- English

What’s important for gold traders is to recognise the changes in trading conditions. Changes in volatility, range expansion/contraction and whether price is trending or balanced, can have huge implications for our strategy but also how much risk we take in each position. The degree of risk we take in a position (mostly through distance to our stop loss) flows into our position size and typical hold times.

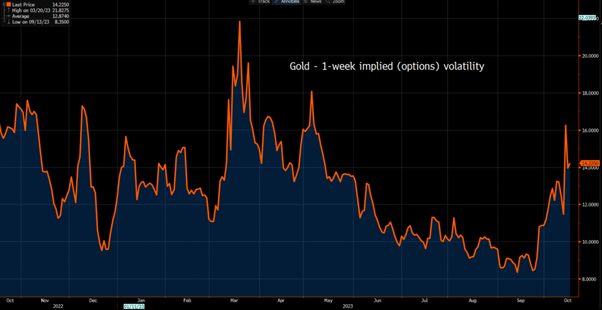

Certainly, this was the case on Friday where 1-week and 1-month options implied volatility spiked significantly higher, showing that options dealers are pricing greater movement over these periods. The levels of implied movement remain elevated.

Friday’s $60 high-low range was thematic of what could lie in store, although we’ve seen that range moderate on Monday. There is no doubt that we are now in a headline-driven market, which suggests trading ranges may be elevated from here and our ability to react, to be agile and keep an open mind to changes in price will be a huge advantage to traders.

The technicals have turned bullish, offering further upside risk - Having broken out of the bear channel price has held since May, gold longs (certainly for swing traders) will naturally want this to build. With price (on the daily) still holding above the 5-day EMA, momentum suggests a risk we push to the September highs of $1947/52 and pullbacks should be supported. A clean break of $1952 would see $1981 come into play, where this level has been a big resistance level since May - where we’ve seen increased supply come in and cap the upside on at least nine occasions.

Looking ahead the potential catalysts to the gold markets we see:

The bull case:

- Traders further hedging geopolitical risks amid further deterioration in the news flow from the Middle East – specifically, if we were to see increased signs of potential military involvement from Iran, then gold will find buyers on safe-haven demand. Conversely, the increasing presence of US personnel may help reduce this risk.

- Energy markets are key for the direction of the gold market - Should the market increase the probability of a supply disruption to gas flow from the Leviathan gas fields in the North of Israel, or even the Straits of Hormuz, it could have significant implications for EU Nat Gas (NG). Most see this as a low probability, but should the odds increase EU NG should respond.

- As we saw in March 2022 and August 2022, when EU NG rallies the moves can be incredibly aggressive – the result of higher EU NG would be concerns about a renewed energy crisis in Europe. We would see EU real rates heading lower and concerns of a more protracted recession in Europe increasing. In this scenario, we could see gold rally along a stronger USD, which is typically rare.

- Again, the odds seem low at this stage, but should the market grow increasingly concerned about supply disruptions in crude, then a move towards $100 in Brent crude would see headline inflation pick up and recession risks accelerate, given it is seen as a tax on the consumer.

- We can add in the rising probability of a US govt shutdown in mid-November. The impact of a shutdown should be contained and the impact on growth modest and temporary, but a dysfunction Congress would likely support gold.

- We see US economic growth slow down and labour markets cooling – this may take time to evolve – but should we see US bond yields heading lower, this should support gold.

The bear case:

- The market builds a conviction, that through US diplomacy, other countries will not become involved in the conflict – subsequently, equities rally and gold hedges are unwound.

- We see EU NG and Brent prices find better sellers and move lower, resulting in investors adding risk to portfolios.

- We see US growth data come in above expectations – this could result in renewed selling in US Treasuries (high bond yields), and a renewed bull trend in the USD.

- While we expect near-term China economic data to remain soft, we should see the various stimulus measures and system liquidity feeding through to better Chinese growth moving through Q4 – this could support risk appetite more broadly and see traders move away from safe havens.

We are in a period where headline risk will drive the gold market – geopolitics, moves in energy markets and the perception of future growth are key. Potentially higher volatility impacts our trading environment, and we need to be dynamic to these changes. Keeping an open mind to market interpretations will be key and price will let us know how the collective sees these dynamics unfolding.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.