- English

The title of the conference is “Navigating the Decade Ahead: Implication for Monetary Policy” and at the risk of being dramatic, it promises to be a defining moment in monetary policy settings.

Fed chair Jay Powell takes centre stage when he speaks at 23:10 AEST, but we also hear from BoE Gov Bailey at 23:05 AEST, and BoC Gov Macklem just after Powell. ECB chief economist Philip Lane rounds out proceedings with his speech at 01:50 AEST.

One may have felt that risk could have been shunned into Jackson Hole, but quite the opposite can be seen. European equities closed up modestly higher with the DAX leading the charge with a 1% gain. In US trade, tech has smashed it once again and from 22:30 AEST the buyers stepped in and pushed the index towards 12k. I was looking at reversing the long call, but the selling just never came in and I continue to hold and will do until price can close below the 5-day EMA. The US500 hones in on 3500 and has closed up 1%, yet we’ve seen the VIX gain 1.2 vols to 23.27%, while the NASDAQ VIX (VXN) has pushed 3 vols higher- an equity rally married with higher implied volatility is odd – traders are betting on movement.

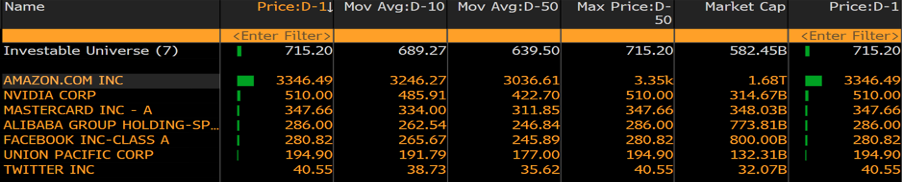

Digging into S&P 500 sector moves, we see comm services on fire, with tech just behind, notably buoyed by Salesforce and Adobe which have exploded 26% and 9% respectively. Microsoft has worked too, but in the universe of US stocks we offer, if I scan for names that are above the 10-day MA, 10% above its 50-day MA, and that reside at or near the 50day high – i.e. momentum/strong stocks – I see these names and they are flying. Buy strong, sell weak, as they say.

(Source: Bloomberg)

On the data side, we’ve seen a monster 11.2% increase in durable goods orders in July, smashing expectations and continuing the theme of better data, which I think is just so key to the risk story. Take out transportation and we saw a 2.4% increase, which still beat consensus by 40bp. French consumer confidence was also pretty good and that added to news that the German govt is extending measures to help business from insolvency, in turn, supporting the German labour market. We’ve also seen news that Moderna will be presenting its new interim clinical data later today (12:30 AEST) and again this is helping sentiment.

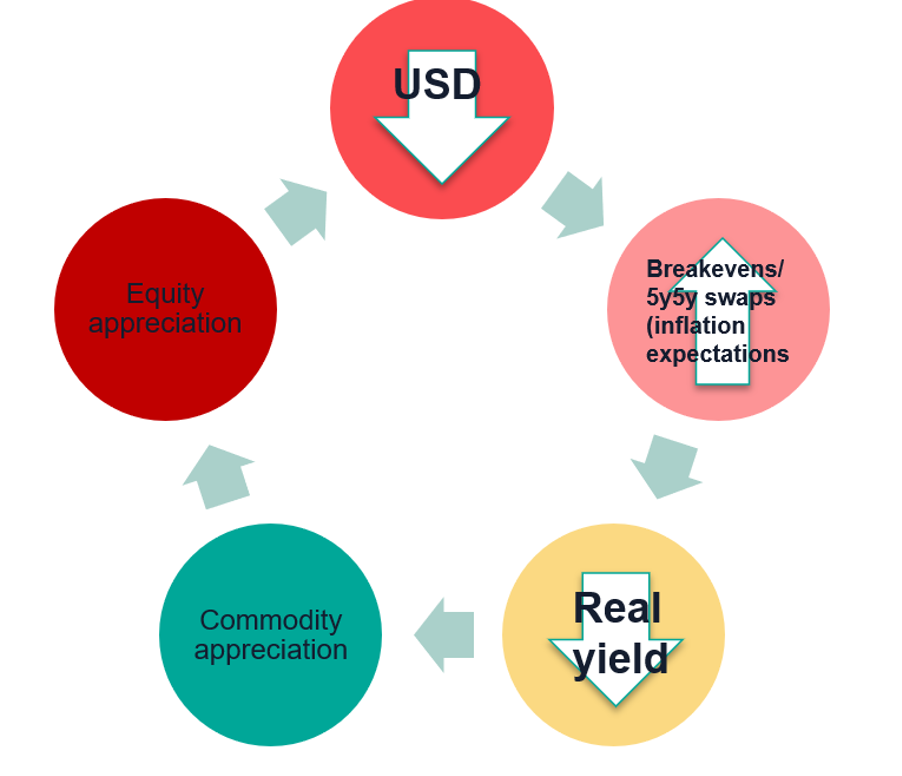

The USD is down smalls vs the EUR, with EURUSD tracking a 1.1772 to 1.1839 range on the day. Yet when EURUSD found a bid from the lows, so too did we see Nasdaq futures rally. This is my tongue in cheek mock-up of the perpetual motion in markets. It all rotates into one circular trade, but does it start with USD weakness?

We’ve seen solid moves in the NZD, with NZDUSD up 1.2% and into the top of the recent channel and through R3 (pivot points), so it tells you it was a punchy move. Can it break out?

<

<

There are other pairs which get the attention for breakout traders, with USDCAD, GBPUSD, AUDUSD, and AUDJPY also in the mix, with price moving into the top of their respective ranges.

Any worry that Jay Powell will disappoint has not been in the precious metals space and whereas yesterday I asked if there was to be a catalyst, it seems the market has found one, with gold printing a strong outside day reversal. Silver has gained a lazy 3.2% and gold 2% and helped seemingly by a 5bp decline in real yields on the day, where real Treasury yield remains the focus as we head to Jackson Hole. We know Powell will be dovish, we expect that he will reveal some of the findings of the long-running policy review and we have a belief that he will detail a tolerance of some sort of inflation overshoot. But how explicit will he be and how much has now been discounted and will we get the full clarity and urgency to meet the market? Given the moves, it feels like the market is confident he will be.

I will update the Telegram channel on FX and gold overnight implied volatility, and implied moves as the day rolls on, so keep an eye out there if it helps.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.