- English

- عربي

The Daily Fix: Terrible China data suggests further falls in equity markets

We certainly closed what was an insane week in markets, with Friday characterising volatility in its entirety, with the Dow rallying 640 points in the final 15 minutes, while the S&P 500 pushed up by 73-handles. Granted, various market internals sit at levels we haven’t seen for many years, showing such extreme pessimism priced, but for a fairly loose statement from Fed governor Powell, that the Fed stands ready to ‘act as appropriate’ in response to the ‘evolving risks’, to promote such a move speaks volumes.

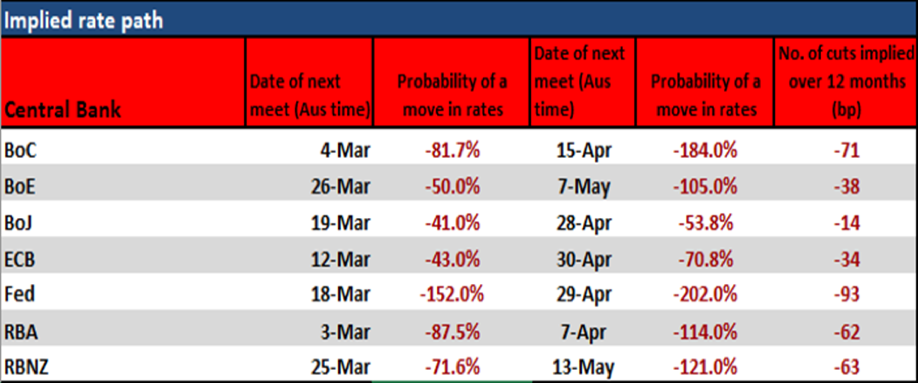

And market pricing for a response is key here, as the move in rates last week was incredible, where rates traders have set the scene for central banks to work in almost coordinated fashion, with the Bank of Canada and RBA expected to cut by 25bp this week, and the Fed to cut not just by 25bp, but there is a view they could go 50bp. Mad times and given the Fed’s blackout period starts on Friday, if the Fed is to talk us out of this pricing structure then they need to get to it soon.

The case that rate cuts will do little to aid the situation is being heard, but if we look at the tightening in financial conditions then it’s clear that if the central banks don’t cut then it will only make life far worse. The Fed, especially, are stuck between a rock and a hard place. Ease and they use ever diminishing firepower on something that won’t likely achieve a lot. Leave the fed funds rate as-is, and risk upsetting the markets. If history is our guide, the Fed simply does not ignore market pricing and will ease, or they will use this week to guide the market accordingly.

Top pane - Bloomberg US financial conditions index, lower - US 5y5y forward inflation expectations

A focus on the RBA meeting

The RBA meeting will be interesting as the market has a cut tomorrow priced at 97.4% and a done deal. Yet only two of 28 economists are calling for a move. This is how incredibly quickly the backdrop has changed, and we’ll be watching for economists to change their calls today, as we just don’t see a market priced for a done deal and economists not following suit. It all suggests AUDUSD implied vols will push higher and we already see AUDUSD 1-week implied vol eyeing a break of 12% and the highest since 2016. In terms of calls, we have seen ANZ bank change its call for RBNZ easing in the 25 March meeting, not just by 25bp but 50bp for March and a further 25bp in May. When we see NZ rates pricing a cut at 71%, 50bp is a bold call and it’s no surprise to see NZDUSD down 0.6% (NZDJPY -1.1%) in early FX trade.

China data in focus

The weekend news started with a horrific China manufacturing (35.7) and services (29.6) print, and there’s no way to window dress data points that miss expectations by such a margin, and into all-time lows. The fact both prints were so far below economists’ expectations has shown a gross underappreciation of how bad things are on the ground. We watch today's Caixin manufacturing print (due 12:45 AEDT), which monitors manufacturing at the smaller end of town and the market will position for a print well below consensus on 46.0. The market will now expect Q1 GDP (released 17 April) to be closer to zero.

Weekend news has largely centred on the spread of coronavirus through the US and Europe, with 500+ new cases in Italy, and a case in Scotland from an individual who had travelled to Italy, which begs the question of how many more countries will impose travel warnings to those travelling to Italy. We have seen new cases in the Czech Republic, Dominican Republic, and Switzerland, while infections in Iran have doubled. Cases in the US have risen, with six cases in Washington State. Clearly, this news is not going to inspire, even in the way the markets are pricing a pretty dark scenario.

On the political front, we’ve seen Biden pull himself back to the Democrat nominee, taking a sizeable stake in the South Carolina primary. It’s looking like a tall order, but not impossible for Bernie to get the required 1,991 pledged delegates to win the nomination outright and we’re looking more convincingly at a situation where the Democrats will need to either back Sanders or take it to a contested convention. That said, let’s see how Sanders fares in tomorrow’s Super Tuesday proceedings, where 1357 delegates are up for grabs from 14 states and on current polling Sanders looks set to pick up the lion’s share of these. Consider that in 8 of the past 9 Super Tuesday’s the winner of proceedings has taken out the nominee, so statistically, it is important.

Turning to the Asia open

If we look at the FX open, the market is seemingly not looking too closely at the US political situation and more so at the China data and virus spread. Equity futures markets were already factoring a weaker Asia open, with Aussie SPI futures -40p, but given AUDJPY is 1.2% lower and JPY crosses are once again flying, one suspects S&P 500 futures open 0.5% to 1% lower.

This is life with the VIX index at 40%, and we will see big moves in the blink of an eye.

Gold needs close attention as the move on Friday (-3.6%) reeks of money managers liquidating one exposure to fund another. The sell-off in gold has been subject to huge debate throughout the weekend, especially as the investment case for owning gold exposures, in anything, has solidified. For example, nominal US Treasury’s are flying, with 2s closing -15bp on Friday, with Fed funds future (March contract) falling by the same amount, as rate cuts have been aggressively priced. US 10yr real yields fell 4bp -28bp, while the total value of negative-yielding bonds (globally) has pushed to $14.56t – so all the classic reasons to buy gold are in place. Watch price today for signs the gold liquidation is over and gold buyers come back into this pullback.

We also watch US ISM manufacturing (due 02:00 AEDT) with the market expecting this to fall to 50.5 (from 50.9). Good numbers here could stabilise sentiment a touch, especially with markets so oversold and underloved. However, while the market is keen to see data through February, what seems more important and seemingly impossible to model is how the economy evolves if people’s daily lives are genuinely affected as they have been in parts of Asia. We also watch credit, as this to me is now arguably taking on new meaning, and further spread widening will make painful viewing for those still holding long risk positions. More on that tomorrow.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.