- English

BoE February 4th Meeting Preview

I don’t expect any monetary policy changes at the February meeting – the bank rate will stay at 0.1% and the QE target of £895bn should remain as is. We will also receive an updated forecast of key macro indicators as well as the quarterly Monetary Policy Report. An acceleration of bond purchases looks unlikely for now with the BoE most likely taking a wait and see approach until there is more clarity on the fiscal support front from the budget on March 3rd. Large British Business groups are applying pressure on Chancellor Sunak to extend the furlough scheme which is set to expire at the end of April. In my opinion it’ll either be an extension of the current furlough scheme or in some other form to support jobs. We could see some further tweaks made to the Term-Funding scheme to further help SMEs with more favourable lending conditions.

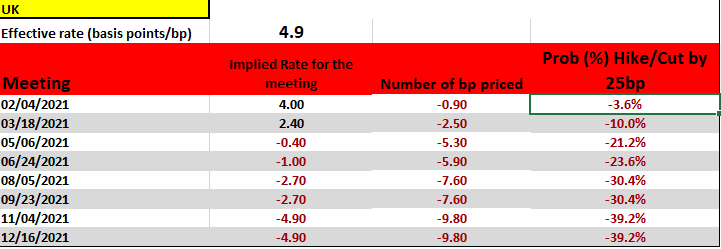

Moving on to the main event – negative rates. Negative rates only had relevance on a no-deal Brexit outcome and even then it was still a high bar for the BoE. It seems increasingly unlikely to me that we will see negative rates at all especially when the vaccine rollout is progressing very well, the latest inflation prints beat consensus (0.6% vs 0.5%) and are moving closer to the 2% target (pent up consumer demand will also help), Governor Bailey seems more bullish on the economy saying “I think we are going to see a pronounced recovery in the economy” and negative rates could reduce lending during the recovery phase as it eats into the banking sectors’ net interest margins. Messing with the plumbing of the banking sector and potentially causing reduced lending is the last thing any central banker wants to do during the recovery. If we look at the Overnight Index Swap rates table below and take the bank rate of 0.1% and deduct the number of bps priced for the 12/16/2021 of 9.8 we can see that negative rates have been priced out for 2021. Some analysts still believe rates will go negative much earlier, but I disagree.

Source: Bloomberg

External member Tenreyro is really pushing the negative rates line, however, internal members like Chief Economist Andy Haldane and Governor Andrew Bailey have been less enthusiastic. Just to give you some soundbites, Bailey has had this to say about negative rates - “changes the whole calculus of how the banking system works” and “we do not know, with any confidence, how that would work.” Furthermore, he commented that there are a lot of issues with negative rates, that they are a controversial issue and that no country has used negative rates in the retail end of the financial market. These comments don't exactly make one believe that Bailey is a proponent of negative rates – the comments certainly sound more negative than positive. At this Thursday’s meeting the results of consultations with banks on the implications of negative rates on their operations will also be released. The time it has taken to get to this point suggests there has been obstacles and push back from the banks. Santander recently stated systems would need 12 – 18 months of preparation in order to implement negative rates. HSBC pointed to the poor results of its implementation in places like Europe, Switzerland and Japan. Recently, banking sources have also highlighted the complexities involved and that nobody has really planned for it, further that “negative rates would absolutely hit our business models”.

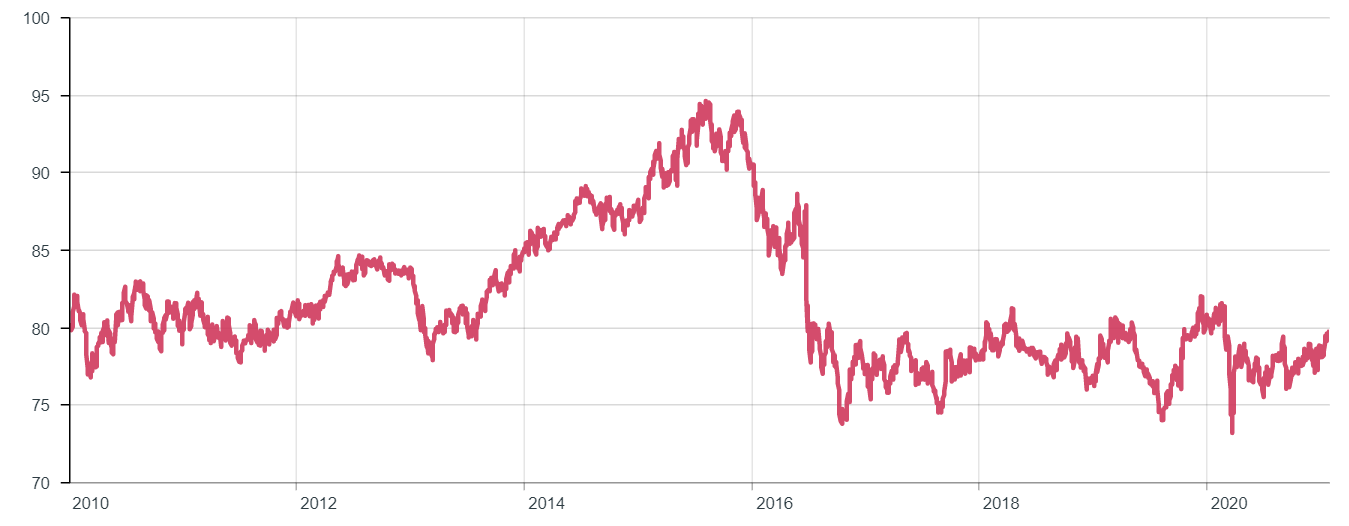

The BoE has skillfully used the strategy of jawboning the market into thinking about negative rates without having to implement them. I continue to believe that QE will be the primary tool used by the BoE with negative rates only being taken out of the toolbox as an absolute last resort. The trade weighted index for Sterling is no where near levels seen in 2014, hence unlike the ECB a too strong currency is definitely not a problem for the BoE, further making a case against negative rates.

Source: BoE Website Sterling Trade Weighted Index

The technical picture for GBPUSD continues to trend upwards. An uptrend channel has been in place since mid-September. Price has been struggling to overcome the 1.375 overhead resistance (horizontal dotted white line) in the last few days, however, this Thursday could be the catalyst which causes a breakout towards 1.40. The RSI is around 57 meaning it has room to run and is not close to overbought territory. There is a mini flat sided ascending triangle pattern which has emerged as indicated by the short white solid uptrend line from January 11th. All 3 moving averages are pointing upwards and the 21-day EMA has offered good dynamic support for GBPUSD.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.