- English

Sovereign bond yields have certainly been grabbing the market’s attention of late, with some very fast and volatile moves. Traders had been hoping to see concerns expressed by certain members of the ECB about rising yields and a tightening of financing conditions backed up with action via the weekly Pandemic Emergency Purchase Programme (PEPP/QE) data. However, purchases have actually slowed week on week over the past 2 weeks. An ECB official stated the slowdown was due to seasonality and larger redemptions, but that type of explanation can only calm bond market nerves for so long. This is what makes tomorrow’s ECB meeting all the more important communication wise as well as the framing of the message to markets.

In terms of specific policy action I don’t expect much. If we get anything it will be an explicit commitment to increase the pace of PEPP, in an attempt to stem the rise in yields and prevent a tightening of financing conditions. The level of the GDP weighted eurozone bond yield currently is consistent with a higher pace of purchases historically. Boosting the overall size of the PEPP envelope at this meeting would be too hasty in my opinion, especially as the ECB still has just under €1 trillion left of dry powder. Despite rhetoric from certain officials, a deposit rate cute seems highly unlikely. There is some chatter about Yield Curve Control. Executive board member Panetta implicitly talked about it via “identifying what level of nominal yields it is aiming to achieve.” Christine Lagarde, however, has pushed back against it, stating their strategy is more holistic than YCC. The Eurozone's legal and institutional framework, would also cause complexities for the implementation of YCC. This leaves the ECB to continue with verbal intervention (jawboning) as well as emphasizing the flexibility of PEPP or increasing the pace of their asset purchases. The key question for the latter strategy will be - do current conditions warrant the ECB taking action now by front-loading their purchases to get ahead of a potential yield rise.

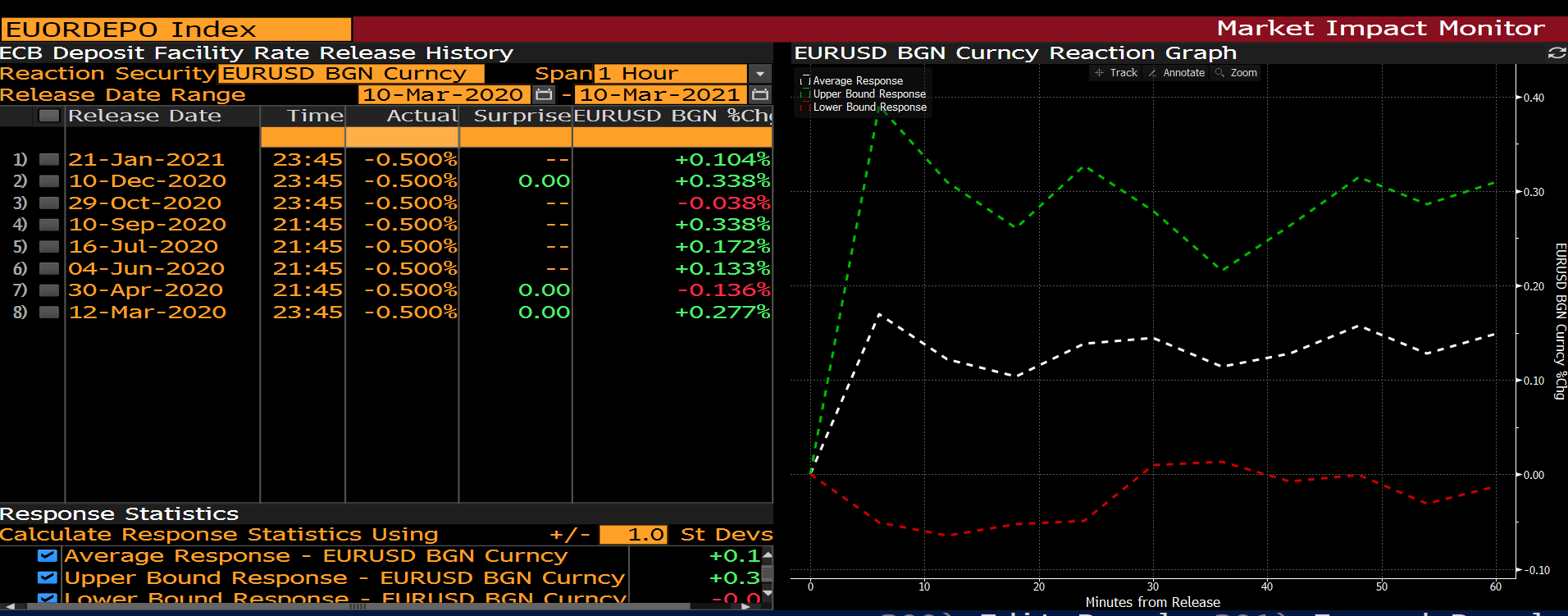

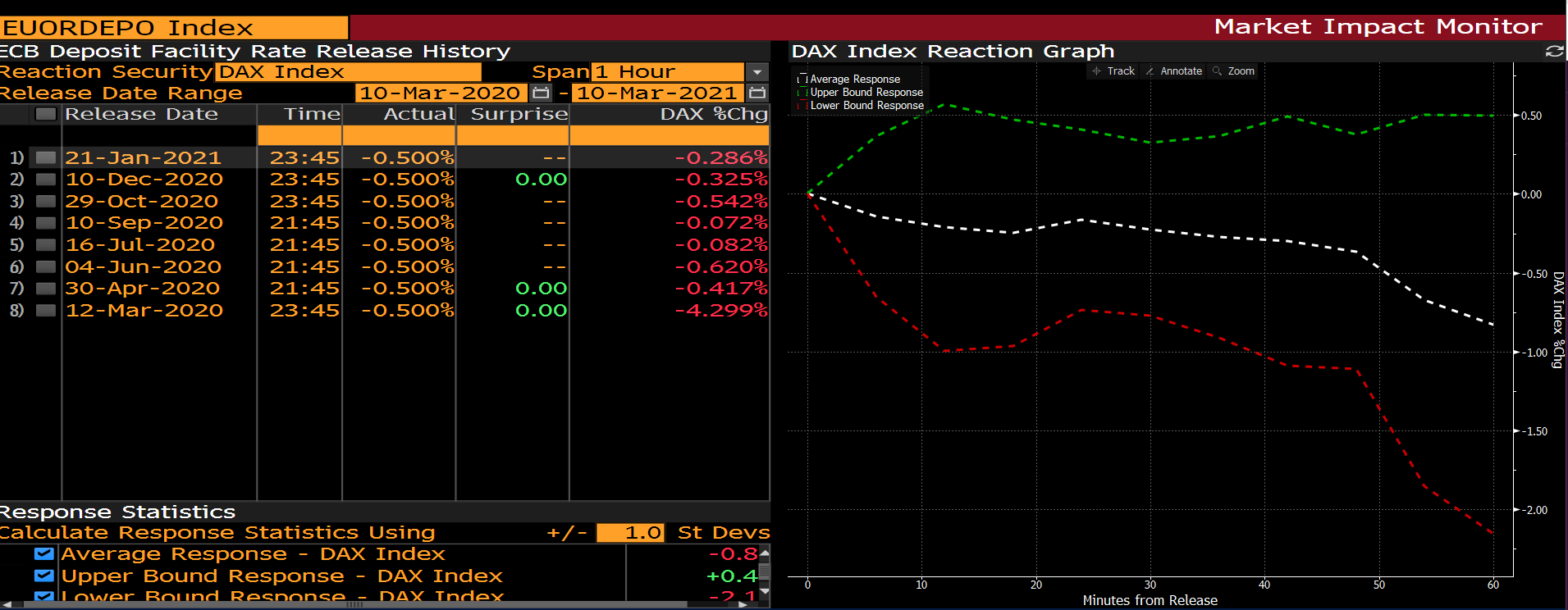

It’s good to look at how the EURUSD and DAX have reacted to previous ECB Meetings. What we see from the historical data is that on average in the first 60 minutes after the ECB statement has been released the EURUSD tends to strengthen, while the DAX tends to weaken.

Source: Bloomberg

We will also receive updated economic forecasts at this meeting. I’m expecting a minor downward revision to 2021’s GDP forecast with a moderate upward revision to inflation forecasts for this year. Downward revisions to this year’s GDP forecast should be made on the back of higher covid infections, slow vaccine roll-outs which have led to longer and harsher lockdowns. Additionally, the disbursement of the recovery fund to fiscally stimulate the economy has been slow. I think the ECB will remain cautious as a result and emphasize although the economic picture will improve, there remains downside risk and uncertainty. On the inflation front the increases will be seen as temporary movements due to base effects and VAT being washed out of the calculations. Additionally, the oil price has risen quite substantially since December’s meeting. Governing Council member Jens Weidmann emphasized the transitory nature in a Bloomberg interview stating, that to see a sustained push in inflation, we’d need to see corresponding movements in wages and that’s not being observed at this juncture. Fears of protracted labour slack are widespread amongst Central Banks.

One of the key aspects to watch in this meeting is financing conditions. Christine Lagarde may offer some insight on this, as she commissioned staff in January to analyse different methods of assessing borrowing costs. The market as am I are hoping for some more clarity on this. In the meantime, one can surmise that indicators such as the BTP-Bund spread, core yields and the value of the euro will filter into the ECB’s reaction function on financing conditions. The BTP-Bund spread is plumbing multi-year lows, real yields are still deeply negative and the EURUSD as well as the trade weighted euro have both weakened since December. Based on these movements I would lean more to verbal guidance being the policy tool of choice at tomorrow’s meeting.

This meeting could be a big catalyst for EURUSD. Price is hovering right around the 200-day SMA and overhead resistance of 1.19 (white horizontal dotted line). The RSI bounced off oversold, but looks if it could rollover again and potentially make another lower oversold reading. If we breach the 200-day SMA, then the 1.175 area would be my first price target of interest, below that we start to open up the lows in November around 1.16. On the upside 1.20 (21-day EMA) seems like a good first target with 1.215 (white horizontal resistance dotted line).

(Pink Line - 21-day EMA, Light Blue Line - 50-day SMA and Dark Blue Line - 200-day SMA. Same for the chart below.)

The DAX has been hitting new all time highs of late, propelled by a shift in narrative towards the reflation linked sectors as well as a weaker euro boosting its large multinational’s revenues. There was a strong break of that sticky 14k price resistance. The RSI isn’t deeply overbought but is very close to printing a 70 reading. As shown above historically the DAX tends to sell-off after the ECB meeting, so could that happen again and we see a re-test of the 14k former resistance as well as the 21-day EMA and 50-day SMA. For the bulls this will be a key level to hold. For a more pronounced sell-off we could see price pullback to the 13500 level which coincides with the uptrend line.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg)