- عربي

- English

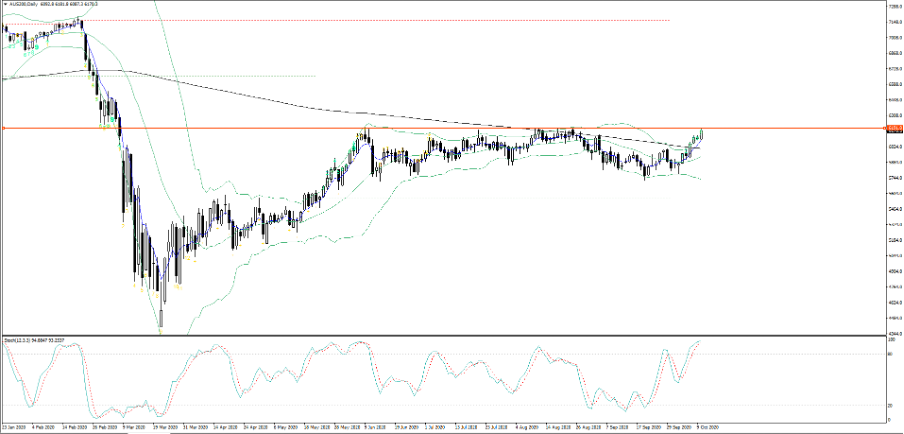

The notion of new all-time highs is there in US markets and we’re also looking at a test of the top of the range in Japan and Australia. Although, news that China has suspended purchases of Aussie coal is not going to aid sentiment Down Under.

(AUS200 daily)

I can look across the S&P 500 options structure and see that the term structure of 25-delta S&P 500 puts show higher implied volatility post the US election, which is the clear hedge against an ugly contested scenario. However, future implied volatility has come down sharply from this time last week. Can we say this portrays some easing of concerns around a contested scenario? Perhaps, but this scenario is still very real and very hard to model, but the market is still reasonably well hedged for this. We can see this in the VIX index too, which sits at 25% and implies daily moves of 1.6% in the S&P 500.

Maybe the market has bought into the notion of a DEM clean sweep but hedged themselves through options and gold to an extent – go long stocks and hedge with gold as a ‘barbell strategy’ some will employ, given the reasonably low correlation between the two variables.

The idea that this was an election play is questionable given we see the NAS100 +3.1% with tech flying, yet materials are lower and the Russell 2000 was only up 0.7% - these are both markets that are supposed to do well should we see a DEM clean sweep. Seems an odd election-focused trade to put on, especially if the DEMs may go after tech to an extent.

Consider that we have Q3 US earnings starting today with JPM starting preceding (at 21:45 AEDT), so perhaps traders are putting on risk and front-running that, despite calls that earnings are due to fall 21% YoY. Digging into tech specifically and expectations around earnings could certainly explain the moves in the mega-cap names as earnings in the ‘big five’ – Amazon, Google, FB, Apple, and Microsoft - are expected to grow 1%, with sales +13%.

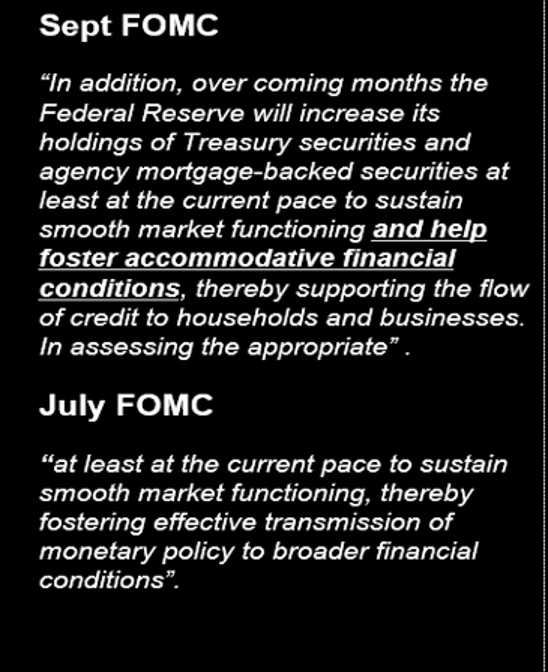

Of course, we revisit the Fed put and the recent change to the Fed’s mandate to an Average Inflation Targeting regime. I’ve included a passage from the statement which I think is absolutely key and the idea that the Fed will use policy to help foster accommodative financial conditions.

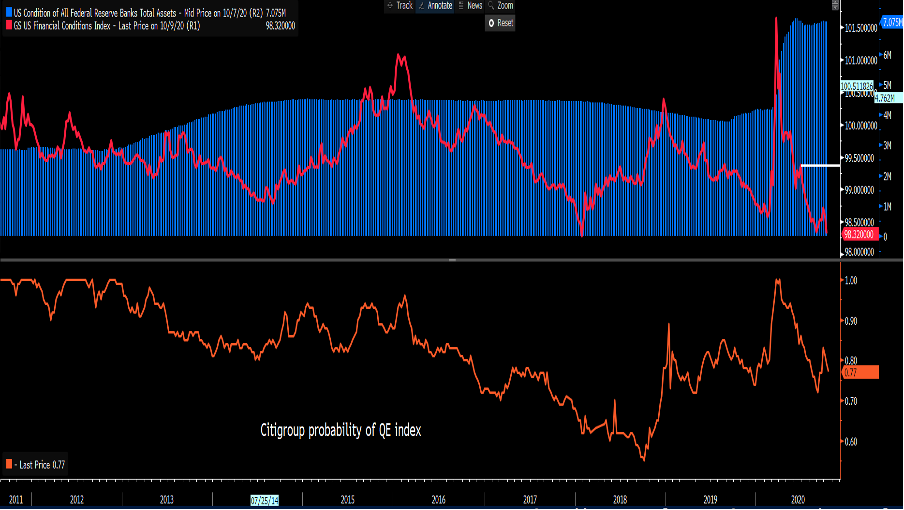

If we look at the chart below, we see:

- Top pane – Goldman Sachs financial conditions index (red) and the Fed’s balance sheet (blue histogram)

- Lower pane – Citigroup prospect of QE index. This currently stands at 77%

(Source: Bloomberg)

(Source: Bloomberg)The crux of this is that financial conditions which aggregate a blend of equity, credit spreads, money markets, volatility, and other market variables sit at multi-year lows – meaning financial conditions are incredibly accommodative. However, the market knows that if threatened then the bar for the Fed to come in with some sort of liquidity intervention is far lower than prior cycles, and that was low. Not only is the Fed unlikely to hike until late 2024 or early 2025 but they will support as and when needed. Liquidity may not create inflation, in fact, asset purchases seem to be disinflationary but they bring future returns in the equity market forward.

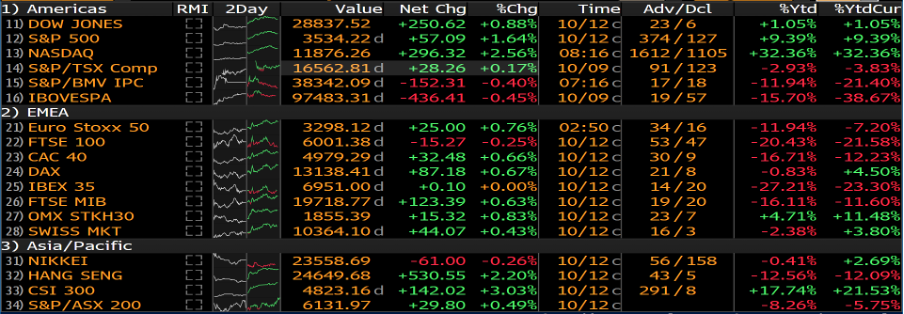

Also consider flow-based factors with trend-following and systematic players piling into the market. While the 20-day realised volatility of the S&P 500 is breaking 20% and that encourage volatility-targeting funds to add more equity exposure. We can probably add some solid participation from retail too. But when it comes to active management the notion of FOMO is absolutely there, but so is FOMU – Fear of Meaningfully Underperforming. If we look at the performance of US equities this year relative to most other global equities, even if we price all markets in USD terms (far right column) the US has blown everything, with the exception of China, out of the park.

(Source: Bloomberg)

Can this continue? It feels like there is more juice in the tank, especially for those who like long and short strategies, where long US and short FTSE is a juggernaut, even priced in GBP.

Related articles

مستعد للتداول؟

يمكنك البدء بسرعة وسهولة. إفتح حساب الآن في دقائق معدودة.

"لم يتم إعداد المواد المقدمة هنا وفقًا للمتطلبات القانونية المصممة لتعزيز استقلالية البحث الاستثماري، وعلى هذا النحو تعتبر بمثابة وسيلة تسويقية. في حين أنه لا يخضع لأي حظر على التعامل قبل نشر أبحاث الاستثمار، فإننا لن نسعى إلى الاستفادة من أي ميزة قبل توفيرها لعملائنا.

بيبرستون لا توضح أن المواد المقدمة هنا دقيقة أو حديثة أو كاملة ، وبالتالي لا ينبغي الاعتماد عليها على هذا النحو. لا يجب اعتبار المعلومات، سواء من طرف ثالث أم لا، على أنها توصية؛ أو عرض للشراء أو البيع؛ أو التماس عرض لشراء أو بيع أي منتج أو أداة مالية؛ أو للمشاركة في أي استراتيجية تداول معينة. لا يأخذ في الاعتبار الوضع المالي للقراء أو أهداف الاستثمار. ننصح القراء لهذا المحتوى بطلب المشورة الخاصة بهم والإستعانة بخبير مالي. بدون موافقة بيبرستون، لا يُسمح بإعادة إنتاج هذه المعلومات أو إعادة توزيعها.

تداول العقود مقابل الفروقات والعملات الأجنبية محفوف بالمخاطر. أنت لا تملك الأصول الأساسية و ليس لديك أي حقوق عليها. إنها ليست مناسبة للجميع ، وإذا كنت عميلاً محترفًا ، فقد يؤدي ذلك إلى خسارة أكبر من استثمارك الأساسي. الأداء السابق في الأسواق المالية ليس مؤشرا على الأداء المستقبلي. يرجى النظر في المخاطر التي تنطوي عليها، والحصول على مشورة مستقلة وقراءة بيان الإفصاح عن المنتج والوثائق القانونية ذات الصلة (المتاحة على موقعنا على الإنترنت www.pepperstone.com) قبل اتخاذ قرار التداول أو الاستثمار.

هذه المعلومات غير مخصصة للتوزيع / الاستخدام من قبل أي شخص في أي بلد يكون فيه هذا التوزيع / الاستخدام مخالفًا للقوانين المحلية."