- English

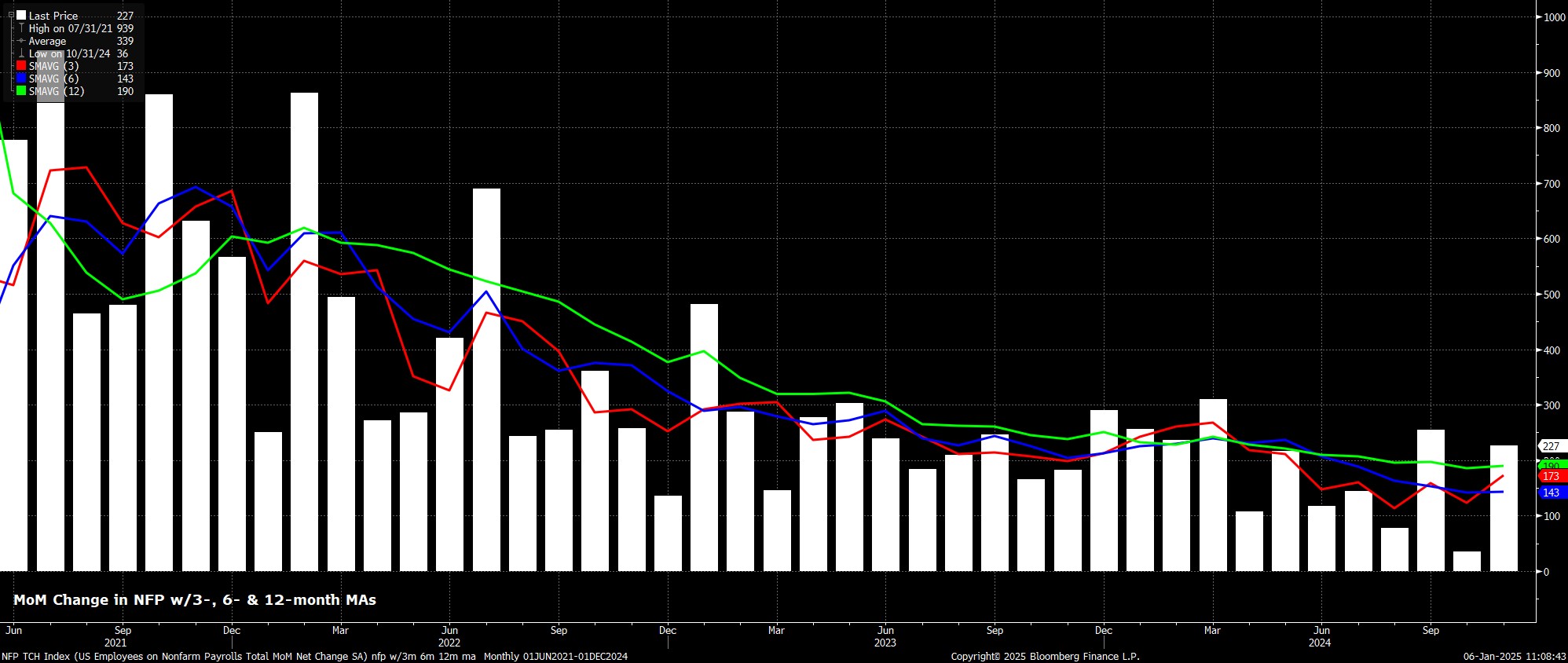

Headline nonfarm payrolls are set to have risen by +160k last month, a modest slowing from the +227k pace seen in November, though that figure was boosted by the restoration of temporary job losses as a result of the Hurricanes which hit the US last autumn. In any case, a print in line with consensus would be broadly in line with the 3-month moving average of job gains, currently +173k, its highest level since May. As always, the range of estimates for the payrolls print is incredibly wide, from +120k to +200k.

Leading indicators for the payrolls print point to some risk of a downside surprise. Initial jobless claims rose by 5k between the November and December survey weeks, while the 4-week moving average of claims rose by 8k over the same period; although, continuing claims were essentially unchanged.

Meanwhile, the employment component of the ISM manufacturing survey sunk deeper into contractionary territory in December, printing 45.3, with the services index not yet released at the time of writing. The ADP employment report, as always, isn’t worth more than a cursory glance, given its near non-existent correlation with the official payrolls figures this cycle.

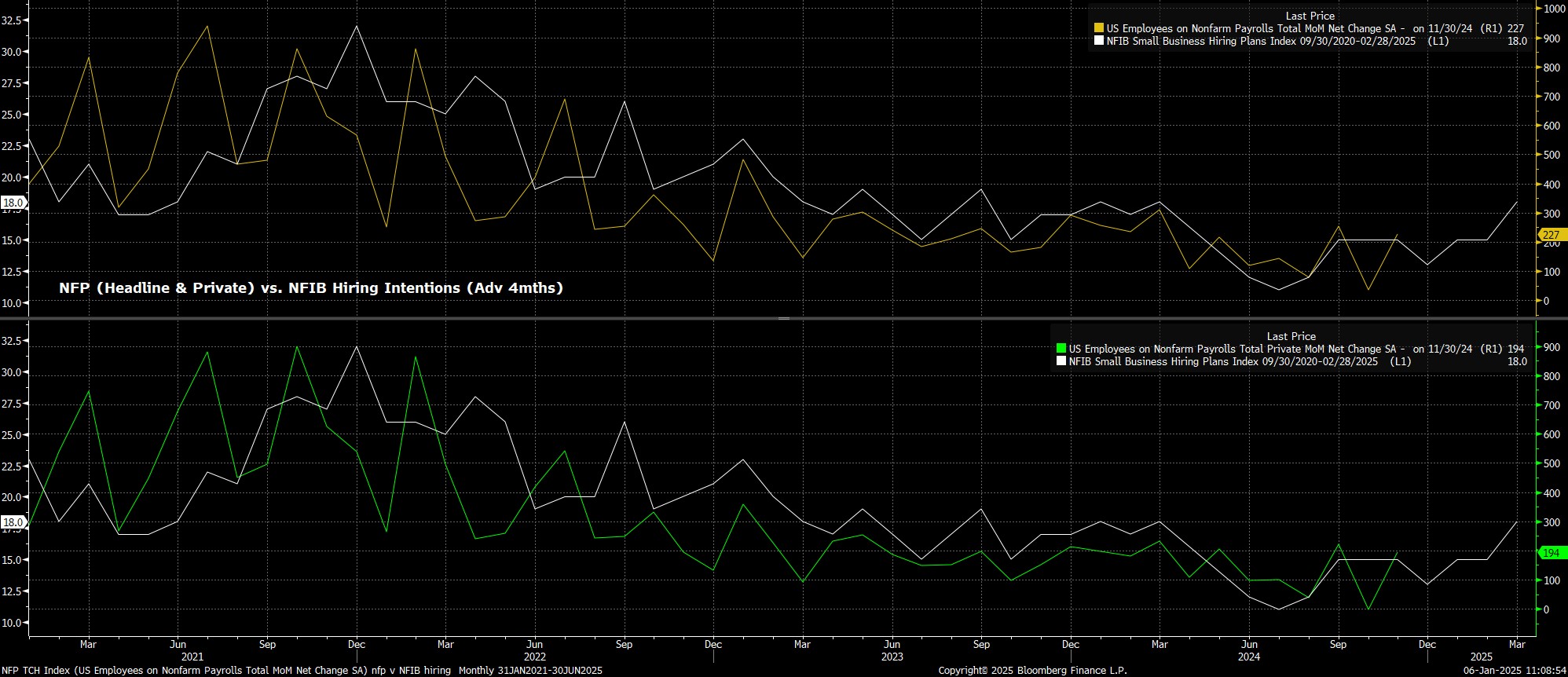

The NFIB hiring intentions survey, though, has proved a more accurate leading indicator, barring a blip during the aforementioned weather-impacted period. That survey, for what it’s worth, points to headline payrolls having risen by around +130k in December, with the private payrolls metric printing around +95k.

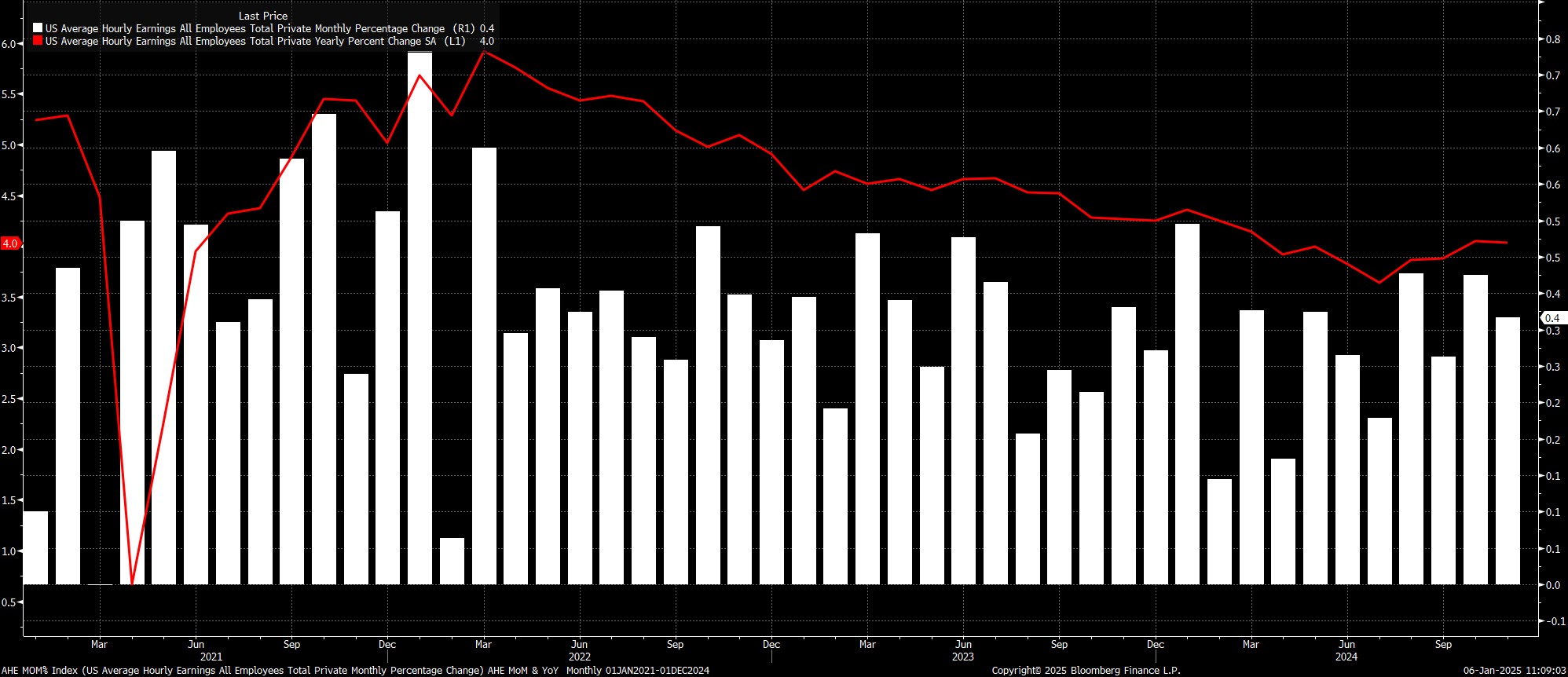

Sticking with the establishment survey, average hourly earnings are set to have risen by 0.3% MoM, a touch slower then the pace seen a month prior, which would see the annual rate of earnings growth hold steady at 4.0% YoY.

Such a pace of earnings growth is unlikely to materially alter the policy outlook, and does not pose a significant upside risk to inflation – with risks on that front stemming primarily from potential fiscal policy shifts in the early days of a Trump Administration.

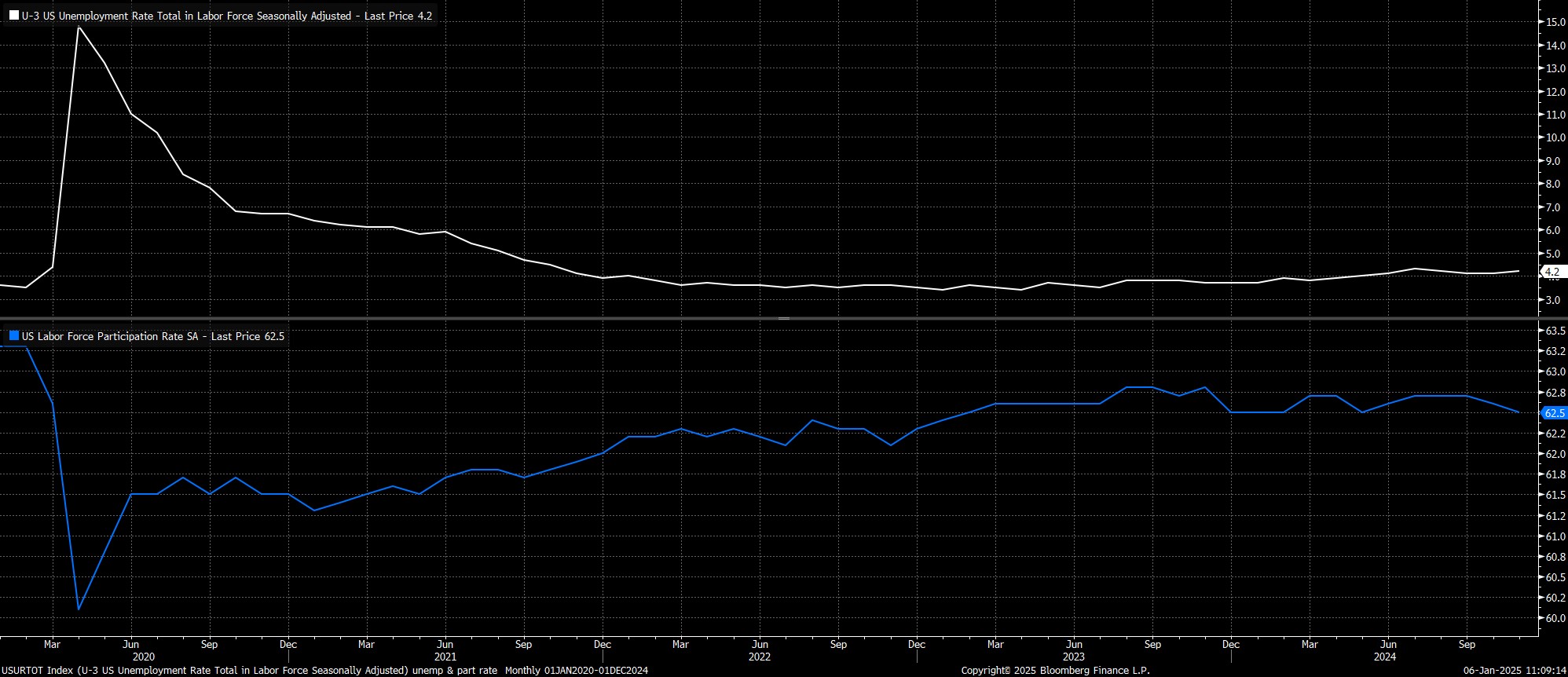

Turning to the household survey, unemployment is set to have held steady at 4.2% in December, just shy of the 4.3% cycle highs seen during the summer. Of note, though, is that November’s print was a ‘high’ 4.2%, being 4.246% on an unrounded basis; hence, there is a possibility for even a modest uptick in joblessness to force headline unemployment higher, equalling the highs seen earlier in 2024.

In any case, labour force participation is expected to have held steady at 62.5% as 2024 drew to a close, while the now-typical caveats over the volatility in household survey metrics, owing to falling response rates, and the impact of higher immigration, must continue to apply.

Taking a step back, it seems unlikely that the December jobs report will materially alter the monetary policy outlook as 2025 gets underway. The base case remains that the FOMC will ‘skip’ the January meeting, allowing time to examine the impact that the 100bp of easing delivered to date has had on the economy, while also seeking greater clarity on the specifics of President-elect Trump’s fiscal policy plans.

Most FOMC officials seem content with the present stable nature of the labour market, a viewpoint which the December figures seem set to reinforce. Policymakers, instead are at this juncture focused primarily on upside risks to the inflation outlook, seeking further convincing disinflationary progress back towards the 2% target before delivering further cuts to the fed funds rate.

In turn, this presents a hawkish risk to the policy outlook that was not present in 2024, while also representing a softening of the ‘Fed put’ which helped to backstop sentiment so significantly last year. As such, with this comfort blanket having been removed, while the path of least resistance should continue to lead higher for equities, said path is likely to prove somewhat bumpier and more volatile than that seen over the last twelve months.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.