Analysis

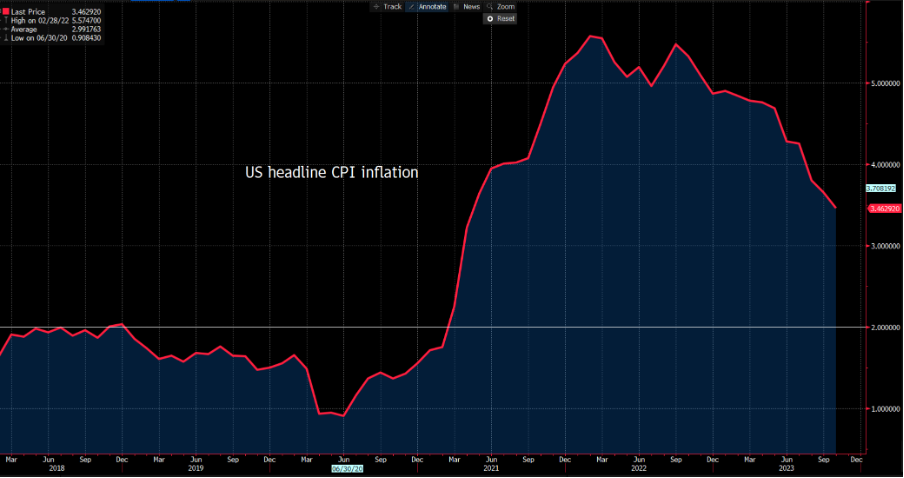

Cast our minds back to January 2023, and investors were seeing inflation falling, with headline CPI coming in from 9.1% (in June 2022) to 6.4% (in December) – however, confidence of further falls was still low, and traders saw the path for inflation as evenly distributed. The absolute level was also still very high, and the Fed were hellbent on bringing that down, where at the time many felt that this could come at the expense of a recession - which was the big consensus view.

We also knew that the Fed was focused on reducing its balance sheet through $95b p/m in balance sheet runoff (or QT). For many, the perception of reduced liquidity meant being underweight or bearish on equity and credit.

It’s not hard to understand why the market felt vulnerable, believing the historical saviour of the capital markets was no longer going to support, even on a 15-20% drawdown in the S&P500.

2024 is a very different dynamic

In 2024, the Fed have a 5.3% fed funds rate to play around with and can cut rates if there is a need to support businesses and the consumer. A far cry from the zero-interest rate world we’ve been accustomed to for many years.

Having reduced the balance sheet by over $1t and having numerous case studies showing how effective the use of its balance sheet has been in providing targeted and immediate support. The markets know the Fed will not hesitate to utilize its balance sheet to provide target liquidity and capital to stave off any issue deemed potentially systemic.

Most importantly, the distribution for US inflation is now considered skewed and one-sided, with a high probability of lower levels.

Hence, the Fed has increased scope to ease policy should the need arise, and while Fed officials are saying their work is not done, and the last push to get to its 2% inflation target is the hardest part, they can front load cuts far more efficiently when core PCE is at 3.5% and falling.

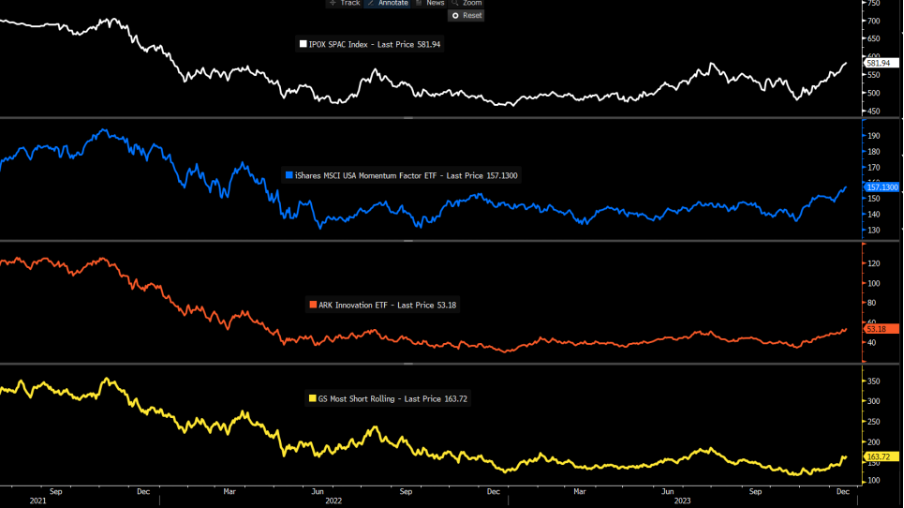

In recent times we’ve seen massive inflows in US equity and ETF funds, accelerated corporate equity buy-backs, which are suppressing volatility, and generally FOMO capital chasing returns. Within the flows, there’s been an active rotation into junk and high leverage equity, as well as high short interest plays – confidence is clearly euphoric.

It’s easy to argue that traders know that if a tail risk event plays out in 2024, then this time is different, and the Fed (and other DM central banks) will support asset markets. The strike price for the 'Fed Put' has moved far closer to the market.

Recent history has shown time after time when bad things happen, they are nearly always rectified in a positive fashion and we ‘climb the wall of worry’. Its why funds are consistent sellers of volatility on spikes.

The buzz phrase for 2024

Talk of a ‘Fed Put’ will be a major buzz phase in 2024 – markets may even test it out and take on the Fed to search out its willingness to act and to support. For market participants, it suggests that equity drawdown will be supported and ‘buy the dip’ will be back in vogue once again – not that it really has gone away.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.