- English

Aus v US terms of trade

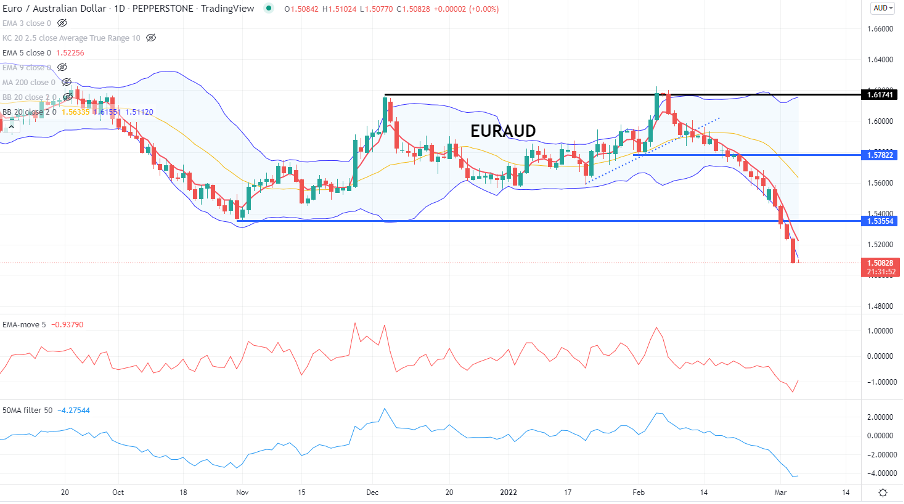

If we look at relative terms of trade (above - AUD vs the US) it’s not hard to see why the world has piled into AUD longs. Let’s not forget that if we look at the weekly CFTC CoT report we see leveraged funds and asset managers were, and still are, net short – they would be covering those positions now, and maybe they had been holding shorts as a hedge against equity weakness, but that is the wrong trade right now and the best expression of a bearish equity trend is short SEKJPY. Incredibly the RBA are still the most patient central bank in G10 circles and it wouldn't be hard to believe AUD wouldn’t be 5%+ stronger if the RBA had moved to market pricing and offered a strong green light of a hiking cycle. We can look at the bond market and see both Aussie real and nominal bond yields are moving higher relative to US yields, at least in 5yr maturities and beyond – this incentives capital to flow to Aussie investments, with Australia looking like a relatively attractive investment destination. It's not just AUDUSD – the easier money has been made shorting EURAUD, as Europe is clearly most affected by the geopolitical tensions and the sanctions placed on Russia – the market is talking stagflation risks in Europe as EU Nat Gas prices spike 200% in the past 11 sessions, pushing EU inflation expectations 2%. The hardest part in trading a cross like this is not entering but holding and extracting as much out of the trade as you can – rules-based trading can be clearly advantageous. GBPAUD is through 1.82 and eyeing the Nov swing low of 1.8126 and even risk proxies such as AUDJPY is now the highest level since 4 November. For those like a slower pace of movement, AUDNZD is pushing the top of the range at 1.0800 and a break here would target 1.0944.

(Source: TradingView - Past performance is not indicative of future performance.)

EURAUD is the big trade though and while I can look and see price is now 4.2% discount to its 50-day MA – typically a factor that leads to mean reversion - these are obviously exceptional times. Until the market feels there is a circuit breaker – likely in the form of de-escalation – then the AUD and commodities will be subject to positioning moves and flow, but pullbacks will be bought.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.