Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

One could argue that given the moves and flows we saw last week the platform was already set, and investors were already questioning their position in big tech - throw in clear disappointment in Alphabets Q3 CAPEX guidance, and outright poor numbers from Tesla (with no real guidance to inspire), and we can see the effect in MAG7, semis and the AI-related plays.

We can also add an ongoing unease around China’s growth trajectory, very poor PMIs in Europe and a bearish opinion piece from ex-NY Fed member Bill Dudley, and investors and traders derisked and de-grossed portfolios - with an outright closing of long position into cash or rotating into the ultra-safe/low volatility beneficiaries - utilities, and healthcare.

We also can’t dismiss the technical developments, where we’ve seen the NAS100 futures break the 50-day MA, which many use as a trend filter. While momentum and trend-following systematic funds (‘CTAs’) have seen both the S&P500 and NAS100 futures breach key price trigger levels that dictate that they reduce the length in positioning.

Options flow would have also exacerbated the selling in equity, where we’ve seen a sizeable ramp-up in S&P500 1-month put buying, with traders/funds looking to hedge downside risks. The VIX index now trades at 18.04%, which indicates daily moves in the S&P500 of -/+1.1%.

The inspiration for the bulls is that IBM sits +4% after hours after reporting upbeat earnings numbers, and with S&P500 futures still holding above the 50-day MA, this level will need to hold, or increasing volatility could beget even higher volatility.

In FX markets, carry continues to be unwound with real venom, and the JPY is flying, with JPY shorts once again taken to the woodshed, backed by solid demand for CHF, CNH, and USDs. MXNJPY has fallen a further 2.2%, where the moves here have been brutal, while AUDJPY and NZDJPY is not far off. Like we’ve seen in US tech and the NKY225, the rally in the JPY is positioning 101 – if you want to dance in the disco, you need to be closest to the exit when the fire breaks out. And after the world had racked up a huge JPY short position, that fire is well and truly ablaze, and it sets us up for a very interesting BoJ meeting next week, where some are calling for a 15bp hike.

We’ve seen good demand for US 2yr Treasuries, with yields settling at 4.43% -6bp, and with the selling seen in long-dated Treasuries (US 10yr Treasury settled at 4.28% +3bp), the result has been a sizeable bull steeping of the US Treasury curve. Gold initially rallied to $2432 on haven buying, but as the US 2yr Treasury yield fell gold was pulled lower in sympathy and gold now holds below $2400 – Our flows in gold have been above average and I would imagine they will remain so, especially if we see a downside break of $2388 and into the 50-day MA (2360).

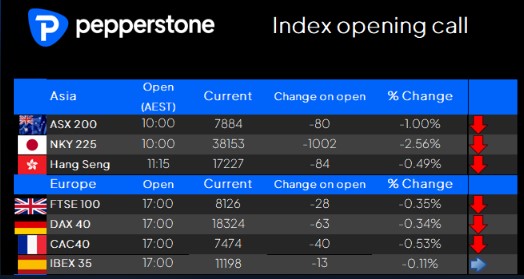

Given the moves seen on the US equity dancefloor, our calls for the Asia equity open are shaping up for a somewhat dark and sinister feel. Notably, the cash equity open for the NKY225 looks ugly, and as we see on the daily timeframe the index is in freefall – almost optimal conditions for the short sellers, with the buyers standing aside and pulling their bids to lower levels.

The ASX200 eyes an unwind 1% lower, and like we saw in the S&P500 sectors, it’s the companies with ultra-predictable and stable cashflows which will find the love today, where utilities and staples should outperform, and materials, banks and tech will find sellers.

China is eyed to open lower, but its times like these when the Chinese equity markets will do the opposite of DM markets and find a bid from seemingly nowhere – so while we see modest selling on open, it wouldn’t surprise at all if the tape turns early in the session and the buyer’s step in hard.

Good luck to all,

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.