Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

Trading Crude in a High-Volatility Environment as Middle East Risk Escalates

The implied volatility in the crude options market has unsurprisingly risen sharply in recent days, perhaps exacerbated by the fact pricing risk in the early stage of a geopolitical conflict is incredibly challenging. Most traders are not geopolitical or military strategists, and as such considering the distribution of probabilities for specific outcomes is certainly not a simple task.

Crude volatility at the highest level since 2022

When market players lose the visibility to efficiently price risk the outcome is nearly always higher volatility (vol) and range expansion – and the volatility in the crude market is now at the highest levels since 2022. Traders can observe implied vol in the oil VIX (OVX on TradingView) which currently resides at 66% - equating to an expected daily move in crude over the coming 30 days of -/+4.2%.

This level of implied movement will be seen as an attractive environment to deploy certain short-term trading strategies. Conversely, it may not be a trading environment in which those utilising a slower strategy, or who hold a lower risk tolerance, may have edge in.

Either way, for those trading crude in such a high vol environment correctly sizing each trade is critical.

Consider gapping risk through the weekend

We also need to consider the possibility of news breaking through the weekend and when the crude markets are closed, subjecting traders to gapping risk upon the Monday re-open. This is a key consideration within the risk assessment framework.

A probability-based framework on crude pricing

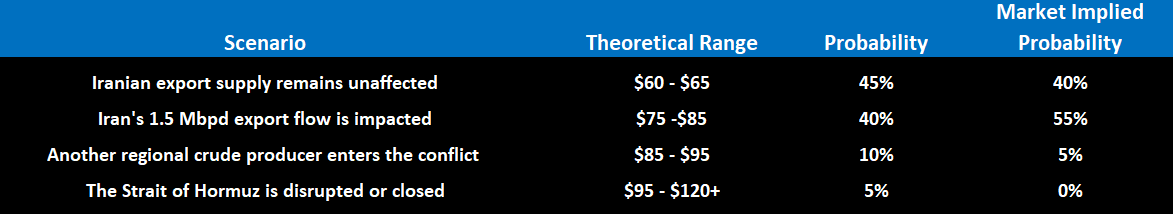

I fully subscribe to the idea that price is the only fundamental required, especially when it comes to short-term trading. However, when we are looking at the crude market, we can loosely ascertain what the price is implying and the impact the conflict could have on the perception of future supply. I have put together a loose framework on crude pricing and a subjective probability distribution of four core scenarios that could eventuate.

The probabilities are my own guestimates, but I have considered inputs from research reports from oil analysts, as well as the crude futures curve and options pricing.

With the crude market driven by how the collective sees the connection between the news flow and the extent of a supply disruption – either through damage to export infrastructure sites or through new sanctions - this framework helps loosely conceptualize what the market is thinking.

These probabilities and perceived eventual outcomes where volatility and liquidity offer such high risk, often result in price overshooting a theoretical ‘fair value’ estimate - subsequently, trading a potential outcome, even when one sees a clear skew in the distribution, is a very different proposition.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.