Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

June 2024 CPI Recap: Further Cooling Cements September Cut

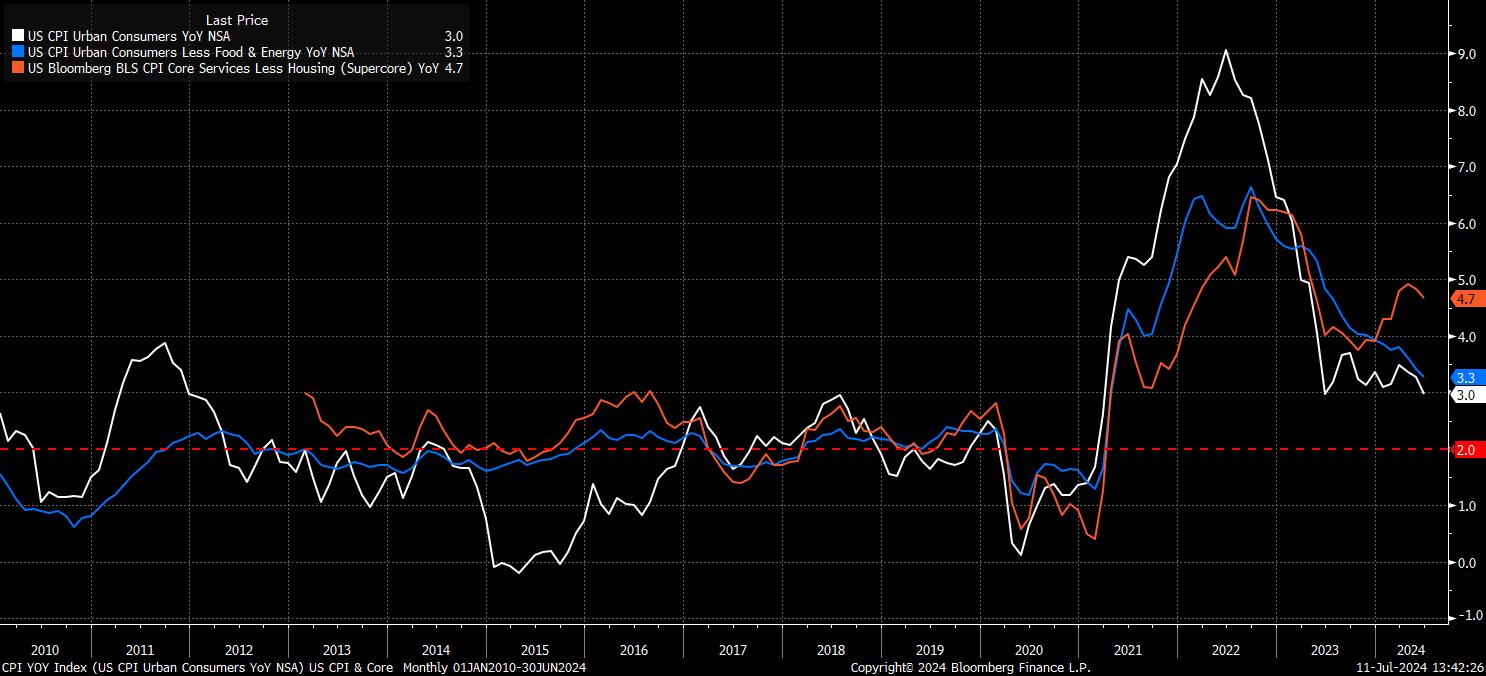

Headline CPI rose by 3.0% YoY in June, cooler than consensus expectations for an 0.2pp decline in the annual inflation rate to 3.1%, and the slowest annual inflation reading since June 2023. During the same period, core CPI – excluding the volatile energy and food components – rose by 3.3% on the year, an unexpected cooling from the prior month, and the slowest pace since April 2021.

The removal of further volatile components to produce the ‘supercore’ metric – aka core services CPI excluding housing – shows a fall to 4.7% YoY, the second straight monthly decline.

Meanwhile, greater attention continues to be paid to the MoM data, as has now been the case for a while, with these figures offering a more precise gauge of underlying price pressures, without potentially distorting base effects which may skew the YoY prints. Here, headline CPI fell by 0.1% in June, the first monthly decline in prices since all the way back in May 2020, while core CPI rose a very modest 0.1%.

Annualising the above data produces the following:

- 3-month annualised CPI: 1.1% (prior 2.8%)

- 6-month annualised CPI: 2.8% (prior 3.4%)

- 3-month annualised core CPI: 2.1% (prior 3.3%)

- 6-month annualised core CPI: 3.3% (prior 3.7%)

Of course, while the above data is promising, and implies continued disinflation, it’s important to recall that the FOMC officially base progress towards the inflation target on the PCE inflation metric, not due until the end of the month.

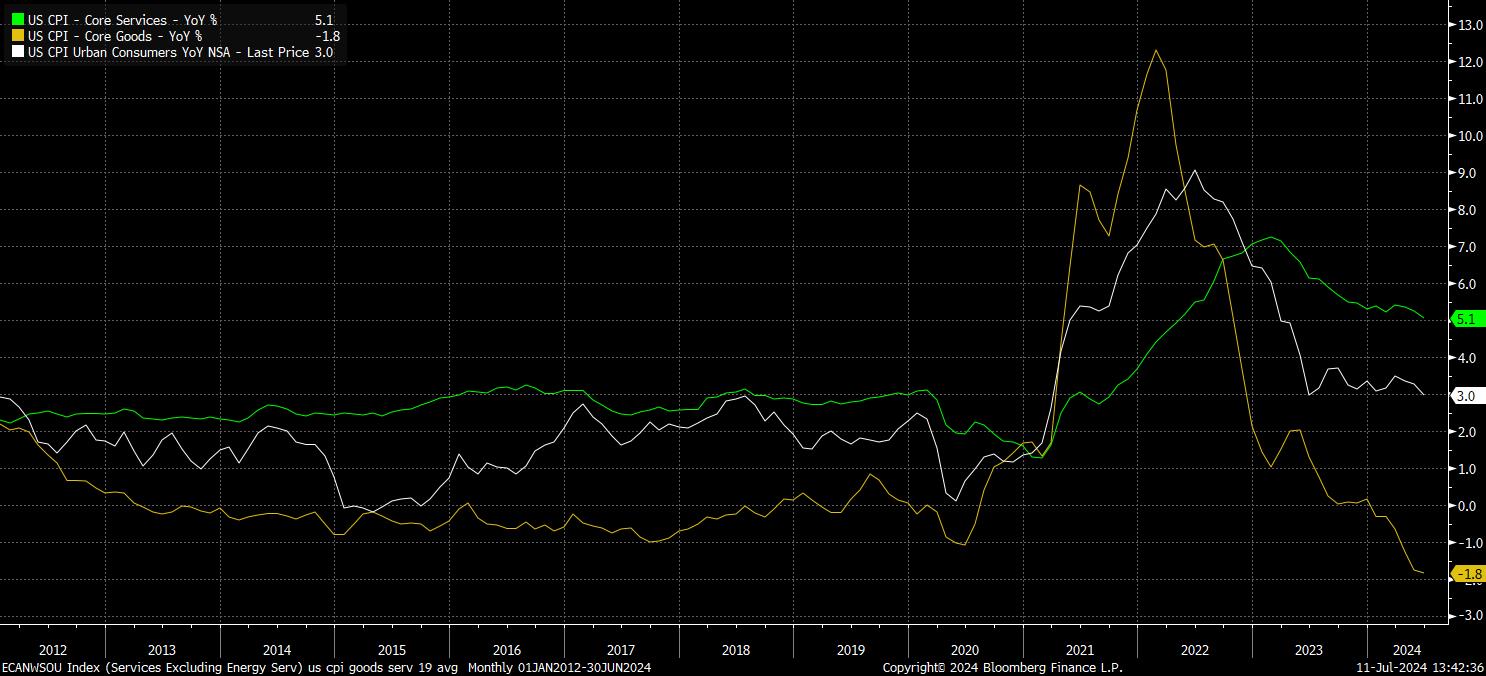

In any case, taking a deeper look into the data shows a continued divergence in price pressures between the goods, and services, sides of the economy. Core goods deflation deepened further in June, with prices falling by 1.8% YoY, the biggest annual fall in well over a decade. Meanwhile, core services prices rose 5.1% YoY, the slowest rate since April 2022, something that policymakers will likely greet with substantial optimism, given the incredibly sticky nature of services prices this cycle.

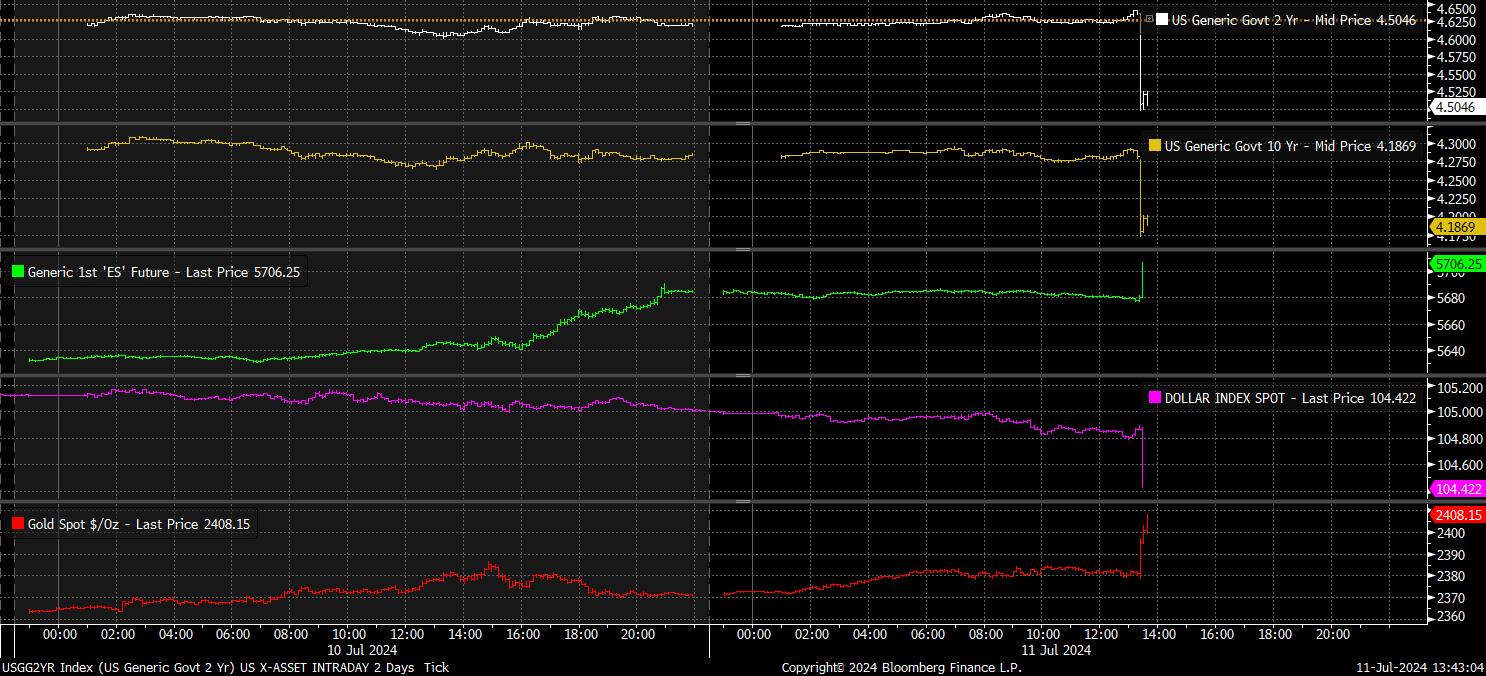

Unsurprisingly, given the substantially cooler than expected figures, the USD OIS curve repriced dramatically in a dovish direction. The curve now implies around an 83% chance that the first 25bp cut is delivered in September, up from around 67% prior to the CPI figures being released. Meanwhile, the curve now discounts just under 53bp of easing by the end of the year, again a substantial dovish revision compared to the 46bp priced prior to the inflation figures crossing news wires.

Of course, this dovish repricing had a predictable impact across other asset classes. Treasuries rallied hard across the curve, led by the front-end, where benchmark 2-year yields fell over 10bp, briefly dipping beneath 4.50%. Equities, predictably, rallied, with the front S&P contract trading north of 5,700, and the front Nasdaq 100 contract rocketing towards 21,000. In the FX arena, the greenback experienced a substantial bout of selling, taking the DXY below 104.50 to a day low, as all other G10s rallied to day highs, with most gaining around 40 pips post-CPI. Finally, gold also surged, with the yellow metal trading north of $2,400/oz in the spot market.

Overall, although one inflation report won’t make up policymakers’ minds on its own, the June CPI figures will help to provide further ‘confidence’ in the disinflationary path back towards the 2% price target. With Fed Chair Powell having already pushed the door to a September cut ajar in Congressional testimony this week – by noting that the labour market is ‘fully’ back in balance, the economy now not being ‘overheated’, and flagging that policymakers can no longer focus ‘solely’ on inflation – the door to such a move has been opened further by today’s figures.

My base case, so long as inflation continue to behave itself through the summer, is for the first cut to come in September, likely being followed by a second 25bp cut at the December meeting. This should continue to see the ‘path of least resistance’ lead higher for equities over the medium-term, albeit with Q2 earnings season a key risk to navigate in the ‘here and now’. Nevertheless, even if cuts were further delayed, contrary to what recent rhetoric would suggest, the flexible and forceful ‘Fed put’ remains in place, with policymakers still seeking to ease policy sooner rather than later. Hence, dips are likely to remain relatively shallow, and be seen as buying opportunities.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420?quality=30)