Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

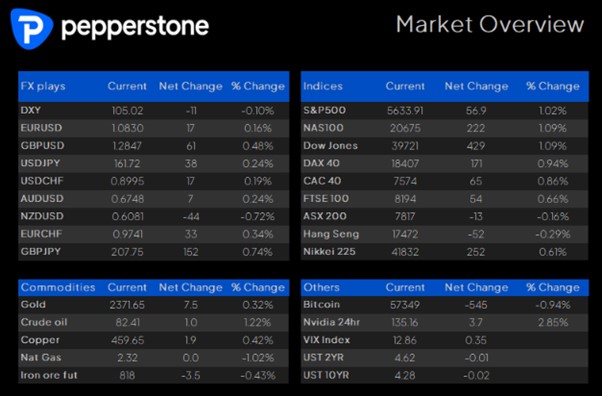

The Daily Fix – A sea of green on screen as US CPI looms large

• US equity rallies for a seventh straight day

• Tech leads the charge, with all sectors working

• Asia equity opening calls – the NKY225 on a tear

• FX moves – the GBP breaking big levels

• US CPI ahead – an event risk that needs focus

There’s a lot of green on screen and the market goes into US CPI in the session ahead with the bull’s firmly bossing proceedings. It’s hard to pinpoint a reason for the rally, so we’ll just go with the fact that the market was open – flow and momentum work to its own rhythm, and as many of the day trading community will attest to, if the market goes on a run, you just must align with the moves being made on the dancefloor.

S&P500 intraday tape

Price action in the S&P500 was suggestive that the buyers were exhausted yesterday, but they’ve been thoroughly reinvigorated, and we see an absolute textbook intraday trend day, with the index setting off higher after an hour of cash trade, with the buyers showing absolutely no regard for the 5600-round number, or any of the raft of technical indicators which suggest grossly overbought conditions.

Seven consecutive days of gains in the S&P500 are rare, and we haven’t seen this run of form since August 2023, and only 9 occurrences of such form since 2020. In 66% of those occurrences (when the S&P500 gained for 7 days), the S&P500 fell the following session, but ultimately in most cases, it was just profits being banked and shortly after the index pushed higher – momentum favours the brave.

Tech has once again been at the heart of the move, with Apple (+1.9%) pushing to new highs and into $232.98 – guiding to 10% more iPhone shipments will keep the dream alive, but it's truly hard to chase this name up at these levels. Similar for Nvidia which closed at $134.91, and eyes a re-test of the ATHs of $140.76, but it takes a brave soul to bet against any of these plays at present. All S&P500 sectors closed higher, although it was the banks that came in at the bottom of the pack.

The goodwill from US and EU equity markets will spill over into a solid open for Asian equity, not that the NKY225 needs much encouragement and with the JPY finding sellers in the mix, the Japanese equity market should open 1.5% higher, and nicely above 42k. The ASX200 has been coiled in a tight range of late, but the open should see the buyers making a statement, with the index eyed to test the 7900 level and an assault on the 16 May highs is on the cards. The question will be whether the bulls can keep the index supported once cash equity trade gets underway, or whether traders use the opening strength to offload longs as we roll on through the day - understanding that the US CPI print could promote gapping risk for individual equities for Fridays open. The challenge for the bulls then, is to see a session close above 7900.

While bond traders saw a solid US 10-year Treasury auction, there’s been very little move across all parts of the Treasury curve, and this has resulted in a flat close in the USD index (DXY) – in G10 FX, the session belonged to the GBP, with BoE Chief Economist Huw Pill speaking, but failing to offer the dovish remarks needed to justify the level of cuts priced for the August BoE meeting. GBPUSD has broken out above the 1.2820 highs I have been flagging, and while it's hard to chase given the US CPI print ahead, the bulls are in control here and this has the potential to kick higher.

GBPUSD daily

GBPJPY is the real momentum play though, with the pair having closed higher in 16 of the past 18 sessions. For those willing to pay a wider spread, GBPNOK is the play of the day, and big movement (+1.5%) more than compensates. This is a pure rates play, with UK swaps pricing coming in for the August BoE meeting (the implied prospect of an August cut now sits at 50%), while a big downside surprise in Norway’s CPI has opened the door to cuts by December.

We’ve seen good selling in the NZD too as the RBNZ removed hints of future hikes and gave a view that inflation could normalise quicker than thought – I saw hawkish risk to that meeting given the level of cuts priced, but that was clearly the wrong call. It happens, and again reinforces the view that trading over news is not a strategy I would promote. Either way, the RBNZ has breathed fresh life into long AUDNZD positions, and that is one that I have been skewed towards of late and pullbacks should be shallow here.

Commodity markets have taken somewhat of a backseat, although we see modest gains in crude, copper, and gold, with iron ore futures and Nat gas down smalls.

By way of event risk, it’s really all about US CPI (due at 22:30 AEST / 13:00 UK) – the consensus is for US core CPI to round to 0.2% m/m (3.4% y/y) which would reinforce the 18bp of cuts priced into US swaps markets for the September FOMC meeting (or a 72% probability implied). We’d need a core CPI print above 0.3% m/m, driven by higher core services to see better USD buying and equity sellers, but we could just as easily see a print below 0.2% m/m – a fate which would likely keep the risk on rally pumping.

Recall, that Jay Powell has shifted some of the weight of Fed thinking away from a heavy concentration of their thought process on inflation towards the labour market – but while we could get a number today that’s in line with the consensus, an outlier print could set the markets off – it is a risk we need to consider and potentially manage.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.