- English

- عربي

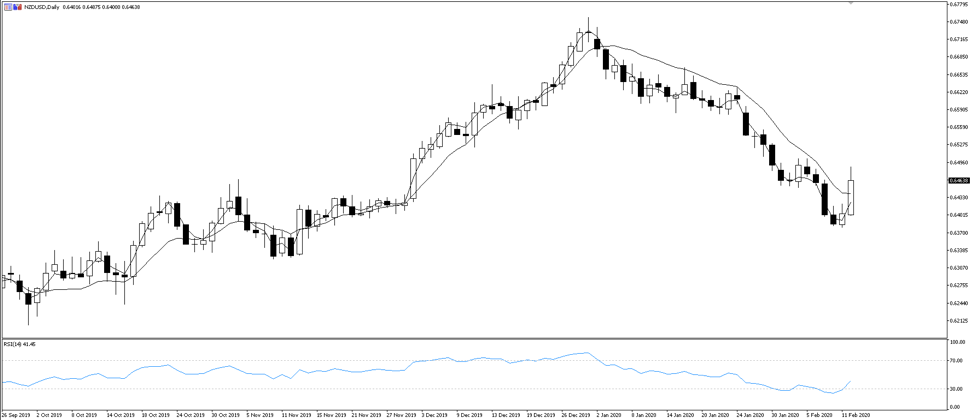

NZDUSD jumped 53 pips to 0.6461 on the news and drifted higher to close the day at 0.6465 after the RBNZ removed its easing bias.

The RBNZ is known for being proactive and getting ahead of the curve. Take last year’s unexpected 50 basis point (bp) rate cut as an example, when the bank caught markets off guard and pledged to do “whatever it takes” to meet its mandate of price stability and maximum sustainable employment.

This puts the RBNZ at odds with its Aussie counterpart the Reserve Bank of Australia (RBA), which tends to be slower to react. The RBA has left all options open as it waits to understand the economic impact of the summer bushfires and CoVID-19.

Data divergence

The neighbouring banks share a dual mandate to manage price stability and unemployment. There’s a discrepancy in this key data too.

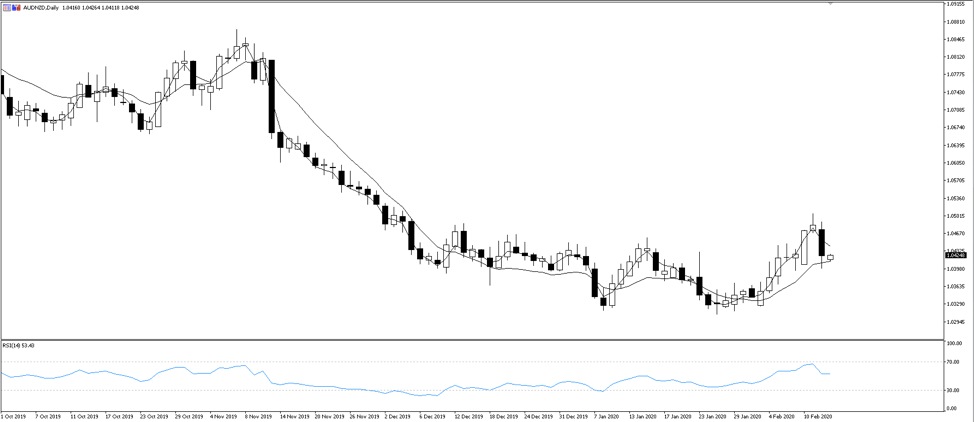

The AUDNZD forex pair has been in a downtrend since early November. Divergence in economic data could see this push lower.

Unemployment remains high in Australia at 5.1%, and despite three rate cuts in 2019 the RBA is struggling to get on top of this. It’s a different story over the ditch. New Zealand’s unemployment rate is a low 4%, near maximum sustainable employment.

The central banks have a similar inflation target of one to three percent, and are seeing modest progress towards the target.

The RBA is watching jobs data closely, and has indicated an increase in the unemployment rate will be the major catalyst for a future rate cut. No meaningful progress towards the inflation target as well as bushfire and virus fallout also present downside risk.

The banks each acknowledge that rates are very low and further easing will inflate asset prices and encourage households to take on more debt, which is already at record levels. Any future cut must be carefully considered.

So where to for AUDNZD?

There’s little Australian data coming up during the rest of February. The only meaningful print is unemployment data on 20 February 11:30 AEDT. Knowing the RBA are watching this closely, a bad print here and calls for easing will increase again.

The calendar is slightly more full in New Zealand. Manufacturing, housing, and food price data Friday might not move markets but will help understand the bigger picture. The January trade balance print on 27 February won’t yet reflect the impact from the China travel ban on tourism. And let’s consider how significant that could be: Tourism is New Zealand’s biggest export and Chinese tourists are the second biggest spenders. The impact of the ban during peak tourist season won’t be understood until late March.

There are no cases of CoVID-19 in New Zealand yet, and the RBNZ expects the economy to recover from any fallout by mid-2020. On the other hand, Australia has 15 confirmed cases of the virus and remains relatively more exposed than NZ.

Of course, AUD reached an 11-year low against the USD last week and has bounced off slightly since. Weighing everything up, it just seems there’s more downside risk for the Aussie.

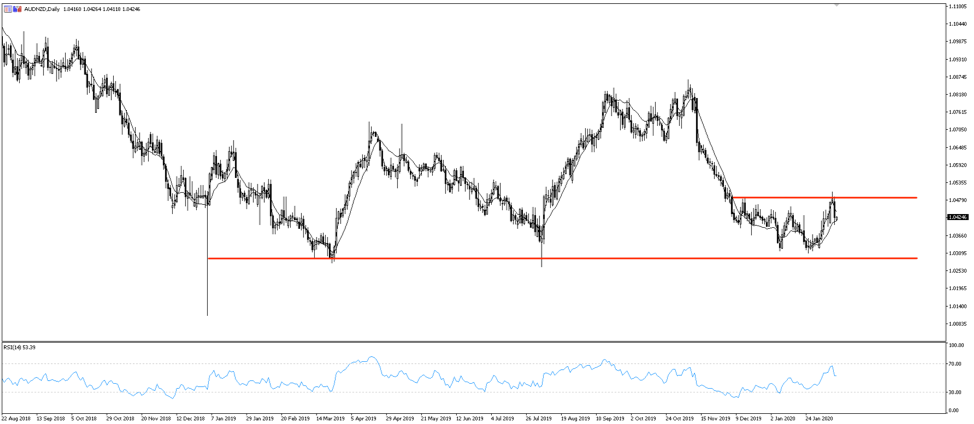

On the AUDNZD daily chart, there’s long term support just above the 1.0300 handle at 1.0308, and a more recent resistance ceiling at 1.0490. Price action rejected resistance on Wednesday. There’s no real reason for the pair to trade above resistance at the moment.

Looking at long-term support, AUDNZD will need a really good reason to move below this level. We’re at a crucial point though, if the RBA can’t keep a lid on Aussie unemployment and is forced to cut rates while their neighbour doesn’t, resistance could well give way. With little Australian data on the horizon, the AUD will continue to be hit by any CoVID-19 headlines.

The kiwi has never had an equal footing with its Australian counterpart, and nor should it with its much smaller economy. For a flightless bird, how far can it soar?

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.