- عربي

- English

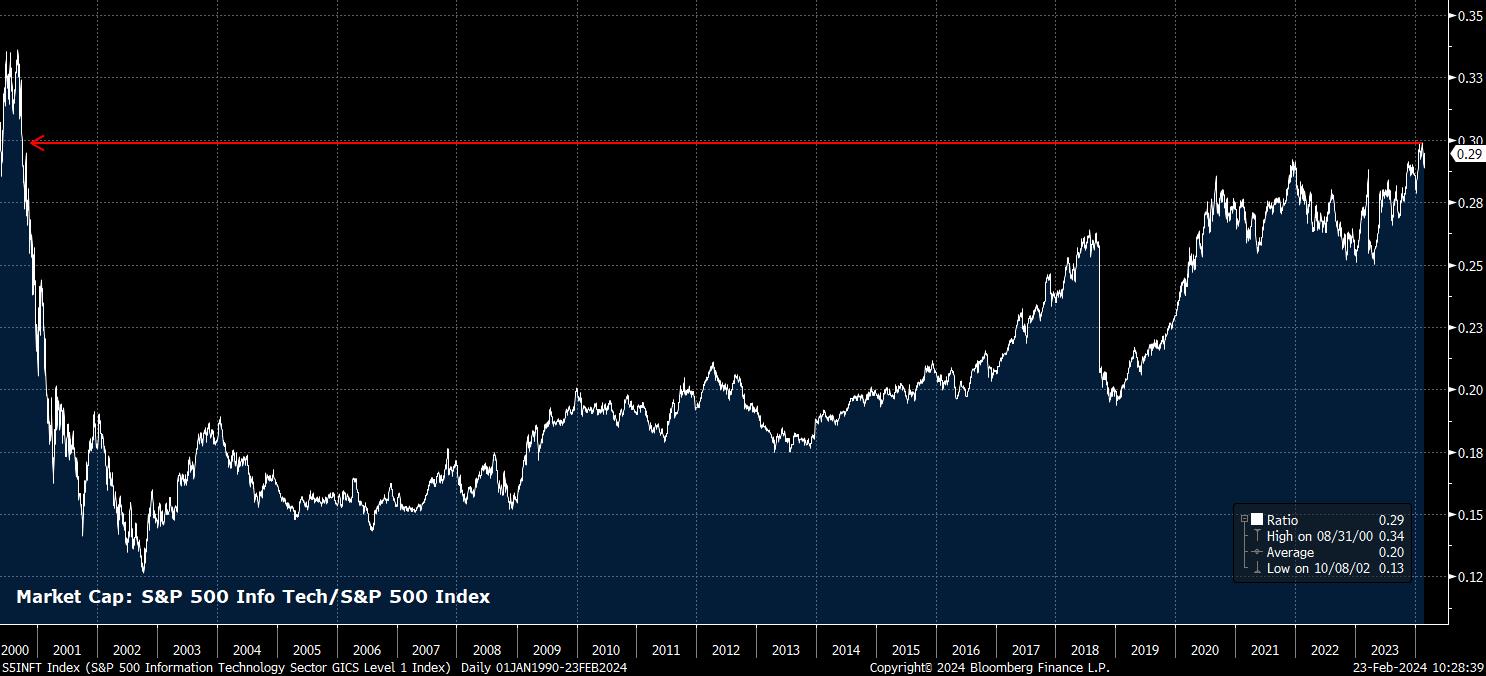

Setting Prince’s lyrical genius to one side – and don’t bother knockin’ on my door if you wish to complain about the puns – it’s worth examining why the landscape for the tech sector, particularly as the S&P 500 becomes increasingly concentrated, as shown below.

Of course, this concentration has been no bad thing for broader indices thus far, with the vast outperformance of the ‘magnificent seven’ having powered the majority of the gains seen in 2023, and continuing to underpin the market in the early part of 2024, with Nvidia and Meta remaining the standout performers of the bunch.

Naturally, as with any market that moves a long way in a short period of time, this begs the question as to whether moves have become overextended, and whether a retracement is likely. In this instance, I would argue that it is not, for numerous reasons.

Firstly, within the ‘magnificent seven’ in particular, there is actually a surprisingly diverse range of sectors and industries represented. While easy to slap the ‘tech’ label on all seven stocks and be done with it, this masks the true story – Meta are, at this point, effectively a marketing firm, with advertising revenue making up the bulk of income; Amazon, recently included in the Dow, are a retailer; Tesla, obviously, are an automaker; Alphabet, officially, operates in the Communication Services sector; leaving just Apple, Microsoft, and Nvidia as the ‘pure’ tech plays of the bunch.

This diversification is, clearly, in stark contrast to those firms – many of which are no longer with us, or are a shadow of their former selves – which dominated the market during the ‘dotcom bubble’, which were, as the name would suggest, almost entirely and squarely focused on the internet, during its infancy.

On this note, not only are the ‘magnificent seven’ more diversified than the biggest stocks during the ‘dotcom’ era, they also all play a substantially more important role in the broader economy. Clearly, the internet is no longer a new and unknown technology, and plays an integral role in day-to-day life. What the market is presently discounting is that the usage of new technologies, such as AI, which per NVDA’s earnings has reached a ‘tipping point’ towards mass adoption, will continue to grow at, or in excess of, the current pace.

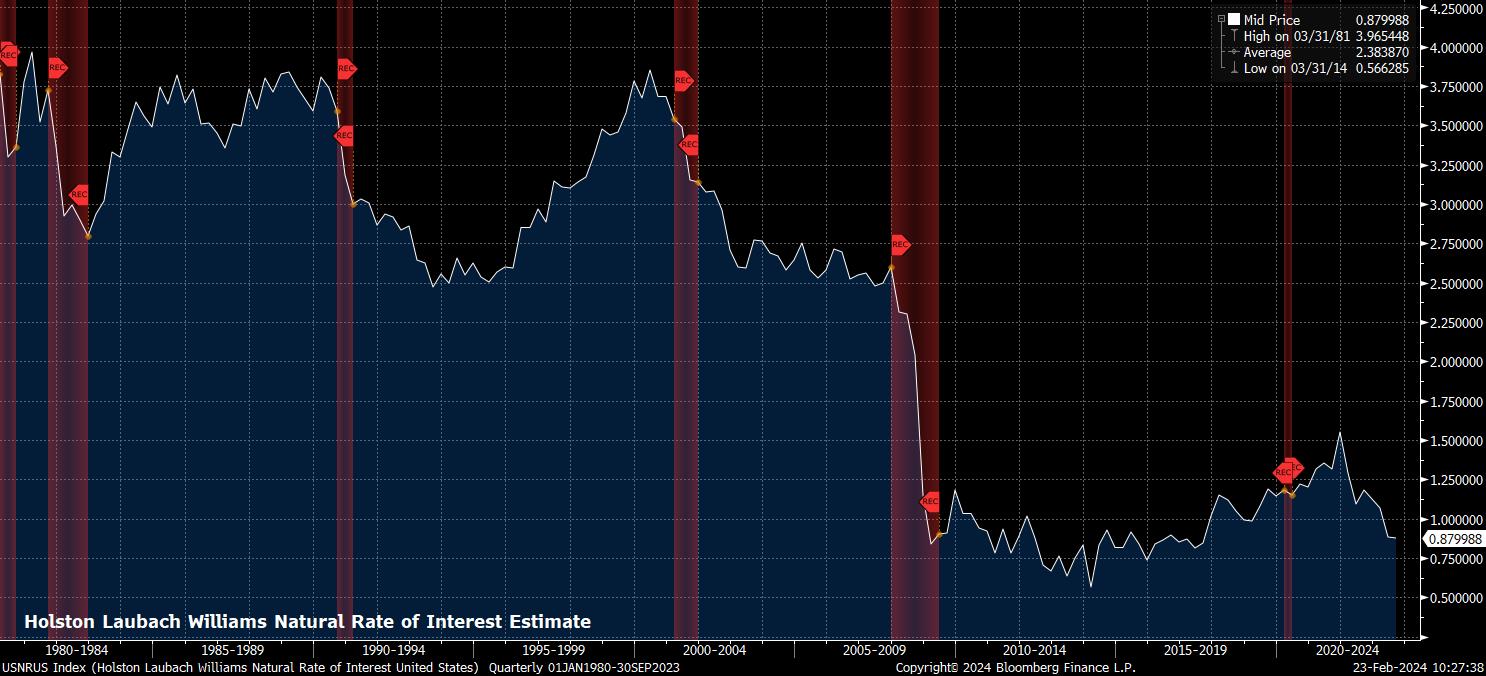

Of course, there is a macro theme here too, if that were indeed to take place. The productivity improvements that increased AI usage may bring across the global economy could, in the longer-run, have a significant impact, potentially resulting in a higher level of r* in the future, all else being equal.

As for shorter-term considerations, particularly with the tech sector having become somewhat decoupled from interest rates of late, both from a price perspective, and in terms of the firms’ ability to deliver consistent revenues regardless of the interest rate environment, the path of least resistance for the sector looks set to continue leading to the upside.

Not only will this continue to support the handful of stocks in question, it is also likely to provide a tailwind to the US market more broadly. Hence, this should see the US continue to outperform DM equity peers, particularly in Europe, where the concentration of tech names is substantially lower and, in some cases such as London, near non-existent.

_Daily_2024-02-23_10-25-59.jpg)

"لم يتم إعداد المواد المقدمة هنا وفقًا للمتطلبات القانونية المصممة لتعزيز استقلالية البحث الاستثماري، وعلى هذا النحو تعتبر بمثابة وسيلة تسويقية. في حين أنه لا يخضع لأي حظر على التعامل قبل نشر أبحاث الاستثمار، فإننا لن نسعى إلى الاستفادة من أي ميزة قبل توفيرها لعملائنا.

بيبرستون لا توضح أن المواد المقدمة هنا دقيقة أو حديثة أو كاملة ، وبالتالي لا ينبغي الاعتماد عليها على هذا النحو. لا يجب اعتبار المعلومات، سواء من طرف ثالث أم لا، على أنها توصية؛ أو عرض للشراء أو البيع؛ أو التماس عرض لشراء أو بيع أي منتج أو أداة مالية؛ أو للمشاركة في أي استراتيجية تداول معينة. لا يأخذ في الاعتبار الوضع المالي للقراء أو أهداف الاستثمار. ننصح القراء لهذا المحتوى بطلب المشورة الخاصة بهم والإستعانة بخبير مالي. بدون موافقة بيبرستون، لا يُسمح بإعادة إنتاج هذه المعلومات أو إعادة توزيعها.

تداول العقود مقابل الفروقات والعملات الأجنبية محفوف بالمخاطر. أنت لا تملك الأصول الأساسية و ليس لديك أي حقوق عليها. إنها ليست مناسبة للجميع ، وإذا كنت عميلاً محترفًا ، فقد يؤدي ذلك إلى خسارة أكبر من استثمارك الأساسي. الأداء السابق في الأسواق المالية ليس مؤشرا على الأداء المستقبلي. يرجى النظر في المخاطر التي تنطوي عليها، والحصول على مشورة مستقلة وقراءة بيان الإفصاح عن المنتج والوثائق القانونية ذات الصلة (المتاحة على موقعنا على الإنترنت www.pepperstone.com) قبل اتخاذ قرار التداول أو الاستثمار.

هذه المعلومات غير مخصصة للتوزيع / الاستخدام من قبل أي شخص في أي بلد يكون فيه هذا التوزيع / الاستخدام مخالفًا للقوانين المحلية."