- English

What is index trading and how to trade major indices

Many investors are familiar with the major global stock indices and their abbreviations, such as the FTSE 100, S&P 500, and DAX. However, not everyone realises that these indices can also be traded using Contracts for Difference (CFDs).

Leveraged index trading involves predicting the future price changes of an index, which is a collection of individual stocks that collectively represent a specific market segment. For example, the FTSE 100 is composed of the 100 most highly capitalised blue chip companies listed on the London Stock Exchange.

What are the basics of index CFD trading?

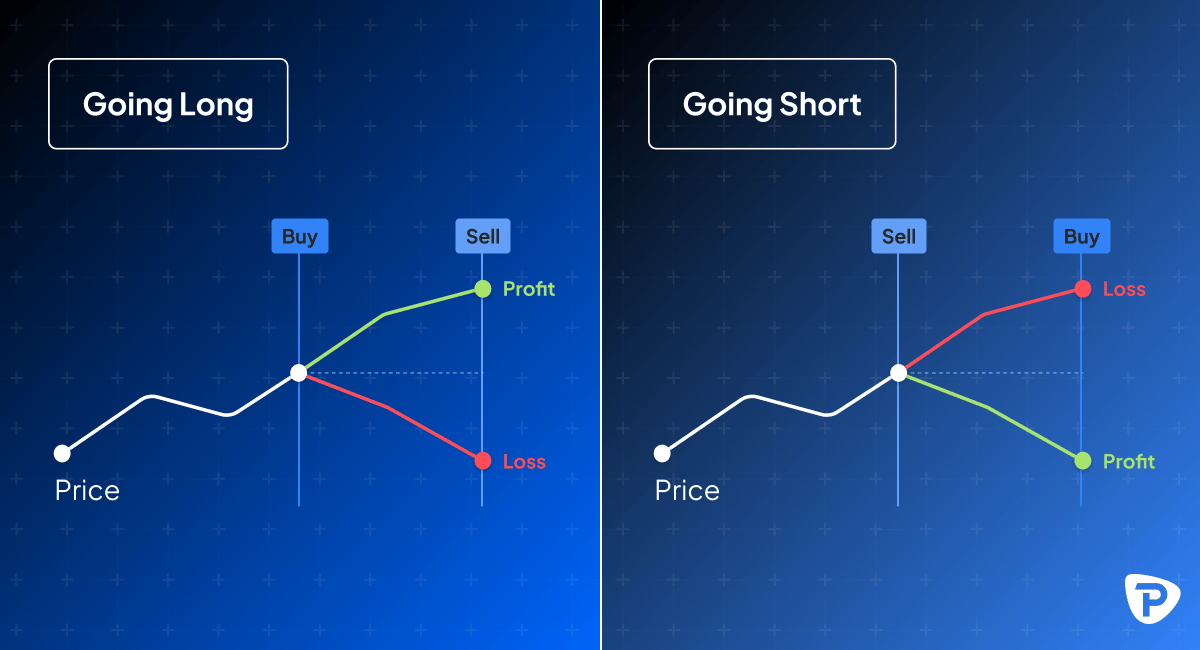

Achieving positive returns from leverage index trading hinges on correctly forecasting the price movements of a stock index. For instance, if an investor anticipates an increase in the FTSE 100, they would initiate a long position. Conversely, if an investor predicts a decline, they would take a short position.

The accuracy of an investor’s prediction determines their profit or loss; the more precise their forecast, the greater their potential gain or the smaller their potential loss. This strategic approach allows investors to leverage market trends for financial gain, depending on their ability to anticipate market direction.

What trading strategies are commonly used in index CFD trading?

Before initiating a leveraged CFD index trade, it's vital to establish a comprehensive trading strategy. This includes deciding the amount of capital to invest, setting parameters for stop-loss and take-profit orders, and assessing overall risk tolerance. Additionally, investors should evaluate the potential losses they are willing to accept if the market moves unfavourably.

There is no one-size-fits-all approach for trading indices, however. Instead, investors should begin with a strategy that aligns with their personal trading style and objectives. Some examples include:

- Scalping: Scalping is a very short-term trading approach where trades are opened and closed within minutes. Due to the brief nature of these trades, each one typically yields a small profit—just a few points per trade. To achieve substantial gains, investors need to execute a high volume of trades or handle significant trade volumes.

- Day Trading: Day trading involves buying and selling within the same trading day. These trades usually last for several hours, and day traders close all positions by the end of the day. This strategy requires a keen eye on market movements throughout the day but eliminates the risks associated with overnight positions.

- Position Trading: Position trading involves holding onto investments for extended periods, ranging from several weeks to years. This approach is designed to capitalise on significant price movements and overall market trends rather than reacting to short-term market changes. Position traders rely on in-depth market analysis and fundamental research to identify and invest in assets that are likely to appreciate over the long haul.

- Breakout Trading: Breakout trading strategies are centred around identifying and capitalising on price movements that surpass predefined support or resistance levels. When an asset's price breaks through these critical thresholds, it typically results in substantial price shifts. Traders employing this method often use technical analysis tools to predict and confirm these breakouts, allowing them to enter positions poised for significant gains.

- Swing Trading: Swing trading spans a longer timeframe, usually from several days to weeks. This strategy is often well-suited for novice investors as it does not require constant monitoring of positions. Swing traders focus less on daily price fluctuations, anticipating that these will balance out over a longer period. Stock indices, which follow economic cycles, are particularly well-suited for swing trading. For instance, the Dow Jones, Nasdaq, and S&P 500 have shown growth over the past decade in tandem with the US economy. If you prefer fundamental analysis over technical analysis, swing trading indices might be an ideal strategy for you.

By understanding and selecting the right strategy based on your trading preferences and market insights, you can effectively navigate the complexities of index trading and optimise your investment outcomes.

How are leveraged products used in index trading?

When trading leverage stock indices such as CFDs, investors’ investments allow them to open positions with just a fraction of the total investment value. This means that with a relatively small deposit, called a margin, investors can gain significant market exposure. However, leveraging is a double-edged sword; it can magnify both an investor’s gains and losses.

For instance, if the margin requirement is 10%, an investor could open a $10,000 position with just $1,000. This allows investors with limited capital to engage in larger trades by essentially borrowing funds from a broker.

Consider a scenario where an investor opens a CFD contract on an index priced at 7,500. The total trade value is $7,500, but with a 5% margin requirement, the trader only needs to deposit $375.

If the index value rises by 30 points to 7,530, the investor gains $30. Conversely, if the value drops by 30 points to 7,470, the trader incurs a $30 loss.

Ultimately, trading indices with leverage requires a thorough understanding of your trading strategy, risk tolerance, and market conditions. It is vital to have a well-defined trading plan that considers these factors to manage potential risks effectively.

Why is index trading important in financial markets?

Leveraged index trading holds substantial importance within financial markets and for investors for several reasons, including:

- Enhanced Returns Potential: One of the primary advantages of leveraged trading is its ability to amplify potential returns for investors. By leveraging their capital, investors can control larger positions than they would with traditional investments, potentially leading to higher profits when market conditions are favourable.

- Effective Portfolio Hedging: Institutional investors and fund managers often utilise leveraged index products to hedge their portfolios more effectively. These instruments allow them to mitigate risks associated with market downturns or capitalise on expected market movements, thereby enhancing overall portfolio stability.

- Opportunities for Speculation: For traders seeking higher returns relative to the risk taken, leveraged index trading provides avenues to profit from short-term market fluctuations and broader economic trends. This becomes especially appealing in volatile market conditions, where leveraged positions can yield substantial gains.

- Contribution to Market Liquidity: Leveraged index products play a crucial role in enhancing market liquidity by adding depth and volume to trading activities. This liquidity facilitates easier entry and exit for investors, contributing to smoother market operations.

- Supporting Market Efficiency: The trading of leveraged index products aids in price discovery and foster's market efficiency by enabling participants to express their views on overall market directions. This mechanism helps in establishing fair market prices based on collective investor sentiment.

- Risk Management and Diversification: Leveraged index trading allows investors to diversify beyond individual stocks or bonds, reducing specific risks associated with single securities. This diversified exposure helps in managing overall portfolio risk and capturing broader market movements.

It's essential to recognise that while leveraged trading offers potential benefits, it also carries increased risks. The use of leverage can amplify both gains and losses, necessitating careful risk management by investors.

Why is it important to understand stock market indices in index trading?

Understanding indices is pivotal for developing robust trading strategies, optimising liquidity, and ensuring portfolio management efficiency. Further, proficiency in index dynamics equips investors with the necessary tools to make well-informed decisions, effectively navigate financial market intricacies, and implement hedging strategies with confidence.

What role do stock market indices play in index trading?

Indices serve as crucial tools for investors to assess the performance of various assets, as well as their portfolios in comparison to the broader market. Essentially, indices act as benchmarks or standards against which performance is measured.

It represents the performance of a group of stocks that are selected and weighted according to certain criteria, such as market capitalization, industry sector, or other factors.

Further, stock market indices are the underlying asset in leveraged index trading, which involves using CFDs to amplify the returns of the underlying index.

Which major indices are most relevant in the global index trading markets?

A stock index serves as a composite measure of selected stocks meeting specific criteria, calculated through a weighted average. Notable examples relevant to investors involved in leveraged index trading include:

- FTSE 100

- DAX 30

- CAC 40

- EURO STOXX 50

- S&P 500

- NASDAQ Composite

- Dow Jones Industrial Average

- Nikkei 225

- MSCI World

What types of indices are commonly traded in index trading?

Index trading involves various types of indices, which act as benchmarks to gauge the performance of different segments of the market. These indices comprise baskets of stocks or other assets and are instrumental in tracking sectors, market segments, or entire markets. An overview of key types of indices include:

- Broad Market / Regional Indices:

These indices provide an overview of overall market performance, encompassing diverse stocks across multiple sectors. Examples include the FTSE 100, DAX 30, S&P 500, and Dow Jones Industrial Average. - Sector Indices:

These indices monitor the performance of specific sectors within the economy, like technology, healthcare, financials, or energy. A notable example is the NASDAQ Composite, which tracks the US technology sector. - Regional Indices:

Focusing on stocks within specific geographical areas or countries, regional indices include benchmarks such as the FTSE 100 (UK), Nikkei 225 (Japan), and DAX (Germany). - Style Indices:

Categorising stocks by investment style, such as growth or value, style indices include the Russell 1000 Growth Index and the S&P 500 Value Index. - Volatility Indices:

These indices gauge market volatility and serve as indicators of market sentiment or for hedging purposes. The prominent CBOE Volatility Index (VIX) is a notable example. - Commodity Indices:

Tracking the performance of commodities, commodity indices include the S&P GSCI (Goldman Sachs Commodity Index) and the Bloomberg Commodity Index. - Bond Indices:

These indices monitor the performance of fixed-income securities like bonds, such as the Bloomberg Barclays US Aggregate Bond Index and the ICE BofA US High Yield Index.

Each type of index serves distinct purposes, enabling investors to access different market segments and manage specific risks. This diverse array of indices forms the backbone of index trading, offering opportunities across global financial markets.

How do price-weighted indices function in the context of index trading?

Stock market indices typically derive their values based on the combined market capitalisation of the companies they include. This approach prioritises larger companies, thereby magnifying their impact on the index compared to smaller companies.

In contrast, some indices follow a price-weighted methodology where companies with higher share prices exert more influence on the index's overall value. This means that fluctuations in these companies' stock prices will disproportionately affect the index's current level.

A notable example of a price-weighted index is Japan’s Nikkei 225 which tracks the performance of the 225 largest companies listed on the Tokyo Stock Exchange.

How do you trade indices using CFDs?

At Pepperstone, you have the opportunity to engage in index trading using CFDs. These financial instruments are derivatives, offering you the flexibility to profit from both upward and downward movements in index values.

What are regional indices and how are they used in index trading?

Regional indices are vital metrics that track the performance of stocks within distinct geographic regions or countries. These indices provide valuable insights into the economic health and market trends of specific areas of the market.

Examples include the FTSE 100, which monitors the top 100 companies listed on the London Stock Exchange, reflecting the UK's economic landscape. Similarly, the Nikkei 225 index showcases the performance of major Japanese companies, offering a snapshot of Japan's overall market conditions.

What are cash indices and what is their role in index trading?

Cash indices are a CFD instrument designed to reflect the performance of major global companies included within specific indices. These financial instruments monitor the price fluctuations of their constituent securities over time, providing a comparative measure of their performance. Among the most widely recognised cash indices are the S&P 500 Index, the Dow Jones Industrial Average, and the Nasdaq Composite Index.

Traded at the spot price, which is the present value of the underlying market, cash indices are particularly attractive to day traders due to their narrower spreads. This characteristic makes them ideal for those with a short-term trading perspective.

To avoid the cost of overnight financing, many traders prefer to close their positions at the end of each trading day and reopen them the next morning. This strategy helps manage expenses and aligns with a day trading approach.

In recent times, the popularity of cash indices has surged, becoming a staple in active trading strategies. They offer investors valuable insights into market movements, enabling swift responses to sudden market changes. This capability is especially useful for those looking to capitalise on short-term market volatility and trends.

Index trading FAQs

Is Index Trading better than forex?

Investing in financial markets often involves trading indices and forex, two prevalent methods that offer diverse exposure. Indices trading centres around monitoring the performance of a group of stocks, while forex trading involves the buying and selling of different currencies.

- Index trading: When you engage in indices trading, you speculate on the price movements of a sector or collection of stocks without actually owning them. These indices often include major global companies and are weighted based on the market capitalisation of their constituents.

- Forex trading: Forex trading, on the other hand, entails exchanging one currency for another with the expectation that the value of the currency you buy will rise relative to the one you sell. Popular currency pairs traded include the British pound versus the US dollar (GBP/USD), the euro against the US dollar (EUR/USD), and the US dollar versus the Japanese yen (USD/JPY). Due to the high trading volume, forex markets are highly liquid and can be very volatile.

Both types of trading offer ample opportunities for profit but come with inherent risks. In indices trading, you might use CFDs to speculate on the spot price for short-term trades, or employ for long-term strategies. CFDs also provide hedging opportunities to manage risk.

Forex trading with CFDs involves speculating on the price difference from the opening to the closing of a contract, allowing for leveraged positions which can amplify both gains and losses.

Which is better?

Determining whether indices or forex trading is superior is subjective, as each has its unique advantages and drawbacks. Indices trading's slower pace and relative simplicity may appeal to beginners and those favouring longer-term positions. Conversely, the rapid nature of forex trading might attract more seasoned investors who are adept at navigating its complexities. Ultimately, the choice depends on individual preferences and risk tolerance, acknowledging that both markets carry potential for both profit and loss.

How much money do you need to trade indices?

Trading index CFDs require investors to post a margin. For example, with a leverage ratio of 10:1, an investor must deposit $1,000 to manage $10,000 worth of an index. However, it is generally unwise to use all available margin because a small adverse market movement can lead to a swift liquidation of the position.

One key benefit of trading CFDs is the flexibility to purchase fractions of a contract. Unlike standard futures contracts, which require a full contract purchase, CFDs allow trading in increments as small as 0.01 lots. This fractional trading capability makes it accessible for accounts of various sizes to participate in the market.

How do I become an index trader?

Investors can trade indices using CFDs on Pepperstone's platform. After opening an account that provides access to these markets, investors can immediately begin buying and selling.

How to buy the Nasdaq index?

On Pepperstone's platform, you can trade the Nasdaq index (NAS100) directly, benefiting from higher liquidity compared to other trading methods. The platform operates 24 hours a day, Monday through Friday, offering round-the-clock trading opportunities.

Using leverage, you can trade the NAS100 through CFDs without owning the underlying shares. By putting down a deposit, you can control a larger position, with profits and losses based on the total position size. This leverage means potential gains and losses can far exceed the initial margin, making risk management tools like stop orders essential.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.