Trader thoughts - where will intervention be seen in USDJPY?

Fundamentally, we need to focus on the Japanese govt bond (JGB) market, as this is the clear driver of the volatility in USDJPY and the JPY crosses right now.

USDJPY daily chart

(Source: TradingView - Past performance is not indicative of future performance.)

The failure to announce a defence of the BoJ’s JGB 10yr 25bp Yield Curve Control (YCC) cap on Friday saw JPY buyers kick in – however, yesterday was a whole different game and we saw a number of statements that the BoJ was buying unlimited quantities of JGBs at fixed rates to defend the YCC 25bp cap.

This is where relative bond yield differentials drive the JPY and where can a Japanese fund or money manager get the best returns.

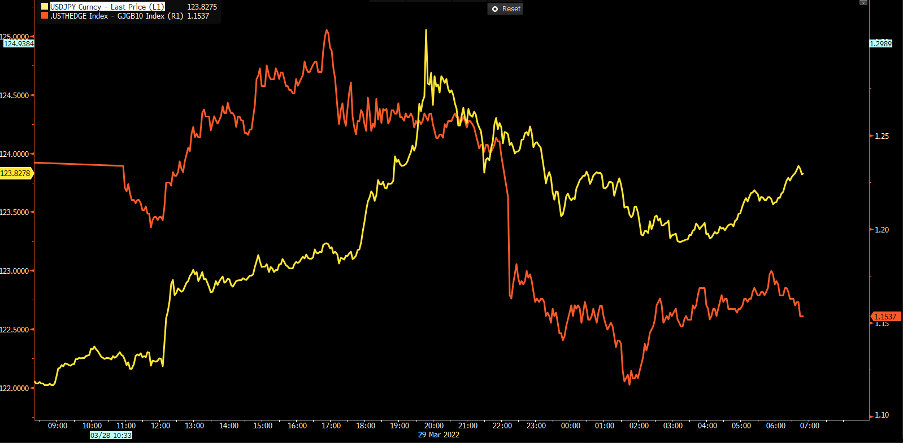

Through late Asia/early EU trade, we saw US 10-year Treasuries widen to a 230bp yield premium over 10yr JGBs – if we adjust for 3-month hedging costs, the yield premium a Japanese fund could achieve buying UST 10-year (currency hedged) over 10-yr JGBs widened 8bp to 155bp (or 1.55%) and US 10yr real rates (adjusted for expected inflation) widened vs Japanese real rates to 13bp – the most since March 2020.

(Yellow – USDJPY, orange – US 10yr with 3m currency hedge – JGB 10yr)

(Source: Bloomberg - Past performance is not indicative of future performance.)

Where do you think capital will flow when we see these dynamics? Indeed, the USD which is why USDJPY ran up to 125.09.

As I write USDJPY has pulled back to 123.84 – really driven by buyers in US Treasuries, with yields retreating from 2.53% to 2.41% through late EU and through US trade and subsequently the US yield advantage has been reduced to 2.20% – a sharp pullback in crude (largely down to the two-phased shutdown of Shanghai) is the smoking gun here – China’s handling of Covid is clearly a major issue for global markets and should be monitored closely.

We should also consider that in early Asia trade (10:50 AEDT) today we get the BoJ’s Summary of Opinions, and this may explore the JPY weakness, which has partly seen Japanese inflation expectations reach 90bp – the highest since 2015.

Japanese retail traders (Mrs Watanabe) are long JPY here, as are our clients (71% of USDJPY positions are held short) and positioned for broad JPY upside. There’s certainly demand to fade USDJPY above 125, as we see growing belief the BoJ will start to say they are “watching the JPY closely”, not that the BoJ can do anything directly in the FX markets – they can lift rates and remove NIRP (Negative Interest Rate Policy) and they can change the YCC target to target the 5yr JGB (from the 10yr JGB), but it’s the government (well the MoF - Ministry of Finance) who manage the currency and would buy JPY in the market - this is a new phenomenon as prior bouts of intervention (take 2011 for example) saw the MoF selling JPY and it didn’t really have any lasting effect – FX intervention, if it is to happen, would really only likely occur if and when USDJPY is above 130 and the rate of change is still high.

Who wants to be short JPY if the probability of a 200-300 pips sell-off (in USDJPY) materialises? Not many I suspect. Until that point, verbal intervention when it hits the wires could see some sharp moves of 30-50 pips in USDJPY and the JPY crosses but that depends on the time of day and the underlying liquidity conditions… until then the JPY should continue to sell off when global bond yields are moving higher, and oil prices are rising (and vice versa).

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.