- عربي

- English

1. What is ‘spread betting’?

Spread betting is a form of financial derivative, a type of trading where you try to predict the direction of an asset in the hopes of making a profit. Spread betting is available to trade on a wide range of underlying assets, including forex, commodities like gold, equities like individual stocks’ share prices and more.

Similar to CFDs, spread betting is considered financial derivatives trading where you do not own the actual asset, but are speculating on its value instead. More about what spread betting is

Spoiler alert: Spread betting: a tax paradise?

Spread bets have been around since the 1970s and are hugely popular in the countries where they can be traded. Although three are many reasons for this, arguably the biggest pro in their favour is that spread bets are completely 100% tax-free.* Many forms of trading accrue some kind of taxes, such as Capital Gains Tax or Stamp Duty in the UK, but spread betting has none of it. What’s more, you can enjoy flexible trading conditions including no commissions,* razor-sharp pricing, deep liquidity, and much more.

2. But how does spread betting work exactly?

Just like other types of trading, you’d spread bet using an online platform and broker (like us) to speculate on the direction of your chosen market. So, instead of buying that asset to later sell it in and make a potential profit, you’re instead simply predicting its future price with spread bets, without taking ownership of the underlying asset.

Unlike the name suggests, you’re not ‘betting’ here – you’re making an informed financial decision on a derivative which directly tracks a real underlying asset. If you predict this correctly, you’ll make a profit. If not, you’ll make a loss.

But how are these calculated? Markets move in points (or pips, as in the case of forex) and with spread betting, your profits and losses per point as well. So, you’re choosing an amount of money to stake on a prediction of a financial market, earning that staked amount of money as profit, which is calculated per point or pip that the market moves in your favour. If you’re incorrect in your assumption and the market goes against you, you’ll lose that amount, which is also calculated per point that the market moves.

This is another advantage of spread bets – they work quite intuitively. A spread betting trade size of £10 per point, for example, would net a £100 profit if the market moved 10 points in your favour or a £100 loss if it moved 10 points against you instead. This conveniently doesn’t take a mathematician to understand.

Spread betting at work: an example

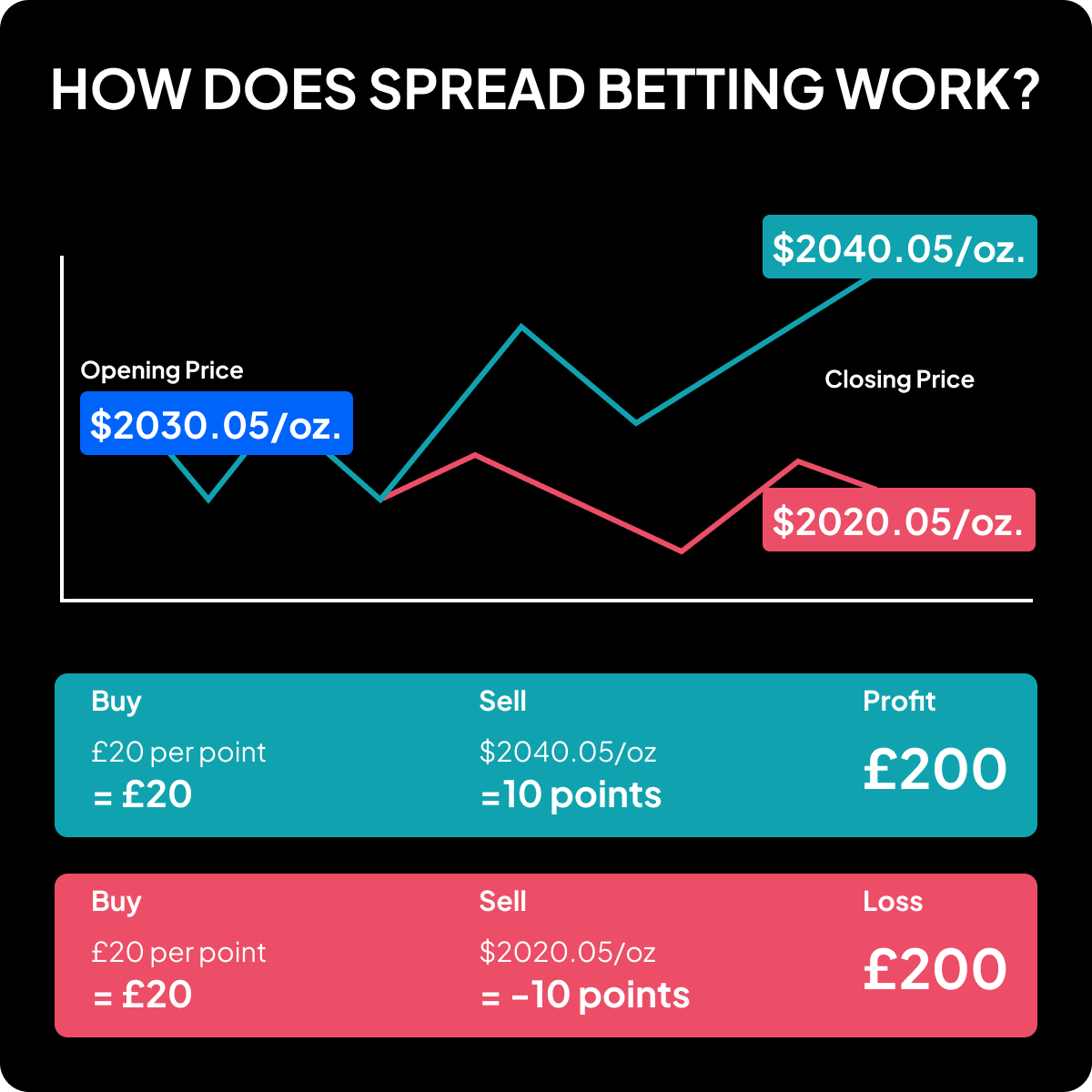

Let’s see an example of spread betting in action. Imagine that you’re a trader who follows the price of gold, and you think that the gold price will go up. So, you decide to spread bet on the gold price, going long with a trade size of £20 when the gold price is at $2030.05/oz.

The gold price does indeed go up, and it’s sitting at $2040.05/oz when you decide to close your position –10 points higher. This means that your profit is £200 – or £20 multiplied by 10 points.

Profit = £200.00 (£20 per point x 10 points)

The same would have held true if you’d been incorrect in your prediction. If the gold price had instead dropped below $2030.05/oz to $2020.05/oz when you closed your trade, you’d then have made a loss of £200.00 instead.

Loss = £200.00 (£20 per point x 10 points)

A comparison: Spread betting vs CFDs

Spread bets aren’t the only instruments you can use to trade on the financial markets. With us, you can also use CFDs, which are similar to spread bets in some ways, but a little different too.

One of the biggest differences between the two is that, while CFD trading is free of Stamp Duty, spread betting is free from all forms of taxation in the UK.*

Another significant difference is the way that each works. With spread betting, profits and losses are calculated per point or pip that the market moves in your favour. If you’re incorrect in your assumption and the market goes against you, you’ll lose that amount, which is also calculated per point that the market moves. CFDs are more complicated. The difference in your underlying asset’s price between its price when you opened your trade and when you closed it, is how profits and losses are determined. Those are then multiplied by how many contracts you’ve traded with.

A con in the column of spread betting? Out of the two, CFDs are by far one of the most widespread. Spread betting is only really available in the United Kingdom and in Ireland, while CFDs are accessible pretty much worldwide.

3. The advantages – why do traders spread bet?

Spread bets can be a powerful way to capitalise on your knowledge of financial markets, to make a profit or a loss, while often paying far less upfront than you would to invest in that same market. Here are the specific pros to trading spread betting:

- Variety of markets: With spread betting, you’re able to place long and short positions on a wide range of assets including forex, stocks, indices, commodities like gold or crude oil, cryptocurrencies and much more

- Have it both ways: You can make a profit (or a loss) whether the market goes up or down in price. That’s due to the fact that you can go long or short sell when trading spread betting, with short selling in particular allowing you to make money (or make a loss) even if your asset drops in price

- No ownership: All this is because you’re not purchasing the underlying asset itself, like an investor would, instead you’re trading on a market that derives its value from that underlying asset – which means you don’t have to take ownership of any underlying assets, you’re just speculating on its value

- Some leverage: Spread bets use leverage, which allows you to trade using a margin, rather than the full amount of a trade, which means it’ll cost you far less to open a position when Spread betting trading as it would to invest in a position of the same size

- Because of this, you can get magnified gains – but you can also get magnified losses – out of a smaller amount of money with spread betting

As you can see, CFDs and spread bets are nearly identical in their characteristics – with added tax benefits to spread betting being one of the main differences.

Understanding leverage

.png)

Leverage is the superpower of derivatives trading, and it’s a potent feature of spread betting. It means that, when you trade on leverage, you won’t pay the entire value of your trade upfront. Rather, you’ll make a kind of down payment, called margin, which is a percentage of the full trade size, to open the trade, basically ‘borrowing’ the rest from your broker.

For example, if the margin rate of your trade was 20% and you decided to open a position worth £1000, that would ordinarily mean you paying the full £1000 in order to trade. But because you’re trading on leverage, you only need to pay £200 in order to open a £1000 position.

4. The downside – why then is it risky to trade spread betting?

There are plenty of risks you face when you trade with a complicated instrument like spread betting. These include:

- A high risk of loss – which could be far higher than the amount you paid to open your trade in the first place, due to leveraged trading (but not more than is in your account, thanks to negative balance protection)

- This means that you could potentially lose a lot more money trading with spread betting than you could when investing. When you buy an asset, you can only ever lose the amount that you paid for it – but that’s not the case with spread bets. Here, losses could significantly outnumber your margin cost

- When spread betting, you’re also exposed to counterparty risks – which is the danger of someone in a financial contract defaulting on the agreement. This is one of many reasons why it’s important to use a regulated, accredited and financial healthy broker that properly screens and protects their clients

5. What trading strategies can be used with spread betting?

One of the great things about spread bets is that they are versatile trading tools that you can use with most trading strategies. Whatever your trading style and the techniques, indicators and types of market analysis you prefer to use, you’re pretty much guaranteed to be able to use spread betting for it.

If you’re still trying to determine what the best spread betting trading strategy for you is, here are some of the most popular ones with other traders.

Technical analysis spread betting trading strategies

If you use technical analysis in your trading strategy, it means that you rely on reading a market’s chart and data, as well as technical indicators available on that chart, in order to make your trading decisions. Spread betting aficionados use these for the following strategies, among others:

- A trend trading strategy – aiming to make money (but potentially making a loss instead) from correctly anticipating a trend in the market and trading it, using various tools and instruments on your market’s chart

- Scalping strategy – using extremely short-term trades, usually just minutes or seconds long, to capitalise on fluctuations and volatility on a chart within a very short timeframe

- Range trading – using a chart’s support and resistance levels to determine when to open or close a position within that ‘range’, in accordance with your trading plans

- A breakout or false breakout strategy – using indicators and other tools to try and determine when a true breakout or false breakout will occur in a market, with the aim of trading it and capitalizing on such moves

Fundamental analysis spread betting trading strategies

While technical analysis looks at the data of what is happening on the charts in isolation, fundamental analysis considers the macroeconomic by looking at the ‘why’ of the markets instead, focusing on whatever headwinds or tailwinds your underlying asset’s market faces in the grander scheme of things. Some of the strategies used here are:

- Studying the major macroeconomic elements that affect the wider market, like for example current interest rates and the level of inflation and where that theme is headed, or understanding employment data and trying to spot patterns and their relations to other factors

6. How do I begin spread betting? What are the first steps?

- Choose a reputable broker and trading platform that offers spread betting

- Create an account to get started

- Research and choose a market you’d like to spread bet on – like stocks, forex, gold, or more

- Form a spread betting strategy

- Open your first spread betting live trade

- Set up stop loss and take profit orders to maximise your risk management

- Observe your trade’s progress and close the position when you’re ready

7. What are some best practise tips to start off spread betting right?

More than 70% of traders typically lose money, rather than gain it, when they first start spread betting. Here are some of the more common mistakes to avoid when Spread betting trading, for when you first begin:

- Beginning trading too quickly, before you’ve done thorough research of your chosen market

- Likewise, starting to trade with your own money on a live account before practising in a risk-free demo environment like ours first

- Not having an adequate trading strategy in place, complete with the goals you want to achieve and the tools and timeframes you’ll use

- Not understanding exactly how spread betting works

- Not having stop loss and take profit ordersin place, as well as other forms of risk management

What the pros think: expert advice on spread betting

Spread bets, like all other derivatives, are complex trading instruments that take work and hours of study to master. To speed up your spread betting learning, look through some of our expert guides on spread betting, including how to spread bet on some of the world’s most most popular markets:

What spread bets are exactly Why use spread betting What’s margin and leverage?

Spread betting an index like the FTSE Spread betting on forex Comparing spread bets and CFDs

Frequently Asked: Answers to other common questions about spread betting

Q: What is Spread betting?

A: Spread bets are a type of trading that allow you to speculate on the direction of a wide range of different markets based on your views and expectations.

Q: Is spread betting good for beginners?

A: Just like all trading instrument, spread bets are complex and require careful study for beginners. That being said, many traders find them easier to work with than CFDs, as their performance is calculated per point that the market moves. So, once you know what you’re doing, spread betting can be good for beginners.

Q: Can I spread bet in my country?

A: Probably not, unfortunately. Spread betting is fully legal – and offered by us, by the way – in the United Kingdom and in Ireland. In most other parts of the world, you can’t spread bet. These include countries like the United States, Canada, most of Europe, Australia, China, Japan, South Africa and most of South America.

Conclusion: key spread betting takeaways

- Spread betting is a form of trading that you can use to speculate on various markets like forex, gold, share prices and more

- Spread bets are a form of leveraged trading, meaning you’ll put down an initial payment called margin, worth a fraction of your position size, to open that position

- With leverage, you can open positions several times larger than your margin amount – with both profits and losses being calculated on your whole trade size

- While this means the potential for far more profits with less initial cost as an upside, the downside is that any losses you make can far exceed your margin – and as much as 70% or more of beginner Spread betting traders lose money

Related articles

"لم يتم إعداد المواد المقدمة هنا وفقًا للمتطلبات القانونية المصممة لتعزيز استقلالية البحث الاستثماري، وعلى هذا النحو تعتبر بمثابة وسيلة تسويقية. في حين أنه لا يخضع لأي حظر على التعامل قبل نشر أبحاث الاستثمار، فإننا لن نسعى إلى الاستفادة من أي ميزة قبل توفيرها لعملائنا.

بيبرستون لا توضح أن المواد المقدمة هنا دقيقة أو حديثة أو كاملة ، وبالتالي لا ينبغي الاعتماد عليها على هذا النحو. لا يجب اعتبار المعلومات، سواء من طرف ثالث أم لا، على أنها توصية؛ أو عرض للشراء أو البيع؛ أو التماس عرض لشراء أو بيع أي منتج أو أداة مالية؛ أو للمشاركة في أي استراتيجية تداول معينة. لا يأخذ في الاعتبار الوضع المالي للقراء أو أهداف الاستثمار. ننصح القراء لهذا المحتوى بطلب المشورة الخاصة بهم والإستعانة بخبير مالي. بدون موافقة بيبرستون، لا يُسمح بإعادة إنتاج هذه المعلومات أو إعادة توزيعها.

تداول العقود مقابل الفروقات والعملات الأجنبية محفوف بالمخاطر. أنت لا تملك الأصول الأساسية و ليس لديك أي حقوق عليها. إنها ليست مناسبة للجميع ، وإذا كنت عميلاً محترفًا ، فقد يؤدي ذلك إلى خسارة أكبر من استثمارك الأساسي. الأداء السابق في الأسواق المالية ليس مؤشرا على الأداء المستقبلي. يرجى النظر في المخاطر التي تنطوي عليها، والحصول على مشورة مستقلة وقراءة بيان الإفصاح عن المنتج والوثائق القانونية ذات الصلة (المتاحة على موقعنا على الإنترنت www.pepperstone.com) قبل اتخاذ قرار التداول أو الاستثمار.

هذه المعلومات غير مخصصة للتوزيع / الاستخدام من قبل أي شخص في أي بلد يكون فيه هذا التوزيع / الاستخدام مخالفًا للقوانين المحلية."