- English

AUD outperformance – A trifecta of tailwinds lifts the ‘battler’

.png)

AUD – the overview

AUDUSD has gained for 5 straight days and has pushed above the 100- and 200-day MA, with supply coming in at the 61.8 fibo of the recent selloff from 0.6644 to 0.6321 – a break of 0.6537 and we may see a retest of the 9 April highs. The FOMC meeting (on Wednesday) offers risk to USD exposures.

AUDJPY has pushed to the best levels since 2013, gaining over 4% w/w for the best weekly gain since June 2020. Being long of this cross comes with the ever-growing JPY intervention risk, so there are risks that need to be heavily considered. AUDJPY is the momentum play in FX, but position size is paramount if trading this pair right now.

AUDNZD sits at the best levels since June 2023 and eyes a break of 1.1000 – the cross is a market darling for those expressing diverging economic trends and expected future central bank policy settings. This is another momentum beast, and pullbacks should be shallow and well-supported.

EURAUD gets a focus as another tactical (divergence) play with price poised to break the 10 April swing low of 1.6362. EU CPI (Tuesday 19:00 AEST) could be a big trigger for further EURAUD flows.

AUDCHF works in a similar vein and trader’s eye the CHF CPI report (Thursday 16:30 AEST), where another weak print will likely compel the SNB to cut rates in its 20 June meeting. AUDCHF is ripping higher and unless we see a turn higher in market volatility (i.e. the VIX pushes into 20%) and a resurfacing of geopolitical concerns, I can imagine 0.6100 in play in the near-term.

The fundamental drivers of AUD appreciation:

It’s not often nearly everything goes right for the AUD, but the AUD’s classic fundamental drivers are all working, and AUD longs are having their time in the sun.

- Positioning – recent data from investment bank flow desks and the weekly CFTC report showed leveraged and real money funds holding one of the largest AUD net short positions since Dec 2022. One can imagine AUD shorts have looked to buy back and cover exposures.

- AUD: the cheaper China proxy - The Hang Seng has broken out of the long-term downtrend and trades into new 40-day highs, having stagged a massive 8.8% rally on the week (the best weekly performance since Nov 2011), with the CHINAH index gaining a massive 9.1%. Chinese tech stocks are flying.

- Broad yuan strength - While USDCNY grinds higher, the yuan on a broad-basis trades to the highest levels since October 2022

- While the HK50 goes on a tear, we’ve seen the NAS100 and US500 stage a solid weekly appreciation (NAS100 gained 4.2% w/w) – positive sentiment in equity markets typically sees ‘pro-risk’ currencies such as the AUD, NZD and MXN outperform.

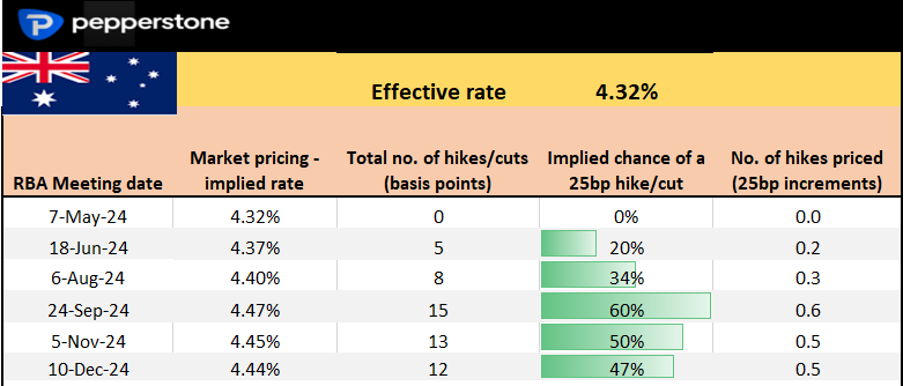

- RBA hikes on the cards? After the hotter-than-expected Aus Q1 CPI report (trimmed mean CPI came in at 4% vs 3.8% expected), Australian interest rate futures had a big repricing on the week and now see a 60% chance of a 25bp hike by September.

- Central bank policy divergence - When we consider the ECB, SNB, BoC and Riksbank are all expected to cut rates in their respective June/July meetings, talk that the RBA may hike this year creates big implications and trends in FX markets.

- Aussie government bonds had a big underperformance on the week vs its G10 peers, where notably 3yr Aussie bonds yields gained 31bp.

- The US 10-year Treasury minus the Australia 10-year bond yield differential – a market measure of central bank policy divergence and relative economic trends - narrowed 22 basis points on the week - this pushed capital into the AUD.

- Commodities finding buyers - Aussie terms of trade have been a big tailwind for the AUD, with copper gaining 1.8% w/w (the 4th straight weekly gain), with Dalian iron ore futures gaining 1.6% w/w. The Bloomberg industrial metals index has rallied 20% from its lows on 12 Feb.

So, when we see the trifactor of AUD tailwinds – that being, Aussie rate expectations now favouring a hike (over a cut), China equity rallying, and industrial and ferrous metals all working and married with a sizeable aggregate net short position (across a range of key FX players) – it’s not hard to see why the AUD has found such form.

We know the tailwinds, but naturally, we ask can they last?

Aussie interest rate futures pricing

Looking ahead

Playing AUDUSD likely requires further gains in HK and US equity markets, but for those looking at more tactical plays and a diverging path between RBA action and other central banks easing then AUDCHF, AUDNZD, and EURAUD are worth putting on the radar. I am sceptical that the RBA hike myself but if we’re looking at dates for the diary that could cement the notion they will hike, or even reverse the bias back to easing, then these are the events that could shape it:

- 30 April Retail sales

- 7 May RBA meeting & Statement on Monetary Policy

- 2-7 May ASX200 bank earnings (NAB, WBC, ANZ)

- 15 May Q1 Wage Price Index

- 16 May RBA member Hunter speaks

- 16 May Aussie employment report

- 29 May monthly (April) CPI

- 5 June 1Q GDP · 13 June Aussie employment report ·

- 18 June RBA meeting ·

- 26 June May (monthly) CPI

- 1 July Stage 3 Tax cuts come into effect

- 31 July Q2 CPI ·

- 6 Aug RBA meeting

Charts for context:

HK50 Index

AUDUSD

AUDNZD

Good luck to all.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.