Preview For The April 2024 US Jobs Report

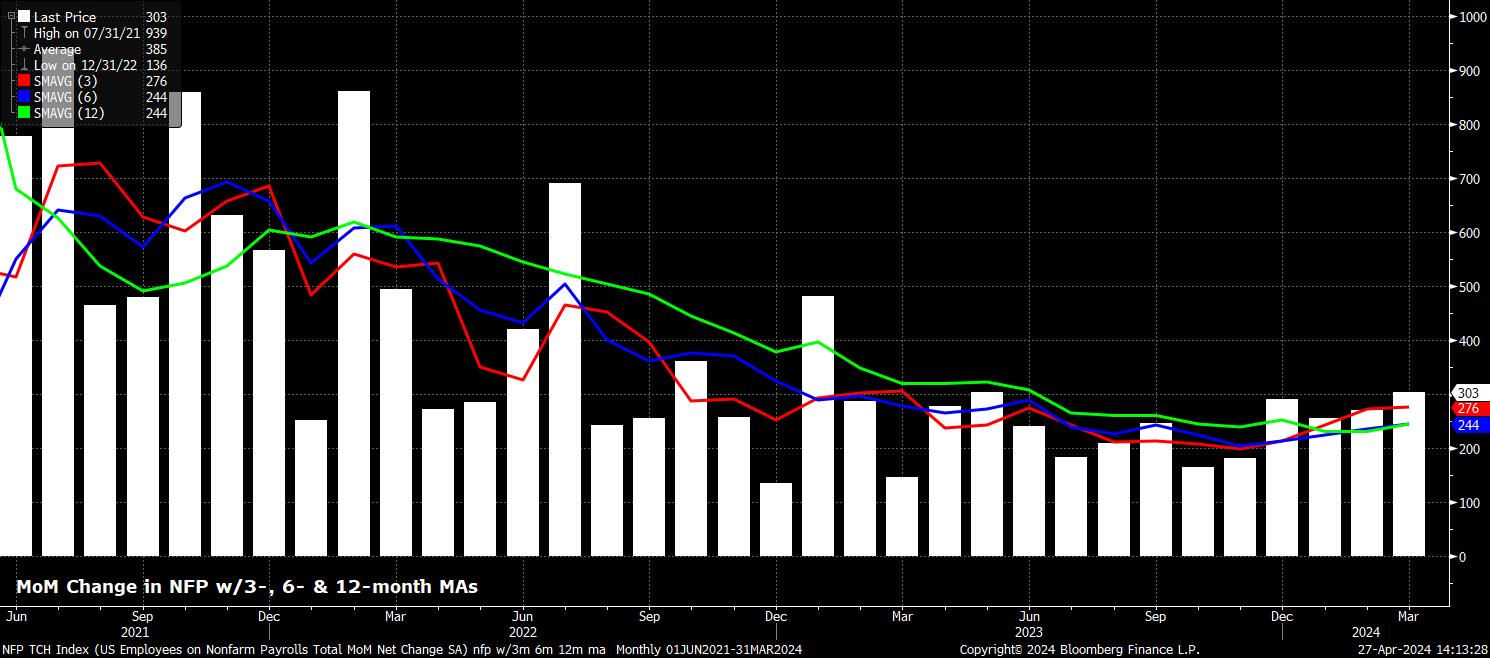

Headline nonfarm payrolls are set to have risen +250k last month, somewhat below the +303k pace seen in March, while also being modestly below the 3-month average of job gains at +276k, a figure which stands at its highest level in a year. Nevertheless, a print in line with consensus would be roughly in line with the ‘breakeven’ rate of job gains required for employment growth to maintain pace with growth in the size of the labour force while also, pending revisions, see the 3-month average remain broadly unchanged, dipping slightly to +274k. In any case, as always, the range of estimates for the payrolls print is wide, from +190k to +280k.

Given the timing of this month’s labour market report, the usual plethora of leading indicators is not fully available, with neither ISM PMI survey having been released at the time of writing, and the ADP employment figures, as well as the monthly Challenger job cuts survey, also not yet out. The usual caveat around the ADP survey, and its uselessness at predicting the headline NFP print, or rate of private sector payrolls growth, must however still apply.

Despite this, there are some gauges upon which one can lean. The April ‘flash’ S&P PMIs, which place a much greater weighting on small- and medium-sized firms than the ISM figures, pointed to an overall decline in employment for the first time since June 2020, with weakness in both the manufacturing and services sectors, in turn presenting a modest downside risk to the payrolls print.

However, the weekly jobless claims figures point to little by way of such downside risk to the NFP print, with initial claims having remained unchanged at 212k from the March to the April survey weeks, while the continuing claims figure declined by just under 30k during the same period. Furthermore, one must recall how, this cycle, survey-based indicators have tended to paint a much more pessimistic picture of the economy than has been borne out by ‘hard’ data, further reducing the aforementioned downside risks.

Meanwhile, remaining with the establishment survey, average hourly earnings should have risen by 0.3% MoM in April, broadly unchanged from the pace seen in March, albeit susceptible to rounding taking the rate to 0.4% MoM in April instead. On a YoY basis, however, relatively tough comps from 2023 should see the annual rate of earnings growth tick lower to 4.0% YoY, representing a modest pace of real earnings growth, and a continued cooling of wage pressures, that is becoming increasingly compatible with the 2% inflation target.

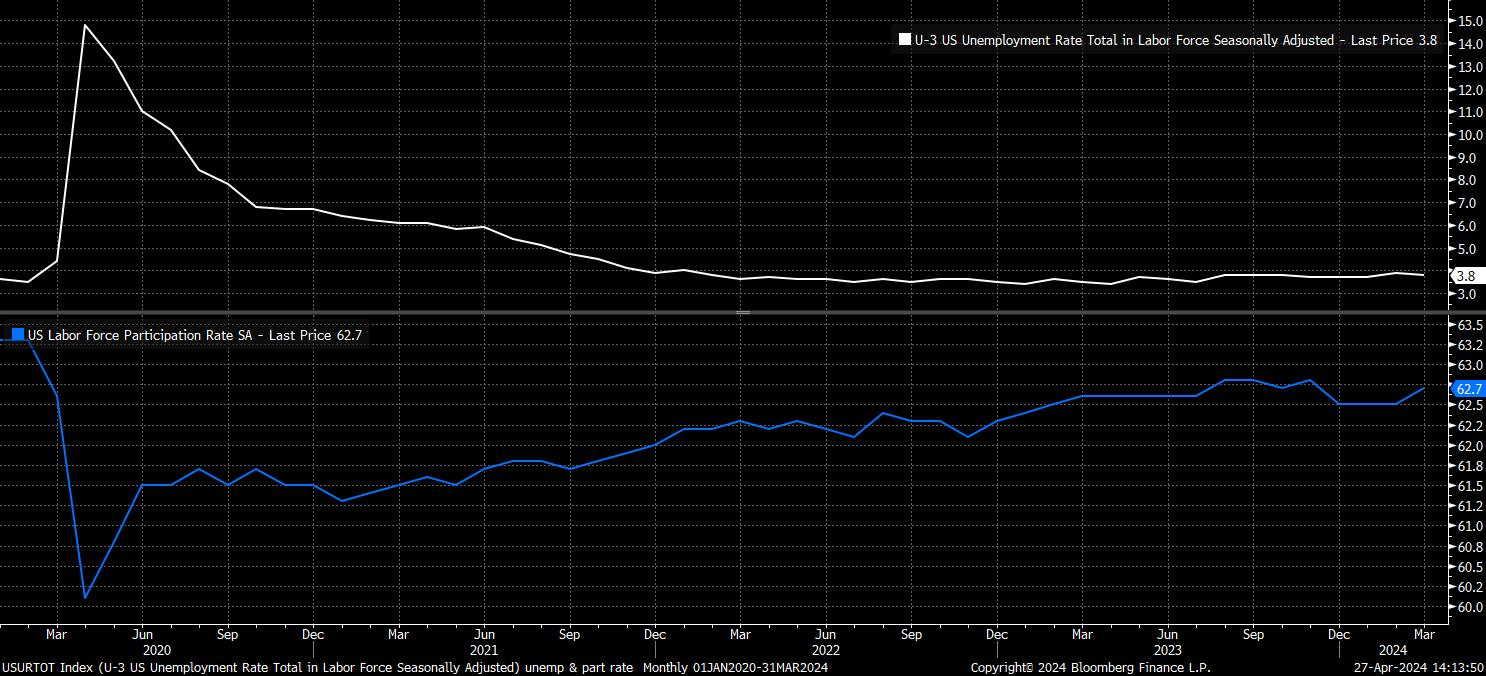

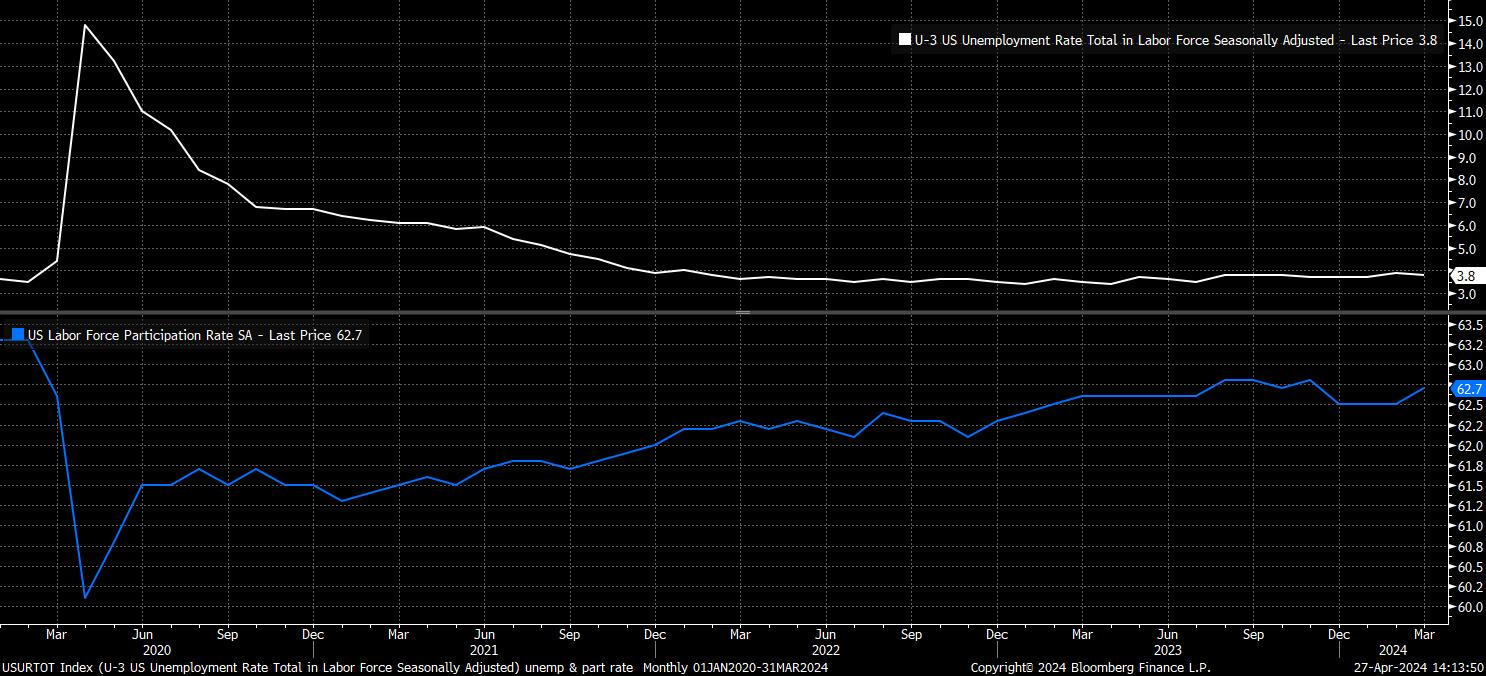

Turning to the household survey, unemployment is likely to have remained at 3.8% in April, sticking within the narrow range in place since the third quarter of last year, and still, historically speaking, representative of a labour market that is running tight, and is likely close to full employment. In a similar vein, labour force participation should remain unchanged at 62.7% in April, after an 0.2pp MoM uptick to that level in March, leaving participation just shy of the cycle highs seen in H2 23.

Immigration, however, is likely to be a particularly important factor here, presenting an unpredictable variable, and likely seeing recent volatility in the household survey continue for the time being. The significant rise in immigration to the US of late is likely not yet fully represented within the survey, potentially resulting in labour force participation continuing to move higher in coming quarters.

All in all, the April employment report should, once again, point to the US labour market remaining incredibly tight, with job gains continuing at a solid pace, unemployment low, and earnings growth cooling.

The policy implications of the report, however, are likely to be relatively limited, at least if in line with, or close to, consensus expectations. While Chair Powell may provide an updated view at the 1st May FOMC press conference, in March Powells stated that a strong jobs market “by itself” would not be a reason to hold off on policy normalisation, but that “unexpected” labour market weakening could prompt the need for greater policy support.

With this in mind, and taking into account the extent of the recent hawkish repricing, which sees the OIS curve now price just 34bp of cuts this year (compared to 73bp before the March jobs report, and the March FOMC), it seems that the balance of risks skews towards a more significant market reaction on a miss, than on a beat, when it comes to the April labour market report.

Naturally, such a dovish reaction would be expected to see equities and Treasuries both gain, and the dollar to soften. However, even in the event of stronger-than-expected data, any significant downside in equities should be relatively limited, given how a tight jobs market should continue to underpin spending, and thus earnings growth, while also considering that the ‘Fed put’ remains in place, with the next move in the fed funds rate still likely to be lower, at some point this year.

The timing of that cut, however, remains uncertain, albeit a move in Q3 seems the most plausible scenario at this moment in time.

Although risks to the FOMC’s dual mandate continue to come into better balance, it remains the case that, barring a sudden and surprising weakening of the labour market, it will be incoming inflation data that determines the timing of the start of policy normalisation. Hence, the April CPI figures, due 15th May, are likely to be significantly more consequential in the grander scheme of things, both for the policy outlook, and any sustained market moves.

Related articles

Pepperstone不保证这里提供的材料准确、最新或完整,因此不应依赖这些信息。这些信息,无论来自第三方与否,不应被视为推荐;或者买卖的要约;或者购买或出售任何证券、金融产品或工具的邀约;或者参与任何特定的交易策略。它不考虑读者的财务状况或投资目标。我们建议阅读此内容的任何读者寻求自己的建议。未经Pepperstone批准,不得转载或重新分发这些信息。