Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

How high can Bitcoin go? How long until price breaks $100,000?

An Expected Election Surprise

Market players had gone into the US election with a considered playbook of what to buy and sell in response to the election outcomes that became reality.

A Trump presidency / Republican ‘Red Sweep’ was always expected to be a positive for Bitcoin and the crypto scene, but the gains we’ve seen would be well in excess of what many had considered likely, at least so soon after the election.

Crypto; The Real Winner from The US Election

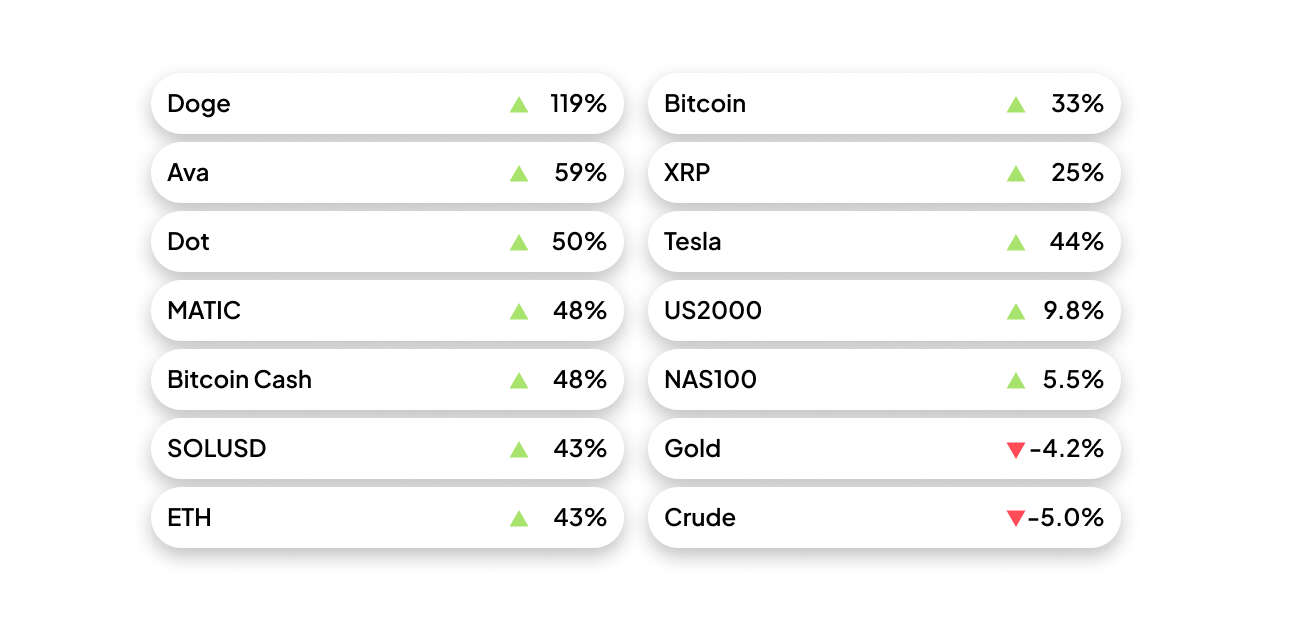

As we can see, the moves (from 5 November) in various cryptos have been very impressive, notably in Doge, which has more than doubled through that period, with many others rallying 30-50%.

Bitcoin sits at the heart of Pepperstone’s client flows, with significantly higher-than-average flows playing out since the break of $70k and above $77,250.

Clearly, we need to consider that each of these markets has a different risk and volatility profile – in essence, a 100% move in Doge is not the same as a 100% move in a diversified index of stocks (like the US2000). But for those with the right risk tolerance, the extent and speed of the gains are so impressive and so rare that it sucks traders in and they simply have to be involved.

$100k Bitcoin is a Growing Possibility

With Bitcoin trading just shy of $90k, the question on trader’s minds is whether there is more juice in the tank and whether it can kick further to $100k in this run.

Many others question, after such a run, whether to take chips off the table and look to reload into more compelling levels within the bull trend.

Those running mean reversion strategies would be looking at the set-up in another light – and while they may not be bearish over the medium-term, would-be seeing Bitcoin 30% above its 50-day moving average and feeling that maybe the band has been pulled a little too far. Either way, after such an explosive rally, these varied questions will be asked.

Bitcoin Tailwinds - The Fundamental Drivers

Few can really question if the rally is indeed justified or if the price is correct – the price is the price and Bitcoin is here for a reason.

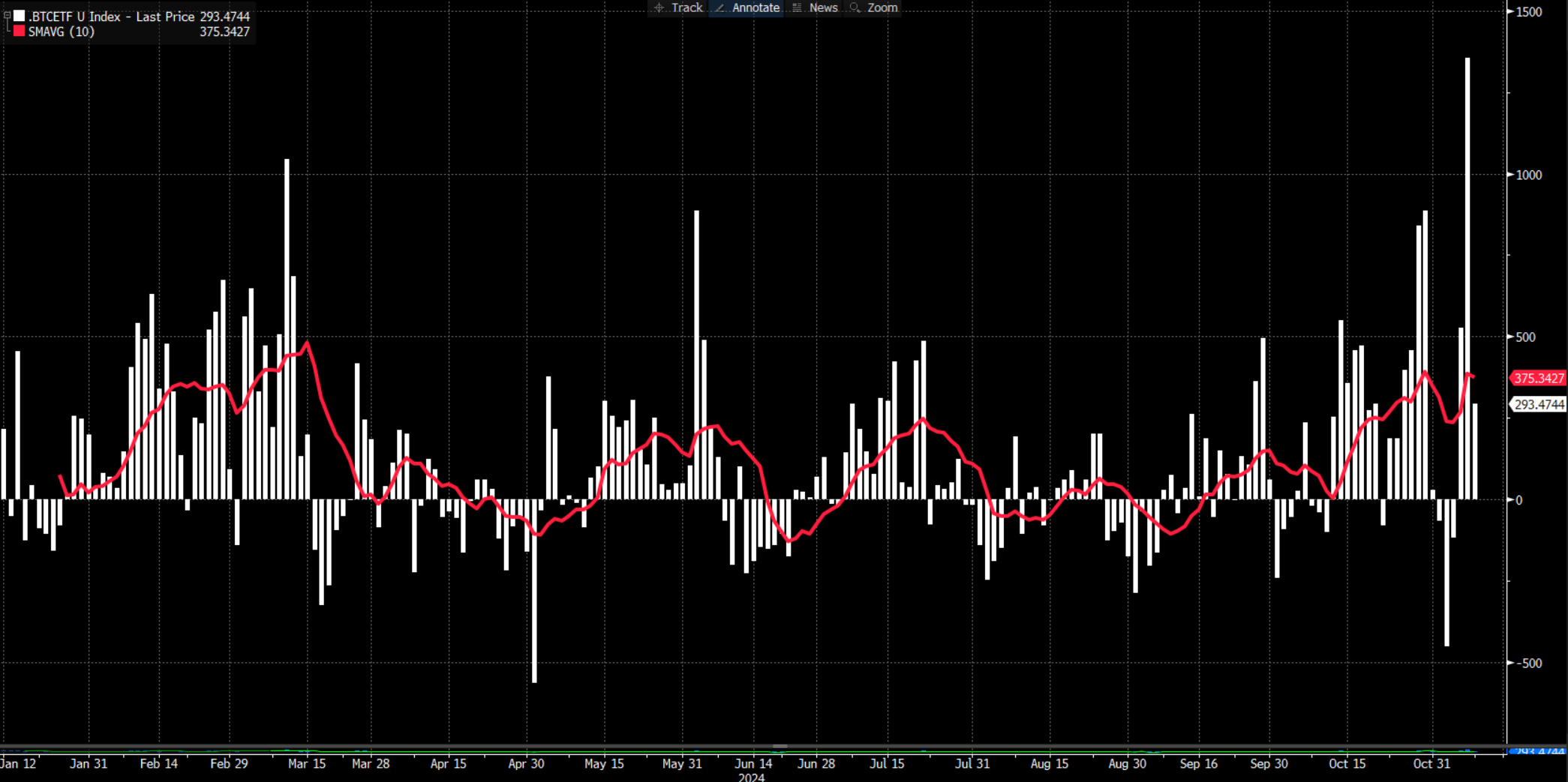

Investor inflows into the various Bitcoin ETFs post-election have been huge, and as we’ve seen for some time, inflows into the BTC ETFs have been well correlated with Bitcoin returns. Many argue these inflows are a sign of greater institutional involvement, with funds increasing the weighting of Bitcoin exposure within a broad multi-asset portfolio.

News that MicroStrategy (Michael Saylor) had purchased a further 27,200 Bitcoins (between 31 Oct and 10 Nov) would be offering tailwinds to Bitcoin too. The market is aware of Michael Saylor’s strategy, but adding a further $2b worth of Bitcoin is a solid chunk of change and will typically not just move a market but lift sentiment in the space.

Speculation is already mounting as to who Trump will replace SEC chair Gary Gensler and a few names have already been thrown into the mix. The SEC kept a tight leash on the crypto scene under Gensler’s tenure, so while a new SEC chair isn’t going to lead to recklessness and let the crypto party run out of control, a more sympathetic SEC regime would certainly a big positive for the evolution of crypto.

Having Trump championing your corner is a strong position to be in

The fact that Trump is championing the crypto cause is clearly a big kicker, with suggestions of the US becoming the sacred home of crypto is highly supportive of confidence – and like any financial asset, Bitcoin and crypto thrives in times of confidence.

Whether Trump will create a Bitcoin reserve fund, as he detailed in July, is debatable and seems unlikely – but should the market really start to believe it is probable then Bitcoin could soon trade far higher.

As we’ve seen over the years when Bitcoin and crypto run hot then what starts as a rally for the brave, can morph into an out-and-out momentum beast, with FOMO kicking in and retail traders chasing.

The Art of Holding Winners

For me price targets – while they can be helpful when defining the risk-to-reward trade-off when entering a position - are irrelevant in this type of environment.

What we’re seeing play out in crypto is now about the art of holding and extracting the most out of a trade, in turn, getting out when the price action dictates. A trailing stop loss is typically the play here, although, in higher volatility/wider-ranging markets one does need to give the stop loss an increased distance.

Trying to pick an upside target to exit a trade, when the pullbacks are shallow and the market acts as one, amid reducing sellers, typically results in missing out on further upside in such a strong market. Many close a trade, and subsequently look back with regret, wishing they’d held but trailed the stop.

That call obviously comes down to the strategy employed - but for now and on current news, upbeat sentiment and flows, it feels like the time to $100k is the right question to be asking.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.