Understanding The Business Cycle

At its core, the business cycle refers to the fluctuations, at a broad level, between economic expansion, and contraction, helping to define the overall state of the economy at a given time. Many indicators can be used in an attempt to time the economic cycle, including - GDP, interest rates, employment, and spending.

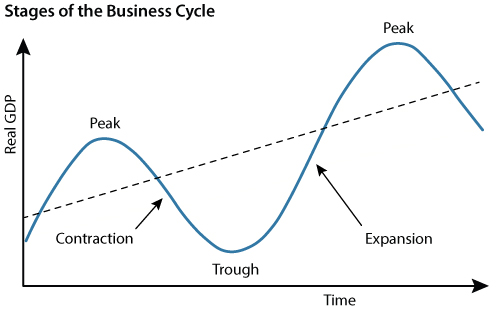

Typically, the business cycle is split into the four stages below. However, it is important to note that no two cycles are identical; the length of expansions has varied wildly over time, as has the length of recessions/depressions, while the amplitude of the peaks and troughs in the cycle also varies over time.

Cycle Stages

- Expansion: During this phase of the cycle, the economy experiences a rapid pace of growth, with interest rates tending to be relatively low, as output increases across most parts of the economy. Employment tends to increase, and earnings - as well as corporate profits - begin to trend higher. This rise in earnings, coupled with an increase in the money supply, does however pose the risk of spurring higher inflation as the economy expands.

- Peak: The cycle’s peak is seen when growth hits its terminal velocity, a point at which various indicators of prices and economic output typically experience a period of stability, before correcting to the downside. This stage of the cycle often creates imbalances between supply and demand (of goods, services, and/or labour) which must ultimately be corrected.

- Contraction: The opposite phase to an economic expansion, and one where growth slows, employment falls, and prices either stagnate or decrease. Often, businesses are slow to adjust to such a contraction, leading to a surplus in supply of goods and services as demand deteriorates, contributing to the aforementioned downward pressure on prices. A contraction is often defined as a recession, technically only if it results in two consecutive quarterly contractions in GDP growth, and may deteriorate further into a depression if it becomes prolonged.

- Trough: The cycle’s trough is when economic growth bottoms out before an eventual recovery begins to take hold. This is the worst moment of the cycle for the economy, where spending and income are at their lowest level, and the labour market has dramatically weakened, with hiring coming to a halt, and unemployment having risen substantially. Following a trough, the economy will begin to recover, and re-enter the expansion phase.

A graphical representation of this cycle can be found below, courtesy of the St Louis Fed:

Related articles

Pepperstone不代表這裡提供的材料是準確、及時或完整的,因此不應依賴於此。這些資訊,無論來自第三方與否,不應被視為建議;或者買賣的提議;或者購買或出售任何證券、金融產品或工具的招攬;或參與任何特定的交易策略。它不考慮讀者的財務狀況或投資目標。我們建議閱讀此內容的讀者尋求自己的建議。未經Pepperstone的批准,不允許複製或重新分發此信息。