- English

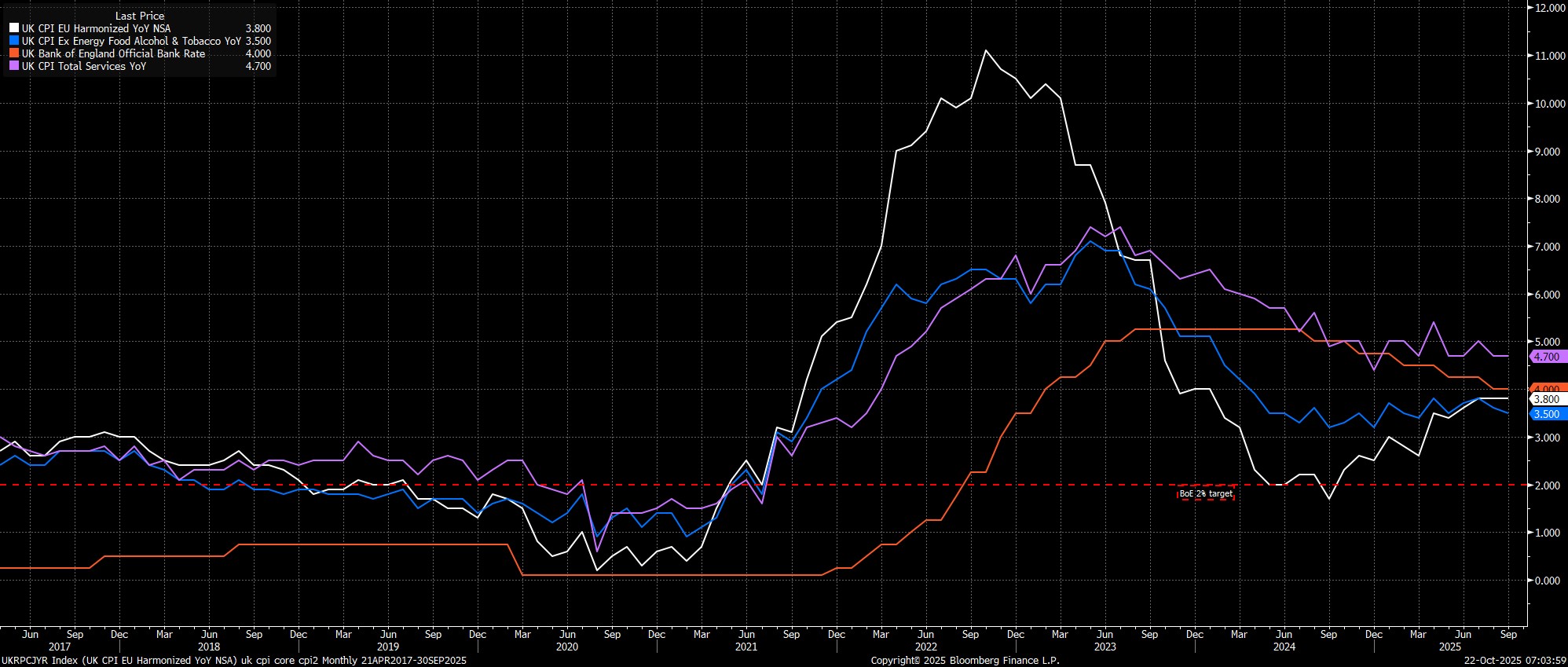

Headline CPI rose 3.8% YoY in September, well below both market expectations, and the BoE's forecast for a 4.0% YoY rise, and unchanged from the pace seen in August. Meanwhile, metrics of underlying price pressures also printed cooler than expected, as core CPI rose 3.5% YoY, and as services CPI rose 4.7% YoY, also unchanged from last time out, and considerably below the Bank's 5.0% YoY expectation.

The details of the report were also surprisingly optimistic, most notable as food prices fell 0.2% MoM, and rose by 4.5% YoY, mirroring declines seen elsewhere in Europe in recent months, and likely giving the MPC some cause for optimism, given how this component remains a key driver of consumer inflation expectations.

On the whole, however, it seems highly unlikely that this morning's figures will materially move the needle in terms of the BoE policy outlook, despite the figures being considerably better than expected.

While the 'Old Lady' expect September to mark the peak in terms of inflation this cycle, policymakers on the MPC will want to be sure that peak has indeed passed before taking further steps to remove restriction, something that is impossible to gleam from just one print.

Furthermore, the huge degree of pre-Budget uncertainty, chiefly in terms of where upcoming tax hikes are likely to fall, and whether those tax increases again prove to be inflationary.

Hence, while there remain significant splits among MPC members over the degree of slack emerging in the labour market, and the speed at which said slack is making itself known, it seems unlikely that a majority of policymakers will favour a rate reduction before the year comes to an end. As such, my base case remains that the MPC are now on hold until next February, at which point a 25bp cut is likely to be delivered, providing that greater certainty of inflation having peaked has been obtained. From then on, a resumption of the quarterly pace of 25bp cuts is likely, before Bank Rate gets to a terminal 3.25% this time next year.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.