- English

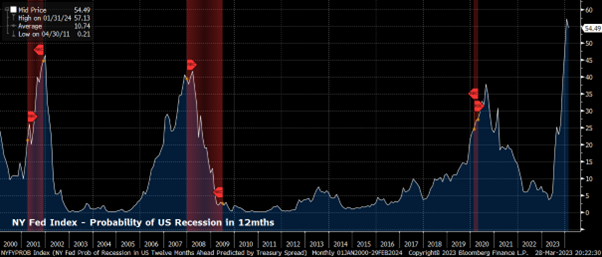

Though a recession is not yet consensus, such an outcome is becoming increasingly likely, with many market-based indicators – such as the bear steepening Treasury yield curve – flashing ever-brighter warning lights. Consequently, many traders and investors are starting to consider the best ways to position themselves into, and during, such an economic slowdown.

Before getting to that, however, it is important to clarify two things – the nature of the recession, and the likely central bank response to any recession in light of that.

On the first point, one must consider specifically whether this is likely to be an inflationary, or deflationary recession. With headline CPI running considerably above central banks’ 2% target across DM, and core inflation proving especially sticky, it seems logical to expect any upcoming recession to be one where inflation remains at an elevated level – a ‘stagflation’ scenario, if you will.

Subsequently, one must then consider what the likely central bank response will be in such an environment. Will central banks cut rates, and turn on the liquidity taps, as they have so readily done so in the past; or, will rates remain high, as the battle against inflation continues? At present, if we are to take policymakers’ comments at face value, and believe that controlling inflation does not come at the expense of financial stability, then one must assume that the ‘central bank put’ may not automatically come into play this time around.

Trading such an environment requires a very different playbook, and mindset, than the ‘traditional’ recession playbook, where one would simply hide out in havens such as bonds until the storm passes.

This is because, in an environment where rates remain elevated, especially one where rate cuts are heavily priced into the curve 6-12 months out, bonds are likely to sell-off, as opposed to finding the haven demand that is typically seen during a steep slowdown.

Instead, it is inflation hedges which are likely to find buyers, which is where gold – which sits just shy of all-time highs in the spot market – and other precious metals, may start to shine.

Other assets that may shine include the USD, which tends to perform well in times of turmoil, as well as defensive equity sectors – such as consumer staples, utilities, and energy – are likely to outperform their cyclical counterparts. This would be the base case going into any 2023 recession.

In contrast, if we are moving into a recession where one can expect looser central bank policy to result, likely due to cooler inflation, the playbook differs. While gold and the USD are both likely to remain solid haven plays, it’s also plausible to expect bonds to rally, as markets price a more dovish policy outlook, and investors seek shelter in government debt. Furthermore, one can expect high beta FX to underperform (currencies such as the AUD, NZD, and GBP), while cyclical stocks may find more love than in the prior scenario we outlined.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.