- English

The aim is to magnify your position with daily 3x leverage. The ETF is not aimed at long-term investors, but short-term daily returns.

What does the TECL invest in

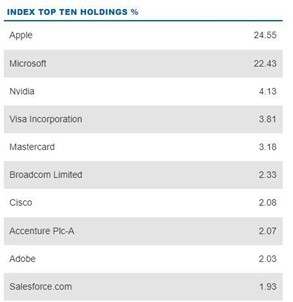

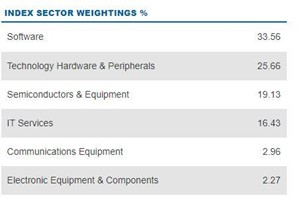

The Technology Select Sector Index (IXTTR) is the target index. It is provided by S&P Dow Jones Indices and covers various companies from the technology sector. It is heavily weighted in Apple and Microsoft. It should be noted that you cannot directly trade the index.

Figure 2 direxion sector weighting

Net expense ratio

This includes management fees. This is the annual fee payable to the issuer. As of the 17th of October 2022, the fees stood at 0.94%

*What is leverage?

Leverage is the ability to borrow funds to increase your exposure in the market. Leverage can exponentially increase your profits as well as your losses so it's crucial that traders take care when using leverage. The larger your position size, the larger your point value will be and therefore, the greater the impact on your profit/loss (P/L).

Trading Hours

The TECL (or TECS) do not offer 24 hr trading. The open and close is in line with the US stock market.

Figure 3 Trading View TECL trading hours

A look from a technical perspective

As the TECL is a technology long (buy) fund, it makes sense that it will underperform when the US technology sector is under pressure. It also makes sense that, because the fund uses leverage, the losses are compounded compared to the underlying sector. In the chart below we can see that the Nasdaq100 has fallen -21.57% since the 15th of August 2022. The TECL (long technology fund) has devalued -56.94% as of October 16th 2022.

Figure 4 Trading View TECL performance

It also makes sense that the TECS fund (short only fund) has outperformed in this bear market with a gain of 99.48% over the same period.

Figure 5 Trading View TECS performance

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.