- English

February 2025 US CPI: Cooler Figures Won’t Shift The FOMC Outlook

Headline CPI rose 2.8% YoY last month, below consensus expectations, while core prices rose 3.1% YoY, also below expectations, and the slowest annual pace since early-2021.

Meanwhile, on an MoM basis, the figures were also cooler than expected. Both headline and core prices rose 0.2% on the month, the headline figure showing a notable cooling from the punchy 0.5% MoM pace chalked up in January.

Annualising the above figures helps to provide a clearer picture of underlying inflation trends, removing the potentially distorting impacts of base effects:

- 3-month annualised CPI: 4.3% (prior 4.5%)

- 6-month annualised CPI: 3.6% (prior 3.6%)

- 3-month annualised core CPI: 3.6% (prior 3.8%)

- 6-month annualised core CPI: 3.6% (prior 3.7%)

Taking a deeper dive into the data, the February CPI report showed a similar backdrop to that seen in the January figures. The pace of goods deflation has somewhat stalled in recent months, likely as US importers front-run the imposition of tariffs, hence exerting upward pressure on prices. That said, policymakers will be pleased to see services inflation having further subsided, to 4.1% YoY, the slowest pace in three years.

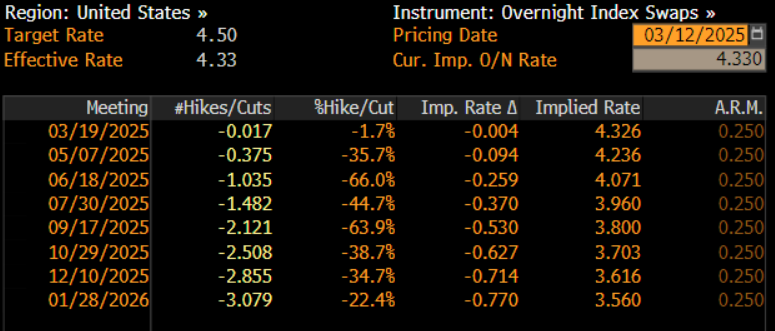

In reaction to the inflation figures, money market expectations for Fed policy were broadly unchanged, despite the cooler data. As such, the next 25bp cut remains fully discounted by June, with around three such cuts fully priced in by the end of this year.

At a broader level, it’s difficult to see the February inflation figures materially altering the FOMC’s policy outlook. As outlined by Chair Powell last week, the Committee are in no hurry to deliver further adjustments to the fed funds rate, with the economy still in a ‘good place’, and risks to the dual mandate being ‘roughly’ in balance, amid an ongoing bumpy disinflationary path back to the 2% price target.

Such a patient stance is a logical one for policymakers to take, and to maintain, at next week’s FOMC meeting, especially in light of the extremely elevated degree of policy uncertainty, which continues to cloud the US economic outlook. The huge chunk of upside inflation risk posed by Trump’s tariff policies will also keep the Fed on the sidelines for the time being.

That said, the direction of travel for rates remains lower, albeit any rate cuts in the first half of the year seem a tough ask for now, barring a material deterioration in labour market conditions, with Powell & Co. continuing to plot a relatively cautious course back towards neutral.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.