- English

- عربي

Gold continues to work like a dream, while AUDUSD is trading sub-66, and EURUSD is holding below 1.08, with EU and German PMI due in early European trade - the consensus is that we see the German PMI print at 44.8. Given how grossly oversold EURUSD is, should we see a beat then the upside in EUR seems likely to be more pronounced than EUR downside, should the data come in below expectations. Although, as always, I guess it’s the extent of the miss/beat that we will really key off.

So, watch EUR exposures.

The USD remains the dominant talking point on the floors, and it is something I focus on in the week ahead video. The risk to the USD remains to the upside, even if the love for the greenback has become a little too intense - the investment case remains, and there really is no alternative, well, except for the CAD, which has worked well this week, where AUDCAD shorts still look compelling.

I talk about this chart in the video, and it may be nothing or it may be one of the most important charts out there. As detailed yesterday, we simply don’t see one-way moves in a currency, with a higher ROC (rate of change), impacting inflation expectations, without a central bank response. In this case, the USD is at three-year highs, US yield curves are inverted, and inflation expectations are testing a level which will be on the Fed’s radar. It will impact EM assets more readily too, and the MSCI EM index should work lower from here.

Source: Bloomberg

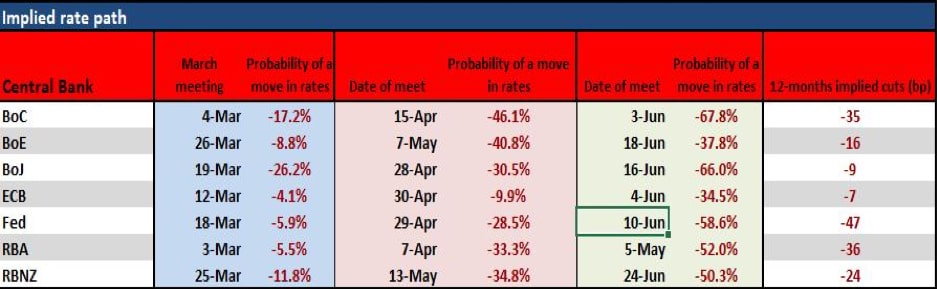

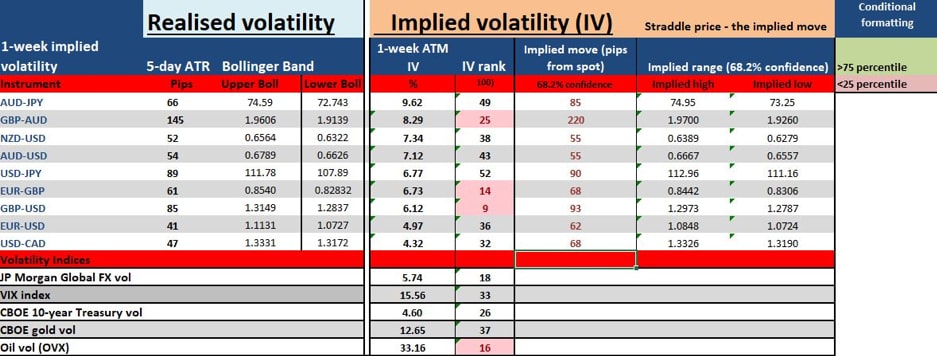

There seems little doubt that if the USD heads higher and lead not just by EURUSD or USDJPY but by USDCNH, then we should be talking about ‘currency wars’. It doesn’t shock that the swaps market has two cuts priced from the Fed over the coming 12 months, and it feels as though we are staring at a similar situation as late 2018 – where the market had priced an aggressive rate cut path and the Fed failed to meet the market. The result was far implied volatility and the market schooled the Fed.

We will need to see the upcoming data, specifically the China PMI (29 February) and US ISM (3 March) come in weak, with the USD moving higher. However, if this scenario plays out, then the market will price in two cuts (from the Fed) by October and if the Fed doesn’t move to a more dovish bias we’ll see higher volatility and even equities will be heading lower – the market will go after the Fed. Consider we see the US 10-Year Treasury trading into 1.49% today – the lowest since September and yields curves are ever deeper inverted. The USD is at three-year highs. Equities remain near ATH. This is just an unsustainable dynamic.

US politics in focus

We also head into the weekend focused on the Nevada primary, with Sanders taking a commanding lead in the polling for the nominee. Nevada is a telling state, with political commentators seeing Nevada as a solid proxy for Super Tuesday (3 March), where we know around 30% of the delegates will be awarded. A win for Sanders here is one that will solidify his chance of the national vote and markets will start to wear a higher political risk premium. We will take notice, and while markets have been of the view that Trump will easily overcome Bernie, as we get closer to the event, the question of “what if” will become more prevalent – the other political case studies are just too fresh in our minds.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.