How can ChatGPT enhance my trading strategy?

ChatGPT can enhance trading by providing real-time data analysis, market sentiment insights, and strategy optimisation. It can help develop and refine strategies, manage risk, and make informed decisions, offering a powerful tool for traders.

While ChatGPT can assist in analysis and decision-making, it does not eliminate market risk, and sound risk management practices are still essential.

The Evolving Role of AI in Trading

Artificial intelligence (AI) is rapidly transforming how traders approach investing. From high-frequency trading algorithms to sophisticated risk management systems, AI is fast becoming an indispensable tool for traders seeking to gain a competitive edge. As market complexity and data volumes continue to expand, the ability to process and analyse vast amounts of information in real-time is becoming vitally important.

One of the most significant advancements in this space is the development of AI-powered conversational agents like OpenAI’s ChatGPT. ChatGPT leverages state-of-the-art natural language processing that can provide traders with insights, data analysis, and decision-making support. This guide looks into how AI, and particularly tools like ChatGPT, has the potential to reshape trading strategies, enhance efficiency, and enable more informed investment decisions. It further highlights practical steps to integrate ChatGPT into trading workflow, explore methods for utilising AI for market analysis and strategy development, and learn how to leverage AI for risk management. Understanding the role of AI in trading is quickly becoming essential for all traders in today's dynamic financial landscape.

Understanding ChatGPT

ChatGPT is a language model developed by OpenAI, designed to understand and generate human-like text based on the input it receives. It is part of the broader suite of GPT (Generative Pre-trained Transformer) models, which leverage advanced deep learning techniques to process and generate natural language. The development of ChatGPT involved training on a diverse dataset comprising vast amounts of text from the internet, allowing it to acquire a wide range of knowledge and linguistic capabilities.

Development by OpenAI

OpenAI created ChatGPT to advance the field of natural language processing (NLP). NLP is a branch of AI that helps computers understand, interpret and manipulate human language. The model's architecture is based on the transformer model, a neural network design that processes sequential data and captures long-range dependencies in text. OpenAI's goal with ChatGPT is to create a powerful tool that can assist with various tasks, from answering questions and providing explanations to generating creative content.

Basic Principles of Operation

ChatGPT operates by predicting the next word in a sentence based on the words that have preceded it. It uses a process known as "attention mechanisms" to weigh the relevance of different words in the context, allowing it to understand and generate coherent and contextually appropriate responses. The model's training involves two main phases:

- Pre-training: ChatGPT learns to predict the next word in sentences by being exposed to large amounts of text data. This phase helps the model understand grammar, facts about the world, and some level of reasoning ability.

- Fine-tuning: The model is further refined using specific datasets and often guided by human reviewers who provide feedback on its responses. This phase enhances the model's ability to generate more accurate and relevant outputs based on user inputs.

Potential Benefits for Traders

ChatGPT represents a significant development in the use of AI in trading. Its ability to process and analyse large volumes of data, combined with its efficiency and accessibility, make it a powerful tool for traders looking to enhance the decision-making processes. As AI continues to evolve, tools like ChatGPT are poised to play an increasingly integral role in the future of trading:

- Efficiency: This is crucial in the fast-paced trading environment, where timely information can make a significant difference in decision-making. For example, ChatGPT can be prompted to summarise 100+ page documents like annual reports in seconds:

- Data Analysis Capabilities: The model can analyse large datasets, including financial news, reports and market data to identify trends, sentiment, and key insights. This can help traders stay informed about market conditions, economic indicators, and potential opportunities.

- Enhanced Decision-Making: It can assist in risk assessment, strategy development, and even backtesting by offering relevant data and analysis. The model's ability to summarise complex information and generate predictions can also help traders formulate and refine strategies.

- Accessibility and Scalability: ChatGPT is accessible through various platforms and can be scaled to meet the needs of individual traders or large trading firms. Its versatility allows it to be integrated into trading workflows, providing support across different aspects of trading, from research to execution.

- Continuous Learning and Adaptation: ChatGPT can be updated and fine-tuned to adapt to changing market conditions and emerging trends. This ongoing learning process ensures that the model remains relevant and valuable in dynamic market environments.

Getting Started with ChatGPT in Trading

Integrating ChatGPT into a trading workflow can significantly enhance the decision-making process and data analysis capabilities. Here's a step-by-step guide to get started:

Signing Up for an OpenAI Account

Step 1: Sign-up for an account on OpenAI's Website

Go to the OpenAI website and explore the available plans and features. OpenAI offers different subscription levels, including free and paid plans, with varying access to their Application Programming Interface (API) and model capabilities.

Step 2: Select a Plan

Choose a subscription plan by considering usage limits, response speed, and additional features like fine-tuning capabilities. Paid plans typically offer more flexibility and higher usage limits.

Step 3: API Key Generation

Once an account is set up, generate an API key from the OpenAI dashboard. This key is essential for integrating ChatGPT with other software and services.

Interested in trading AI stocks but not sure where to begin? Discover Pepperstone's comprehensive guide on the best AI stocks to trade in 2025.

Integrating ChatGPT with Existing Trading Software

Step 1: Assess Trading Platform Compatibility

Check if the chosen trading platform or software supports API integration. Most modern platforms like Pepperstone support API integration, and also provide documentation on how to connect third-party services.

MetaTrader 4 /5 can be linked to ChatGPT:

Step 2: Use API Libraries

Utilise API libraries compatible with the programming environment (such as Python, JavaScript, etc.). OpenAI provides official libraries and SDKs that simplify the process of making API requests.

Step 3: Connect ChatGPT via API

Incorporate the API key and endpoint into the trading software or custom scripts. This connection enables ChatGPT to receive prompts and provide responses based on real-time market data or historical analysis.

Step 4: Test the Integration

Run tests to ensure that ChatGPT can access the necessary data and respond appropriately. This step is crucial to troubleshoot any potential issues with data flow, response times, or accuracy.

Configuring ChatGPT for Individual Trading Needs

Step 1: Define Objectives

Clearly outline what is aimed to be achieved with ChatGPT in trading activities. This could include market analysis, sentiment analysis, risk management, strategy development, or automation of specific tasks.

Step 2: Customise Prompts and Queries

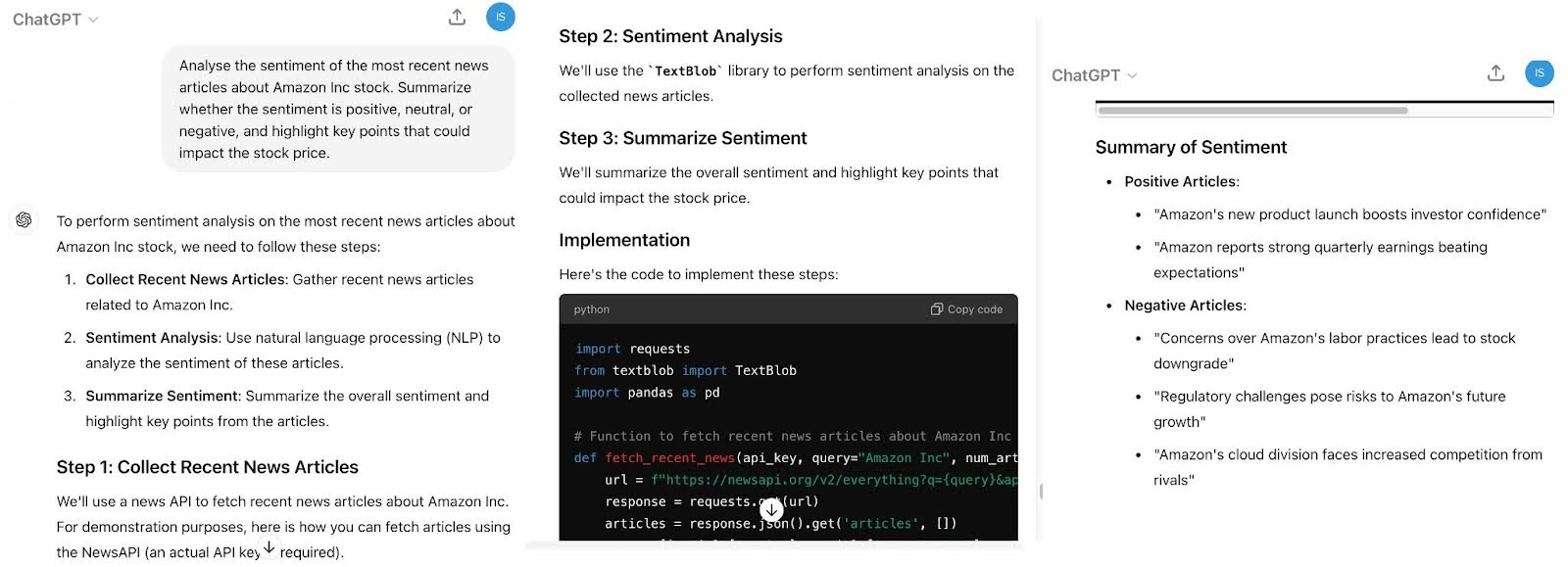

Develop specific prompts that align with the stated trading strategy. For example, create queries that ask ChatGPT to analyse the sentiment of recent news articles about a particular stock, summarise technical indicators, or provide forecasts based on historical data:

Step 3: Fine-Tuning

Consider fine-tuning ChatGPT with data specific to a trading strategy or market sector. This can enhance the model’s relevance and accuracy in generating tailored insights.

Step 4: Implement Safeguards and Risk Management

Use ChatGPT as an advisory tool rather than the exclusive decision-maker. Incorporate risk management strategies to ensure that all trading decisions align with risk tolerance and overall strategy.

Step 5: Continuous Monitoring and Adjustment

Regularly monitor the performance of ChatGPT in trading activities. Adjust prompts, integration settings, and data sources as necessary to refine its output and improve its usefulness.

Using ChatGPT for Market Analysis

Traders can use ChatGPT to collect, interpret, and analyse market data, perform predictive analytics, and conduct sentiment analysis:

Collecting and Interpreting Market Data

Real-Time Data Collection

- API Integration: Connect ChatGPT to data feeds from financial markets using APIs that provide real-time quotes, historical data, and economic indicators. This integration allows ChatGPT to access up-to-date information essential for accurate analysis.

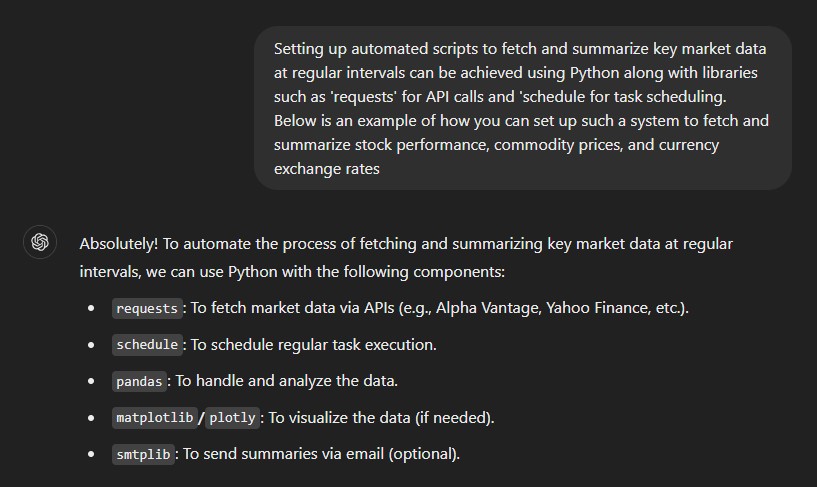

- Automated Data Retrieval: Set up automated scripts that prompt ChatGPT to fetch and summarise key market data at regular intervals. For example, request summaries of stock performance, commodity prices, or currency exchange rates.

Technical Analysis

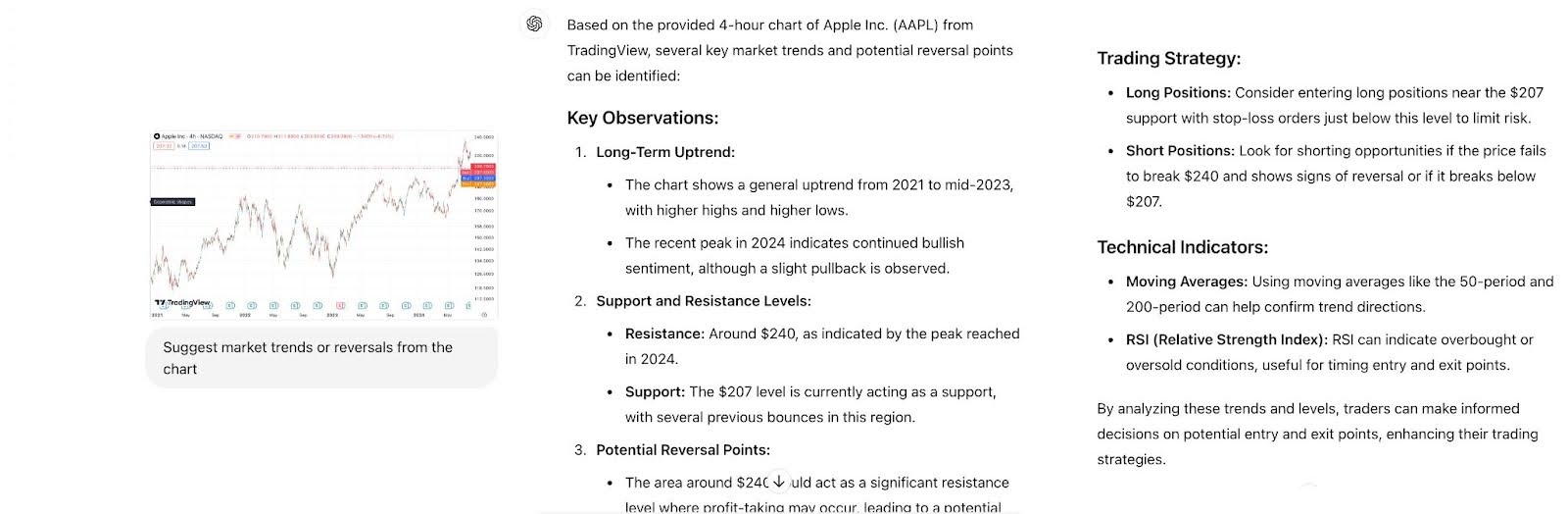

- Indicator Summaries: Use ChatGPT to explain and summarise various technical indicators such as moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands. ChatGPT can interpret these indicators' values and suggest possible market trends or reversals.

- Pattern Recognition: ChatGPT can identify and describe common chart patterns (e.g., head and shoulders, triangles, double tops/bottoms) and what they might indicate about future price movements.

Performing Predictive Analytics

Trend Forecasting

- Historical Data Analysis: Ask ChatGPT to analyse historical market data and identify patterns or trends that could suggest future price movements. This could include identifying cycles or recurring events that have historically impacted market prices.

- Scenario Analysis: Use hypothetical scenarios to explore potential outcomes. For instance, inquire how a change in interest rates might affect stock prices or commodity markets, based on historical correlations and market reactions.

Risk Assessment

- Volatility Analysis: ChatGPT can assess the volatility of specific assets by analysing historical price fluctuations and external factors influencing volatility, such as economic events or geopolitical tensions.

- Risk Indicators: Utilise ChatGPT to interpret risk indicators like the VIX (Volatility Index) and explain their implications for market sentiment and potential future movements. For example, on August 5th, 2024 the VIX spiked above 65, ChatPGT provided the following context from a simple response prompt:

Conducting Sentiment Analysis

Financial News Analysis

- News Aggregation: Use ChatGPT to aggregate and summarise financial news from multiple sources. This can provide a consolidated view of current market sentiment and key events.

- Sentiment Scoring: Request ChatGPT to analyse the tone of news articles, press releases, or analyst reports to gauge market sentiment (positive, neutral, or negative) towards specific assets or the market in general.

Social Media and Public Forums

- Social Sentiment Monitoring: ChatGPT can scan social media platforms, such as Twitter, Reddit, and financial forums, for discussions and sentiments about stocks, or market trends.

- Trend Identification: Identify trending topics or sentiment shifts that could signal changing market conditions. For example, sudden increases in positive or negative mentions of a company could precede significant stock price movements. Download historical data from sites such as Nasdaq.com or stock screener from Trading View (see below)

Developing Trading Strategies with ChatGPT

Here's a detailed process on how to utilise ChatGPT to create, automate, and optimise trading strategies, including backtesting with historical data and real-time adjustments:

Ideas and Strategy Formulation

- Generate Ideas: Use ChatGPT to explore various trading strategies based on different market conditions, asset classes, and time frames. For instance, inquire about momentum strategies, mean reversion, arbitrage, or sector rotation strategies.

- Define Parameters: Ask ChatGPT to help define key parameters such as entry and exit points, stop-loss levels, and position sizing rules. These parameters should align with your risk tolerance and investment goals. See Alphabet Inc (GOOGL) example mentioned above.

Detailed Strategy Description

- Strategy Documentation: Use ChatGPT to assist in documenting the trading strategy, including its underlying rationale, market conditions under which it should be applied, and specific rules for trade execution.

- Scenarios and Adjustments: Inquire about potential market scenarios that could impact the strategy’s performance and discuss possible adjustments. This foresight helps in preparing for varying market conditions.

Automating Trading Strategies

- Automation Scripts: Develop scripts that translate ChatGPT’s strategy outputs into executable actions on the trading platform. This includes setting up automatic order placement based on predefined criteria.

Real-Time Data and Execution

- Execution Monitoring: Implement monitoring systems to oversee the automated execution process, ensuring that trades are being placed correctly and that the system operates as expected.

Conducting Backtesting with Historical Data

- Historical Data Collection: Gather historical market data relevant to the assets and time frames the strategy targets. This data should include prices, volumes, and any other indicators used in the strategy.

- Simulation Tools: Use simulation tools that can replicate the trading environment, including transaction costs, slippage, and market liquidity, to evaluate how the strategy would have performed historically. Pepperstone’s Trading Simulator is an ideal tool to practice.

Strategy Testing and Analysis

- Run Backtests: Execute the strategy on historical data, using ChatGPT to interpret the results. Analyse metrics like profitability, drawdowns, win/loss ratio, and Sharpe ratio to assess performance.

- Identify Weaknesses: Use ChatGPT to identify any patterns or weaknesses in the strategy revealed by the backtest, such as periods of underperformance or specific market conditions where the strategy fails.

Adjusting Strategies in Real-Time

Continuous Monitoring and Feedback

- Real-Time Analysis: Utilise ChatGPT to continuously analyse real-time market data and the performance of the trading strategy. Look for deviations from expected outcomes and market anomalies.

- Alert Systems: Set up alert systems that notify you of significant changes in market conditions or strategy performance, prompting a review or adjustment of the strategy.

Dynamic Strategy Adjustment

- Adaptive Algorithms: Implement adaptive algorithms that adjust strategy parameters based on real-time data. For example, the system might tighten stop-loss levels during periods of high volatility or adjust position sizes based on market trends.

- Human Oversight: Maintain human oversight to make discretionary adjustments or overrides when necessary. This ensures that the strategy remains aligned with overall trading objectives and risk management policies.

Optimisation and Continuous Improvement

Performance Review and Optimisation

- Regular Review: Periodically review the strategy’s performance, incorporating new data and market developments. ChatGPT can generate reports and insights into areas for improvement.

- Optimisation Techniques: Apply optimisation techniques, such as adjusting parameter values, refining entry and exit criteria, or incorporating new indicators to enhance strategy performance.

Scalability and Expansion

- Scalability: Explore the scalability of successful strategies to larger capital sizes or across different asset classes. Use ChatGPT to assess the potential risks and adjustments needed for scaling.

- Exploration of New Strategies: Continuously explore new strategies and innovations in the market, using ChatGPT to stay updated with the latest trends and techniques in algorithmic trading.

Risk Management and Decision Making

Risk management is a crucial component of any form of successful trading. It involves identifying, assessing, and mitigating potential losses in financial markets. Effective risk management helps traders preserve capital, minimise losses, and maintain psychological stability during volatile periods. This discipline ensures that traders do not expose themselves to excessive risk, which can lead to significant financial losses and hinder long-term profitability.

ChatGPT can play a vital role in enhancing risk management practices for traders. Its advanced data analysis and predictive capabilities provide valuable insights that support more informed decision-making.

Advanced Data Analysis

Market Sentiment Analysis

- Example: ChatGPT might identify a prevailing negative sentiment towards a particular sector or stock, alerting traders to potential risks associated with holding or entering positions in that market.

- Benefit: This analysis helps traders anticipate market movements based on the collective sentiment, enabling them to adjust portfolios or implement protective measures such as stop-loss orders.

Volatility Assessment

- Example: ChatGPT can assess historical price data and calculate volatility indicators like the Average True Range (ATR) or Bollinger Bands. See the Apple, Inc. (AAPL) below. If it identifies increased volatility in an asset, it can suggest adjusting position sizes or implementing hedging strategies to protect against large price swings.

- Benefit: Understanding volatility patterns helps traders adjust risk exposure during periods of high uncertainty.

Correlation and Diversification

- Example: ChatGPT can analyse the correlations between different assets or asset classes. For example, if a trader's portfolio is heavily weighted in stocks, ChatGPT might suggest diversifying into other asset classes, like bonds or commodities, which have a negative or low correlation with stocks.

- Benefit: Diversification helps reduce portfolio risk by spreading exposure across assets that do not move in tandem, thus minimising potential losses.

Predictive Capabilities

Scenario Analysis

- Example: ChatGPT can simulate different market scenarios, such as economic downturns, geopolitical events, or policy changes, and predict their potential impact on asset prices. For instance, in the case of an anticipated interest rate hike, ChatGPT can predict likely reactions in equity and bond markets.

- Benefit: Scenario analysis prepares traders for various market outcomes, allowing them to develop contingency plans and manage risk more proactively.

Risk Indicators and Alerts

- Example: ChatGPT can monitor key risk indicators like the VIX (Volatility Index), credit spreads, or macroeconomic data releases. If an indicator signals increased market risk, ChatGPT can alert the trader to review their positions and consider protective measures such as tightening stop-loss levels or reducing leverage.

- Benefit: Timely alerts help traders respond quickly to emerging risks, preventing significant losses and preserving capital.

Stress Testing

- Example: ChatGPT can perform stress tests on a trader's portfolio by simulating extreme market conditions, such as sudden market crashes or rapid interest rate changes. The model can estimate potential losses and identify the weakest points in the portfolio.

- Benefit: Stress testing provides insights into the portfolio's resilience under adverse conditions, enabling traders to make adjustments and strengthen their risk management strategies.

Advanced Applications of ChatGPT in Trading

ChatGPT can significantly enhance algorithmic and high-frequency trading (HFT) by providing sophisticated data analysis, generating complex trading strategies, and supporting real-time decision-making.

Algorithmic Trading

Algorithmic trading involves the use of algorithms to automate trading decisions based on predefined criteria. ChatGPT can assist in:

- Generating Algorithmic Strategies: ChatGPT can help traders design and refine algorithmic trading strategies, including arbitrage, market making, trend following, and statistical arbitrage. For example, ChatGPT can be used to develop a strategy that buys or sells assets based on technical indicators, price patterns, or quantitative models.

- Optimisation of Parameters: Once a strategy is designed, ChatGPT can suggest methods to optimise parameters such as entry and exit points, stop-loss levels, and risk management rules. This involves testing different parameter settings to find the most profitable configurations under various market conditions.

Integration of ChatGPT with Expert Advisors

An Expert Advisor (EA) is a software programme used on the MetaTrader platform to automate trading strategies. EAs can execute trades, set stop losses, take profits, and manage other trading tasks automatically based on predefined rules.

Market Analysis and Signal Generation

- ChatGPT: Can be used to analyse large sets of market data, news, and sentiment to generate trading signals.

- EA: Can execute trades based on these signals. Signals generated by ChatGPT can be fed into an EA to automate the trading process.

Strategy Development and Optimisation

- ChatGPT: Can help in developing and optimising trading strategies by providing insights and suggesting modifications based on market conditions.

- EA: Can implement these strategies, backtest them, and optimise parameters.

Risk Management

- ChatGPT: Can suggest risk management strategies based on current market volatility and trends.

- EA: Can enforce these risk management rules by adjusting position sizes, setting stop-loss orders, and taking other protective measures.

High-Frequency Trading (HFT)

High-frequency trading involves executing a large number of orders at extremely high speeds to capitalise on small price discrepancies. ChatGPT's role in HFT can include:

- Market Microstructure Analysis: ChatGPT can analyse order book data, trade volumes, and price movements at high frequencies, providing insights into market microstructure and detecting arbitrage opportunities.

- Latency Sensitivity: In HFT, minimising latency—the time delay in executing orders—is critical. ChatGPT can assist in designing algorithms that are optimised for speed, taking into account factors like data feed speed, processing times, and order execution delays.

- Algorithm Tuning: ChatGPT can be used to fine-tune HFT algorithms for optimal performance. This involves adjusting the algorithms to be more responsive to market changes, enhancing their ability to capitalise on fleeting opportunities.

- Risk Management: Even in HFT, risk management remains crucial, perhaps even more so. ChatGPT can help develop risk controls, such as monitoring for excessive slippage, tracking exposure limits, and implementing real-time loss-cutting measures.

- Real-Time Strategy Adaptation: HFT strategies often require real-time adaptation to market conditions. ChatGPT can be programmed to adjust trading strategies dynamically, responding to changes in market volatility, liquidity, and other key metrics.

Ethical Considerations and Limitations

As AI continues to revolutionise the trading landscape, it brings with it a host of ethical implications and limitations that traders and institutions must carefully consider. The integration of AI in trading offers unprecedented efficiency and decision-making capabilities, but it also raises significant ethical concerns and potential risks that need to be addressed to ensure responsible use.

Ethical Implications

- Market Manipulation: AI systems, particularly those involved in HFT, have the potential to manipulate markets. These systems can execute trades at lightning speed, creating price fluctuations that can be exploited. This raises concerns about fairness and market integrity.

- Transparency and Accountability: The decision-making processes of AI systems can be opaque, making it difficult to understand how and why specific trades are executed. This lack of transparency can lead to accountability issues, especially when AI-driven trades result in significant financial losses or market disruptions.

- Job Displacement: The automation of trading through AI can lead to job displacement within the financial sector. Traders, analysts, and other financial professionals may find their roles diminished or eliminated, raising broader societal and economic concerns.

- Bias and Discrimination: AI systems are only as good as the data they are trained on. If the training data is biased, the AI can perpetuate or even exacerbate existing biases. This is particularly concerning in trading, where biased algorithms could unfairly impact certain stocks or sectors, leading to unequal market opportunities.

Limitations of AI in Trading

- Data Quality and Availability: AI systems require vast amounts of high-quality data to function effectively. Inaccurate, incomplete, or biased data can lead to faulty analysis and poor trading decisions. Ensuring data integrity is a constant challenge.

- Overfitting and Model Robustness: AI models can sometimes overfit to historical data, performing well on past market conditions but failing to adapt to new, unforeseen market events. This can lead to significant financial losses if the models are not robust enough to handle changing market dynamics.

- Regulatory Compliance: Navigating the regulatory landscape is complex, and AI systems must be designed to comply with various financial regulations. Non-compliance can result in legal penalties and damage to reputation.

- Technical Failures: AI systems are not infallible and can experience technical failures or bugs. These failures can lead to unintended trading actions, causing substantial financial loss and market instability.

Emerging Trends in AI and Trading

Increased Use of Machine Learning and AI Algorithms

- Enhanced Predictive Analytics: AI algorithms are becoming more sophisticated in predicting market trends and identifying profitable trading opportunities. As machine learning models continue to evolve, they can incorporate more complex data sets, including macroeconomic indicators, market sentiment, and even global events.

- Personalisation and Adaptability: Future AI systems will likely offer greater customisation, allowing traders to tailor algorithms to specific trading styles and risk preferences. These systems will adapt in real-time to changes in market conditions, improving performance and risk management.

NLP for Market Insights

- Advanced NLP Capabilities: As technologies like ChatGPT advance, their ability to understand and analyse human language will improve. This includes parsing financial reports, news articles, social media feeds, and even earnings calls for actionable insights.

- Real-Time Sentiment Analysis: Enhanced NLP tools will provide more accurate and timely sentiment analysis, helping traders understand market mood and make decisions based on public perception and sentiment shifts.

AI in Risk Management and Compliance

- Automated Risk Assessment: AI will play a crucial role in real-time risk assessment, offering dynamic risk management strategies that adjust based on market volatility, exposure, and other risk factors.

- Regulatory Compliance: AI technologies will assist in ensuring compliance with increasingly complex regulatory requirements, automating tasks such as transaction monitoring, reporting, and adherence to trading rules.

Potential Advancements in ChatGPT and Similar Technologies

Improved Analytical Capabilities

- Deeper Market Analysis: Future versions of ChatGPT will likely offer deeper and more nuanced market analysis, including the ability to interpret complex financial data and provide more sophisticated predictive insights.

- Integration with Quantitative Models: ChatGPT and similar AI systems may integrate more closely with quantitative models, offering traders a hybrid approach that combines qualitative insights with quantitative precision.

Enhanced Interactivity and Usability

- Voice and Multimodal Interfaces: Advancements in user interface technology could include voice-activated trading systems and multimodal interfaces, making interactions with AI tools more intuitive and accessible.

- Personal Assistant Functionality: ChatGPT could evolve into a more comprehensive personal trading assistant, capable of managing multiple aspects of a trader’s daily activities, from data analysis to portfolio management and trade execution.

Scalability and Integration

- Cloud-Based Solutions: AI tools will increasingly be offered as scalable, cloud-based solutions, making them more accessible to traders of all sizes and improving integration with existing trading platforms.

- APIs and Customisation: The development of more robust APIs will facilitate greater customisation and integration of AI tools with a wide range of trading systems and data sources.

Contact Pepperstone (support@pepperstone.com) to gain access to Pepperstone’s AI Bundle.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own.