Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

A Trader’s Playbook: Navigating Tariff Risks, US Growth & Market Volatility

Throughout last week we have witnessed long-standing international relationships become damaged and distanced, yet, new alliances emerge, with Canada, the UK and Europe forging closer ties and showing solidarity towards Ukraine. Reports that Putin may seize on the opportunity and cut a minerals-backed deal with Trump are also in play and if the reporting builds it could spice things up, although the devil would be in the details.

Europe Set the Ramp up the Spending

Europe looks to galvanize from within and become a stronger and more united entity. Market attention falls sharply on the EU region this week and there are three key aspects that could cause gyrations in the EUR, EU equities and EU bonds markets:

- EU leaders are due to hold an emergency summit on Thursday, with a potential agreement in the works to suspend fiscal limits, which would pave the way for EU nations to follow Germany’s lead and to massively increase defence spending.

- Whether Trump’s threat of a 25% tariff on EU autos (and other imports) comes to fruition.

- EU CPI is released today, with the ECB meeting due on Thursday, with the markets fully expecting a 25bp cut to be announced.

Navigating an Impending Deluge of Tariff Headlines

Tariff headlines are clearly a significant risk for broad market confidence this week, with traders hoping to get a firm outcome on tariff implementation on Tuesday and not see another pushback on the timeline. Tariffs on Mexico, Canada, China and Europe are the focus, with the prospect that the US Administration pulls the trigger on 25% tariffs on Mexico and Canada, with China set to see its tariff rate increase by an additional 10%.

Mexico appears most likely to get some sort of reprieve, having suggested that they may align with the US and slap tariffs on Chinese imports. The probability that Canada and China avoid its tariff increases seem far lower, and should they kick in as scheduled then volatility and risk-aversion would likely increase across broad markets.

Canada reported hotter Q4 GDP numbers on Friday (+2.6% vs 1.7% eyed), but a 25% tariff increase, that is then countered, would result in clear downside risk for future economic activity. We should also get Canadian employment data on Friday, where a weaker jobs print could force a 25bp rate cut from the Bank of Canada on 12 March and put the CAD at risk of attracting increased sellers. A Huge Week Ahead for China It’s the additional 10% tariff set for China's imports that is arguably the bigger issue for broad markets. Front-loaded tariffs on China that get the total tariff rate towards 60% by a far earlier date would significantly impact China’s push to escape its deflation trap – subsequently, it would require a more aggressive approach from policymakers to spur domestic consumption and to build an expectancy from households and businesses that the expected returns from investing compare favourably to paying down debt.

Should the additional 10% tariff kick in, we then watch for China’s counter-response - either through an increased appetite to depreciate the RMB or via tariff increases on targeted US goods. Market players will also be watching for headlines from China’s NPC meeting on Wednesday, where policymakers are expected to announce a RMB2 to 3 trillion fiscal stimulus – a value that risks once again underwhelming the Chinese/HK equity markets and notably at a time when many are banking profits after the blistering run through January and February.

Trading the USD: Tariff Risk vs Economic Data

Trading the USD in the week ahead will not be for everyone, as few will be comfortable carrying over positions when not in front of the screens, given the impact that could come from the impending deluge of headlines.

If implemented, tariff risk offers upside risk for the broad USD, where this force may collide headfirst with US growth concerns. How these two forces pair off this week and impact the price action in the USD will be fascinating.

Last week saw the USD outperform all major currencies and has momentum working for it as we push into the new week. With the USD pairs significantly divergence from the fall in US 2yr Treasury yields and the addition of implied Fed rate cuts, it’s clear that FX players have put more weight on tariff risk than the softer US economic data seen last week. That dynamic may change later in the week when the outcome of tariffs is known. I would argue that the reaction function in markets is skewed towards a greater sensitivity to weaker US data, than the relief we’d likely see on a positive surprise.

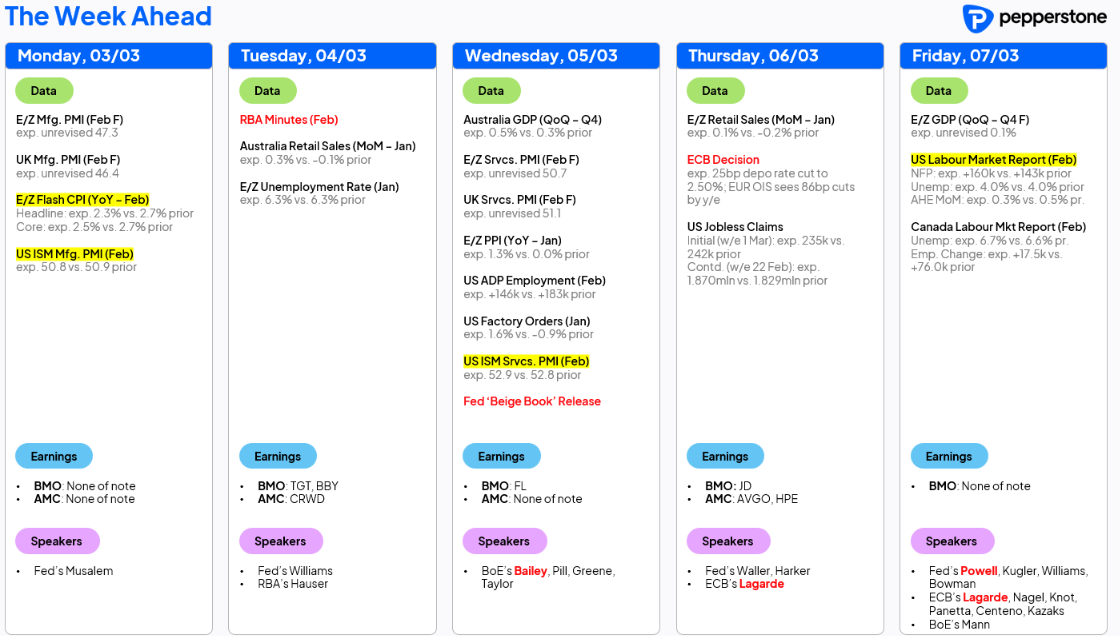

Either way, it’s clear that the market is not going to tolerate weaker-than-expected US economic data this week, with the USD more susceptible to selling flows vs the lower yield currencies (JPY and CHF). Reviewing the US calendar and we see the marquee US data points to navigate are the ISM manufacturing, ISM services and nonfarm payrolls. Consider that Fed chair Powell speaks 4 hours after the payrolls report, so he may offer a view on how the data flow affects his thinking on policy.

Crypto has Come Alive and Looks to Friday's Crypto Summit

In a week of Summits and key deadlines that offer binary outcomes for markets, this Friday’s White House Crypto Summit will be front and centre on crypto trader’s minds. Trump’s Sunday night post detailing his directive to progress the Crypto Strategic Reserve with the inclusion of XRP, SOL and ADA are clearly a positive shock to the crypto scene and a shot in the arm for a market desperately in need of a catalyst to alter the bear trend lower. Whether the sharp rallies we’ve seen today build is debatable, as moves in TradeFi markets may further impact sentiment in crypto – however, the prospect of trader's running BTC, ETH, SOL etc hot into Friday's White House Crypto Summit is certainly elevated.

Can Friday’s Late Session Equity Rally Build?

US equity markets may have seen a solid rally into Friday’s close, but this seems to have been driven by traders squaring positions into the weekend, with short covering and month-end rebalancing flows also a factor. Granted, we’ve seen numerous indicators portray deep negative sentiment towards high momentum and growth equities, but I’d stop short of saying sentiment at an index level has yet to hit an extreme and enough to really compel the buy-the-dip crowd.

That said, we must be open-minded to the idea that US equity indices could be 3% higher or lower by the end of the week – such is the risk to navigate, and what is implied in the volatility markets.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.