Trader thoughts - US payrolls in sight but its US CPI that interests

That may change, but for now the rate of change (ROC) is positive and the 3- & 8-EMA are yet to cross, and price holds above both ST averages.

EURUSD stalls into 1.0150 and the risks of a modest unwind of a large EUR short position is high ahead of US payrolls (22:30 AEST) – here, the market expects 268k jobs, an unchanged U/R of 3.6% and earnings of 5% (from 5.2%) – The strong rally in equities may be called into question if we get a hot jobs number, which sounds odd, but I think the bulls want to see number below 100k, to show signs the labour market is cooling and monthly average earnings below 5% could see buyers of US Treasuries and subsequently push the NAS100 higher.

(Source: Pepperstone - Past performance is not indicative of future performance.)

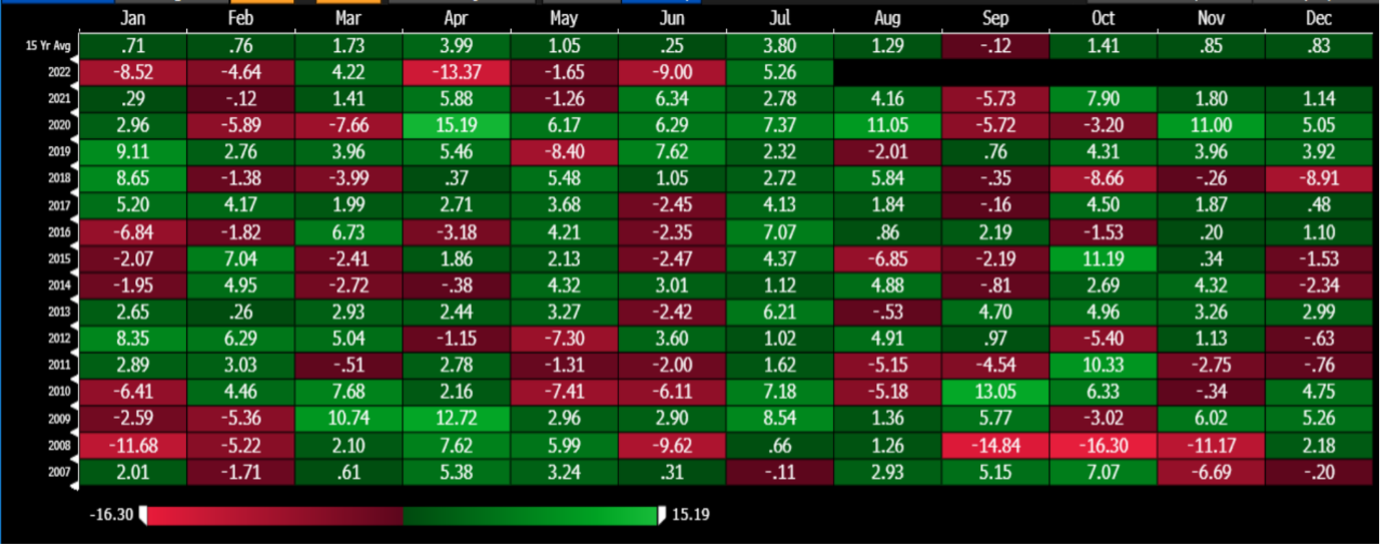

Coincidently, for those who like seasonals, check out the performance of the NAS100 through July – it literally doesn’t go down or at least we’ve seen positive returns each July since 2008.

We see a similar set-up on the NAS100 as we do crypto, which may not shock, but we’re looking for a break of the 27 June swing – Bitcoin is almost there, and for the momentum traders, we’ve had a bullish 3 v 8-day EMA crossover, ROC is positive, and the Bollinger Bands have narrowed sufficiently to make believe we could see a breakout and increased momentum – perhaps even a trend.

(Source: TradingView - Past performance is not indicative of future performance.)

AUDCHF has seen a solid move higher and EURAUD shorts are working well and eye a test of 1.4766. EURCAD is trending and while we could see retracement, they should be shallow and I like this lower too.

One concern I have on the risk front comes next week with US (June) CPI (out Wed 22:30 AEST) – while there are many signs that inflation has peaked, it, unfortunately, won't roll over and the word ‘plateau’ is more appropriate. The market sees US headline inflation lift 1.1% MoM, taking the year-on-year print to 8.8% (from 8.6%). What makes this messy, is that core CPI is expected at 5.8% (from 6%). I see the market as more sensitive to headline inflation, and the risk is that this comes in just above consensus, which is the trend we’ve seen in each inflation release since March 2021 (except January 2022). For the quants out there, if we look at how the NAS100 has performed in the six hours after the US CPI drops, we see the index has fallen every time (except for January 2022) by an average of 0.7% - they say history doesn’t repeat but it rhymes.

A big CPI number should solidify expectations of a 75bp hike from the Fed in the 27 July FOMC meeting. The market is pricing that firmly and another 50bp in September. Buying USDs on a hot CPI print is tough when the market is long of the buck and so much is already priced, for me the easier trade is to keep shorting commodities as higher rates mean lower demand.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.