- English

Broadcom (AVGO) Q4 2025 Preview: AI Transformation Driving Growth

.jpg)

Broadcom is set to release its Q4 2025 results on the morning of December 12 (AEDT), following the U.S. market close on December 11. Year-to-date, the stock has surged more than 75%, closing above $406 this Tuesday, a record high. Market sentiment is elevated, with broad expectations that the Q4 results will continue Broadcom’s trend of “beating expectations.”

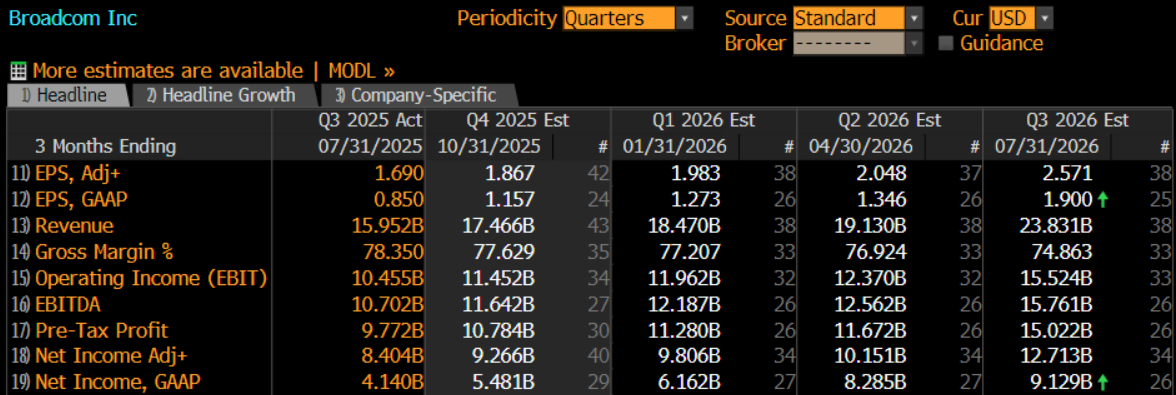

Wall Street consensus forecasts adjusted EPS to rise 31.5% year-on-year to $1.87, revenue to increase 24.3% to $17.5 billion, and adjusted net income to grow 33% to $9.27 billion.

Traders’ optimism is primarily driven by two factors:

- Rapid AI business growth:Citigroup expects Broadcom’s AI revenue in fiscal 2026 to increase 147% year-on-year, accounting for more than half of total revenue, while Goldman Sachs also projects growth exceeding 100%.

- Strong management guidance:F1Q26 guidance could indicate revenue above $18 billion while maintaining a 76% gross margin.

Beyond the headline numbers, the key focus is whether the results will confirm Broadcom’s central role in the ongoing expansion of AI capital expenditure, providing critical signals for the industry’s direction over the next 2–3 years.

AI Investment Chain Accelerates, Broadcom Positioned at the Forefront

Broadcom’s AI business is undoubtedly the centerpiece of the Q4 report.

Nvidia’s dominance has long overshadowed a key trend: AI computing architecture is evolving from purely GPU-based systems to a “GPU + ASIC” hybrid model. As models become more complex and inference costs rise, leading tech companies are increasingly pursuing in-house computing solutions, creating an opportunity for Broadcom.

Unlike Nvidia, Broadcom’s growth relies heavily on long-term agreements and capital expenditure plans with major tech clients, offering unique advantages:

- Predictable order flow:Google’s TPU has reached its seventh generation, with Broadcom involved in design and manufacturing. Long-term agreements with OpenAI, Meta, Microsoft, and Anthropic also provide stable revenue support.

- Significant incremental potential:As AI commercialization and scale accelerate, computing demand is rising. Broadcom is positioned as the preferred partner for leading companies developing a “second computing system,” bypassing Nvidia GPUs. This suggests ASIC chip shipments could grow rapidly alongside industry demand.

In my view, the AI chip industry shows a “winner-takes-all” pattern—companies with the strongest R&D capabilities and deepest client relationships capture the greatest rewards. Broadcom is well positioned to benefit from this tailwind.

Non-AI Business Remains Stable, Providing Growth Base

While AI is the primary growth driver, Broadcom’s non-AI semiconductor business remains significant, particularly in networking chips, storage connectivity, and enterprise software. Recent stability in these areas provides a baseline for overall results:

- Traditional semiconductor segments have stabilized after several years of decline, with potential double-digit growth expected in early 2026.

- Enterprise software and networking infrastructure businesses offer high margins and steady cash flow, partially offsetting volatility from AI operations.

This means that even if AI business experiences short-term fluctuations, Broadcom’s overall profitability remains solid.

Valuation Enters a New Phase as Market Position Evolves

Overall, Broadcom’s Q4 results are likely to “beat expectations” and may further reinforce market confidence in sustained AI spending in 2026.

Despite significant gains earlier this year, major institutions such as Citigroup, Goldman Sachs, and Jefferies have collectively raised their price targets. The key reasons are:

- Partnerships with leading AI clients globally (Google, OpenAI, Meta, Microsoft, etc.)

- TPU orders expected to continue growing over the next three years, with ASIC business facing minimal true competition

- Projected AI revenue growth leading all chipmakers except Nvidia

Compared with Nvidia GPUs, highly differentiated ASICs function more like “customized services,” making client switching unlikely once contracts are established. The market often underestimates the importance of suppliers like Broadcom before orders materialize, but once growth is unlocked, the profit leverage can be substantial.

That said, potential risks remain:

- AI capital expenditures are cyclical; any reduction in client spending or delays in new model commercialization could slow growth.

- Heavy reliance on a small number of major clients creates concentration risk, as any strategic adjustment by a single client could materially impact revenue and stock price.

In this context, understanding Broadcom’s growth logic is essential for market participants. While strong AI performance is a long-term positive for the stock, it also implies higher volatility, requiring careful attention to risk management and timing.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.