Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

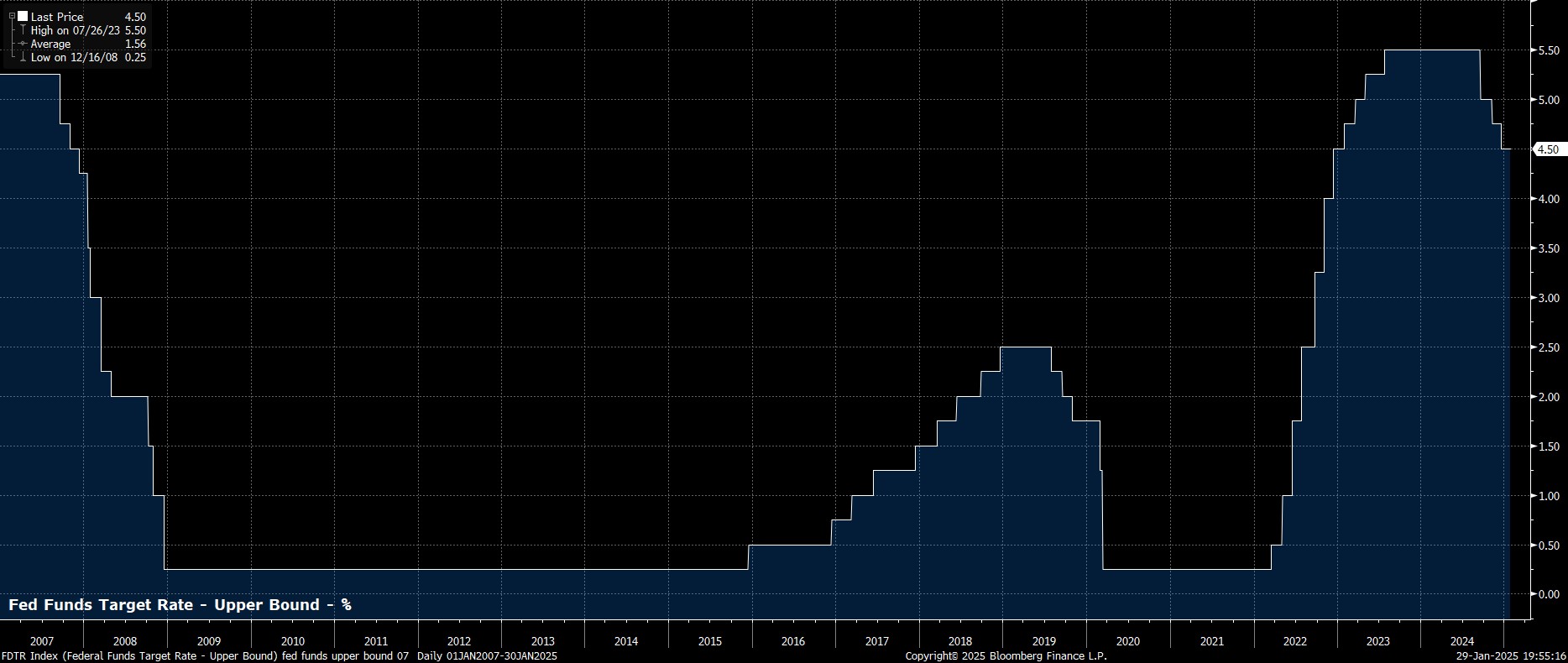

As expected, and had been fully discounted by money markets, the FOMC stood pat at the first meeting of the year, holding the target range for the fed funds rate steady at 4.25% - 4.50%.

The decision to hold steady this time around had been well-telegraphed in advance, and allows policymakers not only to take stock of the impact that last year’s rate cuts has had on the US economy, but also to digest how the initial policies of the new Trump Administration may alter the balance of risks to the economic outlook.

Also in keeping with expectations, the decision to leave rates unchanged was a unanimous one with the Committee, for now at least, displaying less by way of diverging opinions than had been seen last year.

That said, it is worth noting that the Committee does now tilt in a marginally more hawkish direction than that seen last year, with 2025 voters Musalem and Schmid, in particular, having made notable hawkish remarks in recent months.

Accompanying the rate decision, was the Committee’s updated policy statement. Those updates, though, were relatively minimal and insignificant in nature, with the statement, largely, a ‘cut and paste’ of that issued after the December meeting.

Consequently, the statement noted that the economy continues to expand at a “solid pace”, and that price pressures remain “somewhat elevated”, though policymakers did remove reference to inflation having made further progress back towards 2%. In addition, unemployment has stabilised at a low level, and risks to the dual mandate remain “roughly” in balance.

Meanwhile, as usual, significant attention also fell on Chair Powell’s post-meeting press conference. Participants entered the press conference hoping for clarity on two themes – whether a cut in the first half of the year could be on the table, and whether President Trump’s initial policy moves have significantly shifted FOMC members’ views on the policy outlook.

Perhaps unsurprisingly, Powell offered little by way of concrete guidance at the presser, instead largely reiterating remarks made towards the back end of last year. As such, Powell repeated that feels they are in a “very good place” when it comes to the monetary policy stance, and that the delivery of further rate cuts hinges on either “real” inflation progress, or unexpected labour market weakness – an unchanged reaction function from that detailed at the back end of last year.

On politics, Powell noted that he has thus far had no contact with President Trump, and that policymakers are “very much waiting” to see what policies the new Administration enact before incorporating them into their outlook.

Importantly, Powell noted that the aforementioned statement changes on inflation were “a bit of a language cleanup”, and not in any way intended to send a policy signal.

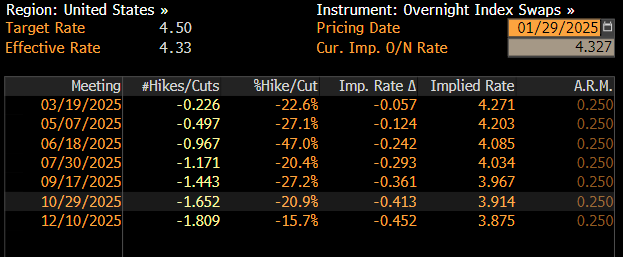

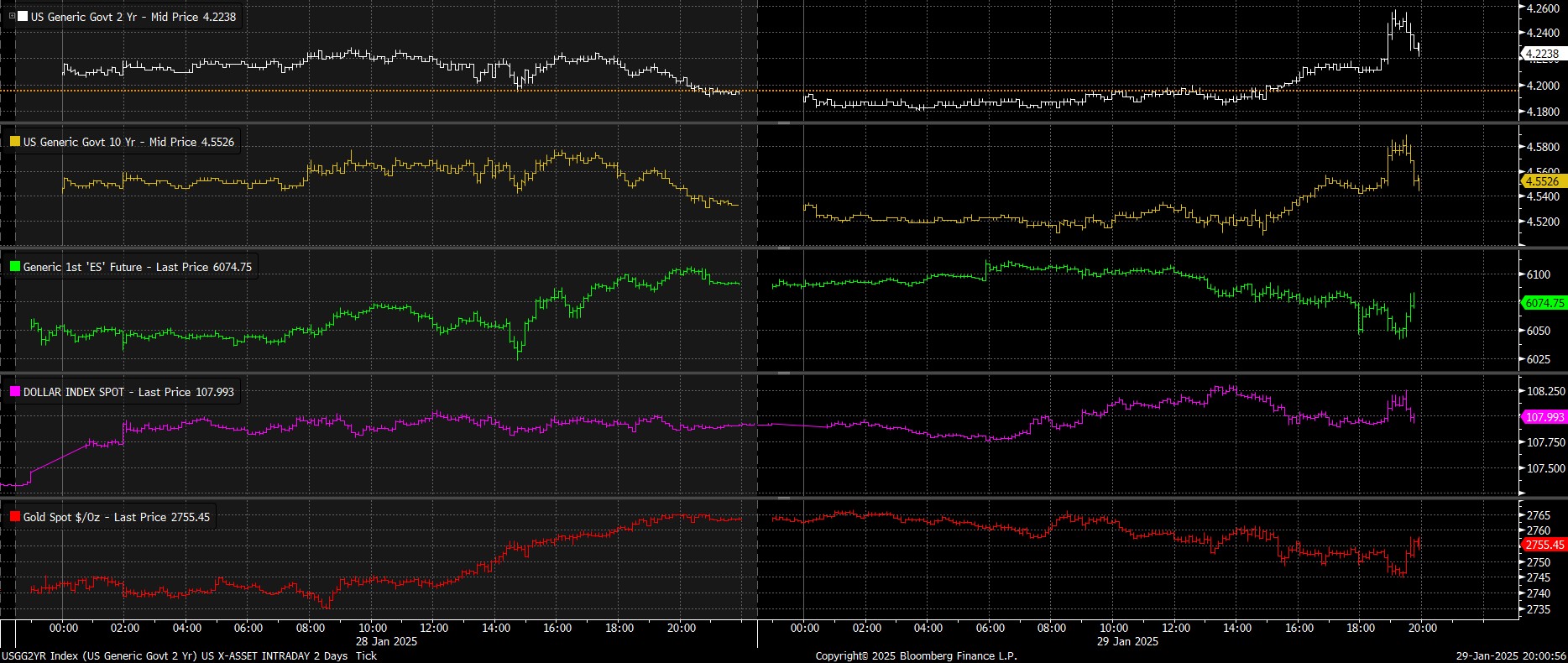

As participants digested all of the above, money markets repriced marginally in a hawkish direction, as the first cut was pushed back to July, from June previously, while the USD OIS curve now discounts around 45bp of easing by year-end, compared to 47bp pre-FOMC.

More broadly, in reaction to the FOMC decision, markets were a little choppy, initially reacting hawkishly to the modest statement changes, before paring moves as the press conference progressed, to see most asset end the presser where they begun it.

Taking a step back, it’s tough to say that the first FOMC decision of 2025 has materially moved the needle in terms of the policy outlook for the year ahead. Unsurprisingly, with risks to the dual mandate balanced, and fiscal policy uncertainty elevated, policymakers are seeking to ‘play for time’. By the time of the next meeting in March, there is not only likely to be greater clarity on the Trump Administration’s trade policies, but also greater evidence of how both labour market and disinflationary momentum have progressed in the early part of the year.

While a cut at the March meeting is impossible to rule out at this juncture, substantial further progress back towards the 2% price target, or unexpected significant labour market softening, would likely be required to see the FOMC take another step back towards neutral so soon.

On the whole, risks surrounding the policy outlook this year are considerably more two-sided than those present in 2024. Consequently, the ‘Fed put’, which has acted as a comfort blanket for risk assets over the last 18 months or so, is no longer present, with the metaphorical strike price for that ‘put’ falling each month that incoming data remains solid. This, coupled with a greater degree of policy uncertainty, will likely result in a bumpier ride for equities this year, though solid economic growth, and subsequent earnings growth, should see the path of least resistance continue to lead to the upside.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.