has said (on Sunday) that Russia/Ukraine “have almost reached agreement” on four critical points of a peace agreement, the market has seen several false starts on diplomatic talks and potential de-escalation - after some solid covering of shorts and geopolitical hedges, the market wants to see real clarity before putting on new risk positions. That said, the bar to see a renewed volatility spike is high and we may need to see crude price back to $130 to cause EU equities and the EUR to trend lower again

- Central bank speakers will dominate the narrative this week. On the docket we get:

- 17 Fed speakers, including Powell x2 Tuesday (03:00 AEDT) and Wednesday (23:00 AEDT) – with the FOMC meeting clearly as hawkish as we could have expected and former Uber doves (Kashkari for example) turning hawkish, USD traders will be looking for the prospect of a 50bp hike (currently 55%) in May and more clarity on QT. I still believe US real rates are key to markets and if the Fed really want to tighten financial conditions, they need higher real rates (10yr real rates currently -75bp)

- 12 speeches from ECB officials, including ECB President Christine Lagarde (Monday 18:30 AEDT and Wed 00:15 AEDT) – we see an emerging double top in EURUSD at 1.1123, where a break of the neckline (1.0900) should take us to 1.0700

- BoE Governor Bailey (Wed 23:30 AEDT), also BoE Cuncliffe (Wed 02:15 AEDT) and Catherine Mann (Friday 00:00 AEDT) speak

- RBA governor Lowe speaks (Tuesday 14:30 AEDT) – after last week's strong jobs report the market sees RBA lift-off in June – will Lowe open the door to an earlier hike?

- NATO Leaders Summit (Thursday)

- EU Council Meeting in Brussels (Thursday to Friday) – the focus of the meeting is dealing with the impact of higher energy prices, notably for vulnerable citizens and SMEs. Unlikely to be a vol event for markets.

- UK Chancellor Sunak hands down budget statement (Wednesday 23:30 AEDT)

- China 1 & 5-year prime loan rate (12:15 AEDT) – the consensus is that the prime rate remains unchanged at 3.7% and 4.6% respectively. It would not surprise to see a 10bp cut to both durations, which would likely be well received by those long China’s equity indices. A cut to the RRR would also provide a tailwind

- UK CPI (Wed 18:00 AEDT) – the market expects 6% headline and 5% core inflation. Hotter numbers should see the prospect of a 50bp hike in May move closer to 50% (currently 25%). Favouring GBPUSD shorts but am happy to square and reverse through 1.3200.

- German IFO survey (Friday 20:00 EDT) – Unlikely a vol event but the market expects modest deterioration across the three surveys. Again, feel the risks are skewed for EUR weakness this week.

(Source: Pepperstone - Past performance is not indicative of future performance.)

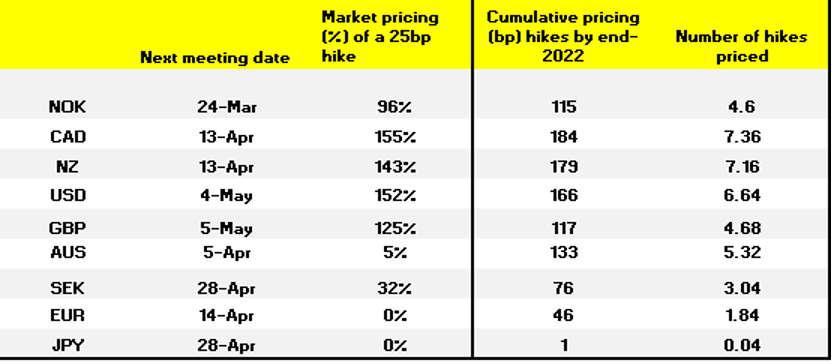

With the FOMC meeting out of the way and the market looking for more colour on the terminal rate, QT and whether the Fed will indeed do whatever it takes, we can see from market pricing that the upcoming meetings could be lively events – in some cases, the debate on actions from a central bank will be 25bp or 50bp hikes and that could lead to increased volatility in markets into and after the event.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.