Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

Nvidia Q2 2026 Earnings: Key Expectations and Market Implications

The Set-Up into Earnings

Having traded down to $83 in April, Nvidia staged a sharp reversal, with a strong bull trend pushing the stock +120% before meeting heavy selling at $184. Into earnings, the share price has consolidated, with price breaking uptrend support and seemingly content to hold a $184–$172 range.

A break of this trading range post-earnings could be key in evolving the trading environment, with many looking to chase an upside break and potentially target $200+, or conversely, a break of $172 could see increased position unwinding – which, given how widely held Nvidia is, could drive a rise in volatility.

While the macro backdrop and broader market sentiment are clearly important, Nvidia’s earnings are set to be an important catalyst and risk event for the share price.

Nvidia 24-Hour CFDs: Greater Control Around Earnings

Traders can react to the news and subsequent moves through Pepperstone’s Nvidia 24-hour CFD. Pricing is sourced from a major US equity exchange, offering traders excellent liquidity and the flexibility to trade Nvidia long or short, even during the overnight Asia session.

What Traders Need to Know

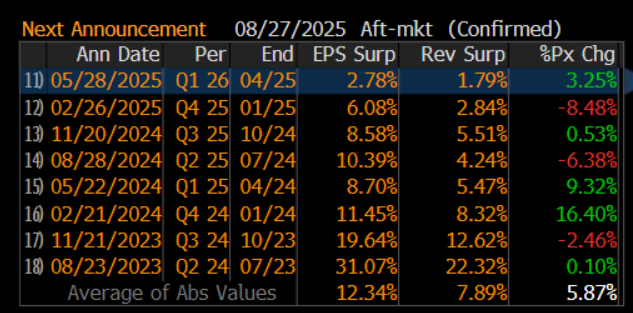

• The options market is currently implying a ±5.8% move on the day of reporting. While punchy for a company with a $4.3 trillion market cap, it is one of the smallest implied earnings day moves for Nvidia in years.

• The options implied move falls almost perfectly in line with Nvidia’s 8-quarter average absolute move of 5.9% on reporting day.

• Nvidia carries a massive 8% weight in the S&P 500 – a record high for the index. Should Nvidia rise or fall by ±5.8% on earnings day, and assuming all other constituents remain flat, the stock would move the S&P 500 by approximately ±0.4% and the Nasdaq-100 by ±0.8%.

• Nvidia has consistently beaten consensus expectations on revenue, margins, and earnings since 2017. That said, this does not guarantee a positive reaction: shares closed higher in just five of the last eight earnings releases.

• In the past four weeks, analysts have lifted expectations for Q2 revenue by 0.6% and EPS by 0.8%.

Earnings Expectations

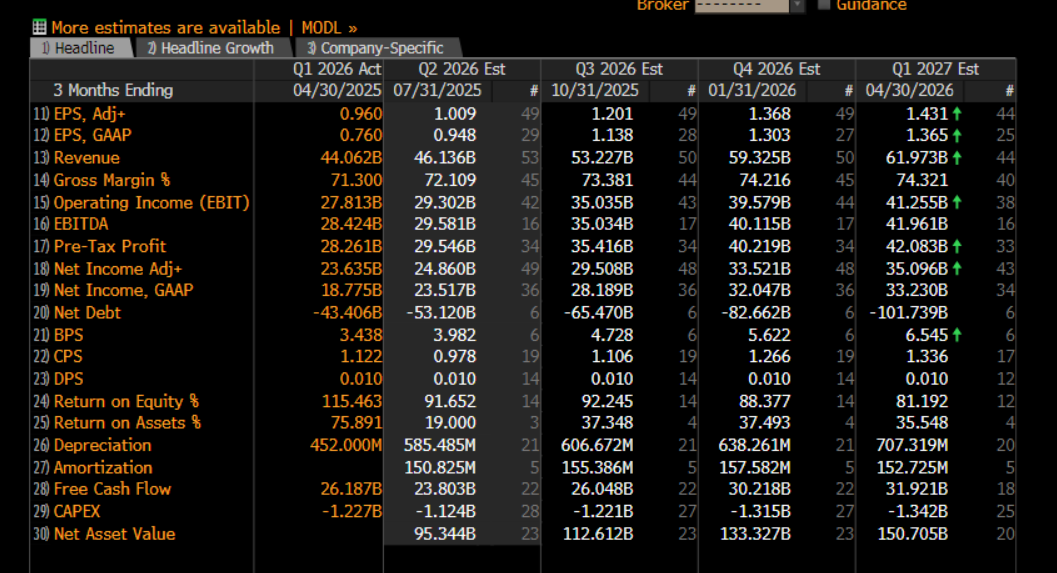

Below are the median analyst (consensus) expectations for Nvidia’s key metrics, as compiled by Bloomberg. As is typical, investor expectations sit slightly above these forecasts, since Nvidia almost always beats consensus. To impress, Nvidia must not only beat current-quarter expectations and Q3 guidance but do so by a meaningful margin.

• Q2 revenues are expected at $46.14b (+5% q/q), marginally above prior guidance, with data centres at $41b. Analysts anticipate guidance for Q3 revenues of $53.2b (+53.6% y/y).

• Q2 gross margins (GM) are forecast to rise to 72.11%, with management expected to guide to 73.38% in Q3.

• Q2 EPS is expected at $1.00, with management expected to guide to $1.20 in Q3.

• Investors will be closely watching for updates on shipments of H20 chips to China, and how expected sales to China could impact Q3 earnings.

• Progress on the Blackwell ramp, as well as updates on other key product innovations and demand trends, will feed into market models for ongoing sales and margin growth.

I would argue that to really get the stock pumping, Nvidia would need to report Q2 sales of $47b and guide to Q3 sales of $55b+. Gross margins are also a critical factor that drives the share price performance, and again, to meet expectations from buy-side firms (hedge funds, pension funds), GMs, will need to come in slightly above consensus and install a belief that margins should continue to build.

Summary

The key risk is that Nvidia beats expectations but fails to impress a market already positioned for a “beat and raise.” CEO Jensen Huang will need to deliver an inspiring outlook, or we could once again see traders rotate out of Nvidia and into Chinese/HK-listed AI names. Despite these risks, the bigger picture is that Nvidia remains in excellent shape. Should the share price pull back in the days after earnings, unless there is a sharp deterioration in the macro backdrop or a surge in cross-asset volatility, dips are likely to be shallow and present themselves as buying opportunities.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.