- English

The Daily Fix – The ever-growing dispersion in global indices

- Global equity indices tread their own unique path

- US equity trades in the third lowest high-low range of 2024

- US banks finding the love

- The USD is unchanged, but watch NZD and GBP exposures ahead

- Commodity moves on the day

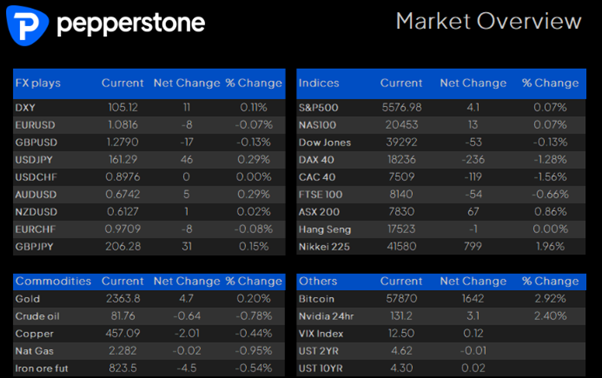

Moves are being made in global indices, but many are treading their own path and the dispersion in performance in the major markets is striking. European equity indices find sellers easy to come by, and in the case of the CAC40 the set-up looks decidedly like it wants to break to new cycle lows. Japan heads in completely the opposite direction and has been an absolute pillar of equity strength as global capital moves to ‘what’s strong and working’ and where the momentum is most pronounced.

The HK50 has been trending lower since mid-May, and while our opening call of 17,587 (+0.4%) for today’s cash open looks positive, the buyers hold little confidence that rallies will be any more than a one-day affair. The ASX200 is essentially moving sideways and chops in a 7850 to 7650 range, and while banks support the index, materials are in the doghouse and can't sustain a bid – I am not sure today is going to get any easier, with iron ore and copper futures lower, with BHP’s ADR suggesting the stock opens 1% lower.

In the US, the S&P500 is grinding higher, having closed higher for a sixth straight day, although the net percentage change was a meagre +0.1%. It was not a particularly great session for the day traders with the S&P500 trading in a 16p high to low trading range – the third lowest of the year, and the buying looks exhausted as we approach 5600. Moves are made beneath the index surface though, and despite Citi putting out a note suggesting investor take profits in the high-flying AI enablers, Nvidia still found some form and added 2.5%. Tesla has the wind to its back and while this is hard to chase at current levels, I feel the path of least resistance is still higher. The banks are where we’re seeing capital allocated – perhaps this is late-cycle investing, or perhaps traders are front-running earnings on Friday, but Citi, Bank of America and JPM all look strong and well-liked.

On the day, we’ve seen very little net change in US Treasuries, and this has spilt over into limited moves in FX plays. Fed chair Powell testified to the Senate Banking Committee, but his comments offered no real insights or new intel for traders and were perfectly balanced. Powell speaks again in the session ahead, this time to the House Financial Services, but there is little chance he will say anything that is not already known – US CPI (tomorrow) is the real catalyst, and it makes sense for Powell to be purposely vague until we get this intel. Either way, the USD is little changed on the day, with limited moves across the G10 FX spectrum, and one needs to head out into the LATAM plays for any real life, with the CLP, BRL, and COP gaining around 1%.

In the session ahead keep an eye on NZD exposures given we get the RBNZ statement dropping at 12 pm AEST – the bank won’t move on rates, and the NZ cash rate will remain at 5.5% - however, this is an exercise in reconciling the tone of the commentary and guidance to NZ swaps/rates pricing. Here we see 12bp of cuts priced for the October RBNZ meeting, and 64bp of cuts priced by February 2025. The RBNZ will want to see the Q2 CPI print (due 17 July) before committing to a more explicit easing bias, so it feels on balance that there are greater upside risks to the NZD today – I am not one to bet on a policy announcement, but I am warming to a short EURNZD (with a stop on a daily close above the 50-day MA) position and long NZDJPY.

GBP positioning also requires some consideration given we hear from BoE personnel Huw Pill and Catherine Mann in the session ahead. Again, we may need to see next week's UK CPI data to obtain new intel, but the UK swaps market price 15bp of cuts (60% implied) for the 1 August BoE meeting, and 47bp or almost two full 25bp cuts priced by December.

Tactically I like EURGBP lower, but the flows and momentum are not there yet, and I’d want to see price crack and the downside momentum pick up. GBPUSD consolidates below 1.2800 and in the higher timeframes I hold a neutral bias, and this needs work to offer a strong conviction on a directional bias – one for the radar though.

Commodities get attention – Crude looks heavy, and looks probable to head into $80, where we see all the main moving averages. Gold sits at $2364 (+0.2%), which is a far more fitting reaction to the confined moves seen in the USD and Treasury market. Getting a bit exotic and we see coffee (+5.8%) and cocoa (+4.7%) have made moves that have kicked up on the radar. Coffee has broken out to new highs, but I won’t chase – I do like cocoa longs though and feel this has the potential to kick through the 50-Day MA and onto 10k.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.