EU equities closed mixed, but the intra-day tape showed the buy-the-dip crowd were out in force, with the DAX rallying 2.6% off its low, suggesting the last two days drawdown were a pullback within a bull market. Asia is opening on the front foot, with the AUS200 pushing above yesterday’s cash opening high.

Volatility has dropped, with the VIX -4.4 vols to 23.1% and value working over growth sectors of the market with financials putting on a good show.

Inflation, it seems matters less today than yesterday and the moves really play into the factor of flow and de-grossing stemming from a market that had sold too many calls (to enhance returns on long equity holdings), were short gamma and needed to de-risk. The price action suggests the de-grossing and de-risking has played out.

On a single-stock basis, the Tesla daily chart is one I have been pushing of late, with the multi-year trend break getting some airtime. The new development is that price has closed through the 200-day MA for the first time since 18 March 2020. The last time price broke the 200-day it was a one-day affair before we saw a monster 412% rally over the coming 80 days. Naturally, it's hard to see that repeat again, but it does highlight this is make or break time for the big EV – it's the poster child of so many of the momo and low or no earnings stocks. So if this cracks it could be well worth watching. Shorts anyone?

Daily chart of Tesla

(Source: Tradingview)

Commodities have had a bad day at the office and notably, energy has been hit. With crude -3%, the Colonial pipeline resuming and ongoing concerns about Indian demand. We’ve seen WTI holding support at 63.05 and buyers have pushed price back to the 20-day MA. The risk near-term seems asymmetric, so I‘ll be keen to see the flow as we push through Asian trade. Price is below the 5-day EMA, which is headed lower, so it seems reasonable to expect some chop in the near term.

With crude lower, the oil proxies such as CAD have underperformed – the MXN (another petrocurrency) conversely has actually flown with the Mexican central bank giving a hawkish assessment of inflation risks – USDMXN has therefore attracted good selling flow, and ex-Brazil, when I look at interest rate pricing, the market is pricing 227bp of hikes (9 hikes) over the coming two years – the hedge funds will be drawn to the MXN for carry (income), although, while clients get paid swaps on short USDMXN position (if held past rollover), trading leveraged FX for carry (swaps income) is not something I would be advocating - its all about the capital movement.

I had looked into AUDCAD shorts yesterday and still look for price behaviour into the 5-Day EMA (0.9420) – a rejection would be a sign for me to jump on. USDCAD has some increased flow and looks good for further upside, but I’d be expecting price to flip and reverse into 1.2270/80.

Gold has found small buyers of 1808 and has benefited to a degree from the move lower in real Treasury yields, and a flat USD. However, the bulls remain unconvinced and there is clear supply into 1844/46 and we may revisit this zone if price can break above 1828 in the session ahead – US retail sales (22:30 AEST – consensus 1% mom) may be a catalyst here, so consider this a modest event risk.

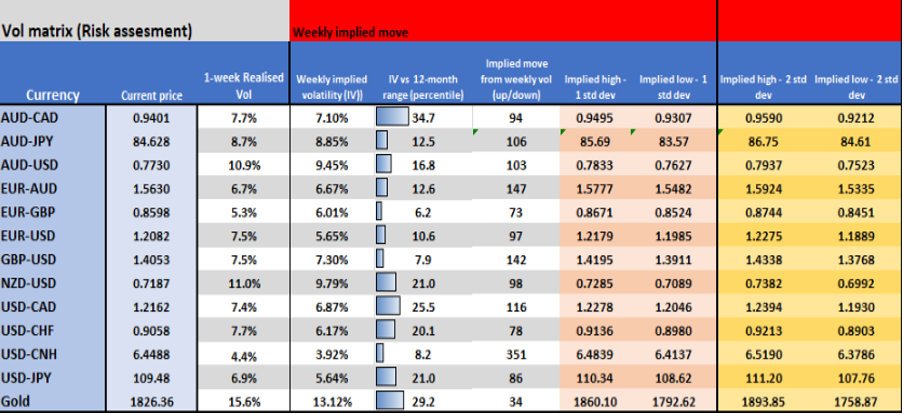

As per the volatility matrix Gold has upside in the week ahead (through to Friday) to 1792, with a 68.2% level of confidence, before I would consider mean reversion strategies.

For the Crypto heads out there, I wrote this article on why a number of traders are heading to Crypto and why it could be the perfect short-term trading vehicle. Take a look at it here.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.