- English

- عربي

Fed Rate Cuts Pushed Back - US Equity On Fire

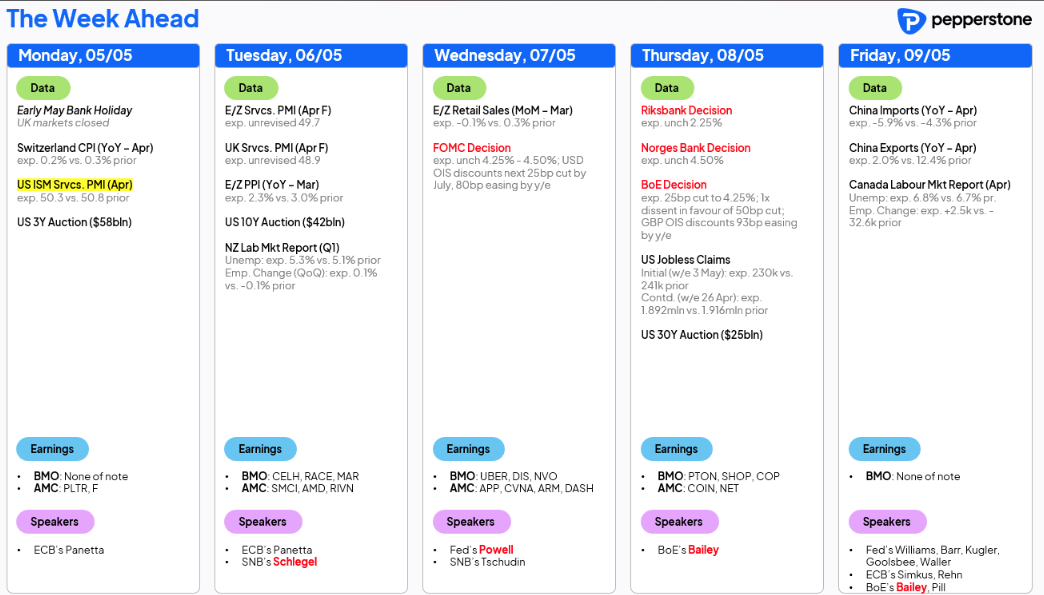

Friday’s US nonfarm payrolls report was strong enough to reduce expectations that Wednesday’s FOMC meeting will be seen as a major volatility event to manage – and with the easing of financial conditions and well-anchored longer-term inflation expectations, the prospect of a neutral stance from the Fed is the base case. In theory, market players won’t learn a great deal of new intel from Powell and Co, who will likely state they are monitoring the situation closely.

The US payrolls report sees positioning and tactical expressions for nearer-term US recession risk unwound, with traders further covering legacy shorts in small caps and high beta growth equity. Cognizant that the S&P500 has now closed higher for 9 consecutive days (the best run since 2004), the risk that S&P500 futures test the 200-day MA at 5818 and potentially beyond is remains in play, especially with over 75% of US-listed equities resuming buybacks later in the week.

With S&P500 futures +18.1% from the April lows, NAS100 futures in a technical bull market, and strong momentum rallies in most DM equity indices, funds have reduced volatility hedges, with the VIX index closing at 22.68%, and now eyes a move to the 12-month average at 18.10%. S&P500 1-month 5-delta put implied volatility trades at a 12 vol premium to S&P500 At-The Money volatility, a small premium to the 12-month average, but a sharp reduction from the 35 vol premium seen on 8 April. Portfolio hedges subtract from the fund’s performance in a market raging higher, but these levels of vol do start to become interesting for traders who feel there are still elevated risks to navigate.

Traders also add to longs in G10 risk FX (long AUD, ZAR, NZD), with some notably bullish flows in AUDUSD, as well as the AUD FX cross rates - AUDCHF, AUDJPY, and AUDNZD, while GBPAUD and EURAUD have been well traded from the short side, and I see the risk skewed for the AUD to further outperform.

Having seen a solid NFP report, the default position is now for the US hard economic data releases to break down in the June series (the June NFP report is released on 3 July). Expectations remain elevated that the US hard data will deteriorate, but it will take time to evolve, and there will now be increased doubt that a breakdown even comes at all – there’s one thing CEOs lacking confidence, and companies responding to surveys with a message that all is not well - but whether they act and lay off workers on that view is another thing. We need to be open-minded to the idea that perhaps we don’t see the level of deterioration in the labour market that many expect.

A Reduced Sensitivity to the ISM Services Print

Had the US NFP print been sufficiently weak, it would have put today's US ISM services print firmly on the radar as a genuine risk landmine - but with US swaps pricing having pushed out the next Fed cut to July (from June) and now implying three 25bp cuts this year, the market's sensitivity to a weaker ISM services print will likely be dialled down. One could argue that we could see a larger reaction in equity, Treasuries and the USD to a positive ISM services print, relative to the negative reaction in risk to a weaker services print.

US Earnings to Come in Heavy This Week

US earnings will continue to come in heavy this week, and while we won’t see any with significant weights on the S&P500 or NAS100, we should see some lively 1-day moves in the trader favs, such as Palantir (the implied move on earnings is -/+12.8%), AMD (-/+7.2%), ARM (-/+8.7%) and Novo Nordisk (-/+6.2%) and Uber (-/+7.1%). Looking ahead, Walmart’s earnings (on 15 May) will get huge attention and have the potential to influence market sentiment, and we all know the attention Nvidia will get when they report on 28 May.

With 72% of S&P500 companies having reported, 76% of these names have beaten the consensus EPS expectations, with 48% beating on the sales line, with those that have beaten on EPS having done so by an average of 8.3% - this seems impressive, but the level of beats falls in line with the historical precedence. However, with the market going into earnings positioned so bearishly, the bar was low and as a result over 60% of reporting names have rallied on the day of reporting.

Key Event Risks Outside of the US

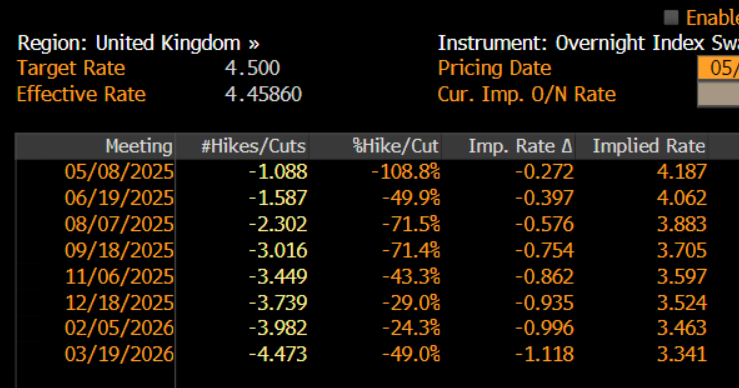

Wednesday’s FOMC meeting may now be seen as a lower-impact event, but Thursday’s BoE meeting is worth putting on the risk radar. The BoE should almost certainly cut rates by 25bp, with at least 2 MPC members set to call for a 50bp cut at this meeting. The reaction in UK gilts and GBP will come from the guidance and whether the door is sufficiently opened for a back-to-back cut at the June meeting, and whether there is the appetite expressed in the statement to ease the bank rate to 3.50% by December.

In Australia, Labor’s landslide election victory should be taken well by Aussie equity, as will the make-up of the Senate, as the passage to pass its agenda will play out with reduced friction. Fiscal spending matters for the Australian economy and the markets are comfortable with Jim Chalmers approach to spending, with the result set to lift the pressure on the RBA to ease, and over time the strong mandate offered to Albo from voters should result in the ALP stepping up its reform agenda. The ASX200 is already fired up and trending strong higher into this week’s ASX200 bank earnings, with Westpac starting the proceedings today and setting the tone for a sector already on fire - on first blush, the numbers won't blow the lights out, with 1H NIM at 1.88% and the interim div of 76c shy of expectations, while operating expenses are modestly higher than expectations. Deposits and volumes look solid enough, with its credit quality in good shape, with the bank seeing a lower impairment charge, although the bank stated the low in the credit-quality cycle may have passed. While the banks will need to please an increasingly high bar, it’s hard to fade the rally in the ASX200 and having broken convincingly through the 100- and 200-day MA, I look for 8400 to come into the mix soon enough.

On the Chinese economic data front, we look to Friday’s release of the Q1 balance of payments and trade data, with the market keen to see the level of imports from the US and just how severe the cutbacks will prove to be. China’s bond market is typically my guide on how market players see the prospect for reflation in response to the fiscal measures and monetary easing, and with the 5yr bond at 1.50% and with yields looking to head lower, we can expect new announcements on both trade talks and policy initiatives to occur soon enough. China will also release its April CPI and PPI on Saturday, and both should show little progress.

Through the week, traders also navigate Canada jobs, central bank meetings in Sweden and Norway and inflation prints in Switzerland, Mexico, Brazil, Columbia and Chile.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.