- English (UK)

Trading accounts

Our three account types have been designed to help the active trader achieve more. Whatever your trading strategy or level of experience, you’ll find an account to align with your goals.

Why trade with us?

Range of accounts

Swing trader, scalper, or something else? Choose an account to suit your priorities, backed by local support.

Tight spreads

Trade gold from just 0.1 points, and FX starting at 0.0 points on our Razor account.1

Five elite platforms

Use our native Pepperstone platform and app, or connect to MT4, MT5, TradingView or cTrader.

Trusted globally

Join over 750,000 Pepperstone traders2 around the world, processing a monthly trading volume of US$350bn.

What account types are available with Pepperstone?

We offer one spread betting account, and two CFD accounts – Standard and Razor. All of them can be accessed via our in-house platform and app, or via our seamless integrations with leading third-party technology.

While spread betting and CFDs are very similar, there are some key differences to understand.

Spread betting

This might be for you if you want:

CFDs

A CFD account might be for you if you want:

3In the UK, spread betting and CFD profits are exempt from capital gains tax. Please be aware that tax treatment depends on your individual circumstances and tax law may be subject to change.

What’s the difference between a Standard and a Razor account?

If you’re a high-frequency FX trader or scalper, our Razor account could give you more control over trading costs.

Standard account

All fees – apart from any overnight funding – are included in the spread, and there is no commission to pay. This provides a straightforward fee structure for newer traders or those seeking an easy-to-manage account

Razor account

Offers identical trading conditions to our Standard account, but with commission-based pricing on forex. Clients can enjoy raw spreads from 0.0 points,¹ alongside fixed, transparent commissions from £2.25 per lot, per side. If you need help deciding whether a Razor account is right for you, get in touch with our support desk.

3In the UK, spread betting profits are exempt from capital gains tax. Please be aware that tax treatment depends on your individual circumstances and tax law may be subject to change.

At a glance: Compare our account types

Account type | Spread betting | CFD trading (Standard) | CFD trading (Razor) |

|---|---|---|---|

What is it? | Placing a monetary stake per point of movement in a financial market. | Trading the price difference between the opening and closing of a contract. | Trading the price difference between the opening and closing of a contract. |

Is this account leveraged? | Yes, a spread betting account is leveraged. | Yes, a Standard CFD trading account is leveraged. | Yes, a Razor CFD trading account is leveraged. |

Do I pay tax on any profit I make? | No, you won’t pay capital gains tax (CGT) or stamp duty.3 | You won’t pay stamp duty, but you’ll need to pay capital gains tax (CGT). However, losses can be offset as a tax deduction for CGT.3 | You won’t pay stamp duty, but you’ll need to pay capital gains tax (CGT). However, losses can be offset as a tax deduction for CGT.3 |

Which markets can I trade? | 1350+ markets including shares, indices, forex, commodities and more. | 1350+ markets including shares, indices, forex, commodities and more. | 1350+ markets including shares, indices, forex, commodities and more. |

Suitable for hedging? | Yes | Yes | Yes |

Which platforms are available? | Pepperstone’s webtrader platform and mobile app, MT4, MT5, cTrader and TradingView. | Pepperstone’s webtrader platform and mobile app, MT4, MT5, and cTrader. | Pepperstone’s webtrader platform and mobile app, MT4, MT5, cTrader and TradingView. |

What are the risks? | Spread betting is leveraged, so you put up a percentage of the deal size to open a position. Your profit or loss will be based on the full position size, so your profits or losses will be amplified. Managing your risk is key. | CFD trading is leveraged, so you put up a percentage of the trade size to open a position. Your profit or loss will be based on the full position size, so your profits or losses will be amplified. Managing your risk is key. | CFD trading is leveraged, so you put up a percentage of the trade size to open a position. Your profit or loss will be based on the full position size, so your profits or losses will be amplified. Managing your risk is key. |

What is the minimum funding amount? | £10 | £10 | £10 |

3In the UK, spread betting profits are exempt from capital gains tax. Please be aware that tax treatment depends on your individual circumstances and tax law may be subject to change.

What are the costs?

Spread betting | CFD trading (Standard) | CFD trading (Razor) | |

|---|---|---|---|

Spreads and commission5 | You’ll pay a spread on all markets, wrapped around the market price, along with overnight fees on spot trading (no overnight fees on forwards). There’s no commission to pay. | Variable spreads on FX, indices and commodities, starting from just 0.4 points on the US500. No commission except on shares, starting at just 0.1% per side on UK share CFDs. | FX commission is from £2.25 per standard lot, per side. Spreads are raw (from 0.0 points). All other markets are charged in the same way as a Standard account. |

Overnight funding (swap rate) | Market rate (latest rates displayed on the platform) | Market rate (latest rates displayed on the platform) | Market rate (latest rates displayed on the platform) |

Admin charges/market data fees/anything else | None | None | None |

5 If you trade 0.01 lots on our Razor account, please note that commission will round up to £0.023 per 0.01 lot. MetaTrader 4 commission is calculated for both sides of the transaction upfront and then charged upon opening the trade.

You can find a full breakdown of our costs and charges here.

How many instruments can I trade on each account?

You can trade a wide range of instruments on any of our accounts:

Spread betting | CFD (Standard) | CFD (Razor) | |

|---|---|---|---|

Total number of instruments | 1432 | 1444 | 1444 |

Forex | 91 | 93 | 93 |

Indices | 26 | 26 | 26 |

Commodities | 40 | 40 | 40 |

Shares | 1162 | 1162 | 1162 |

ETFs | 95 | 95 | 95 |

Number of markets can vary. Data was sourced on 12 March 2025

Protecting your trading capital

Markets move quickly, so it’s important that you can protect your capital from adverse market movements. All our accounts provide a number of risk-management tools to help you limit any potential losses.

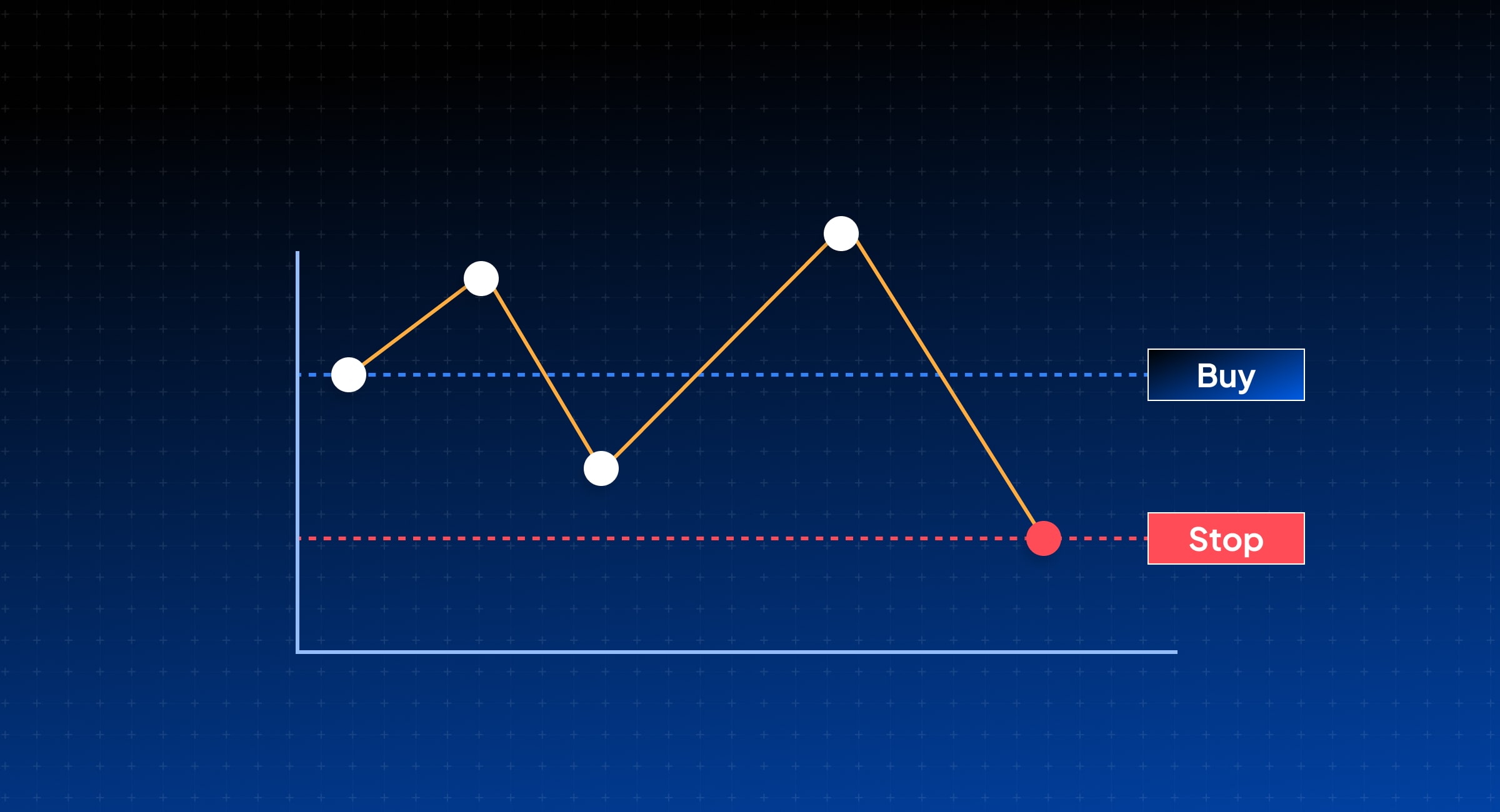

Stop-losses

Before you open a position, you can determine where you’d like your position to be closed if the market moves against you. Specify by price or pips, and view your projected loss before you place the trade6

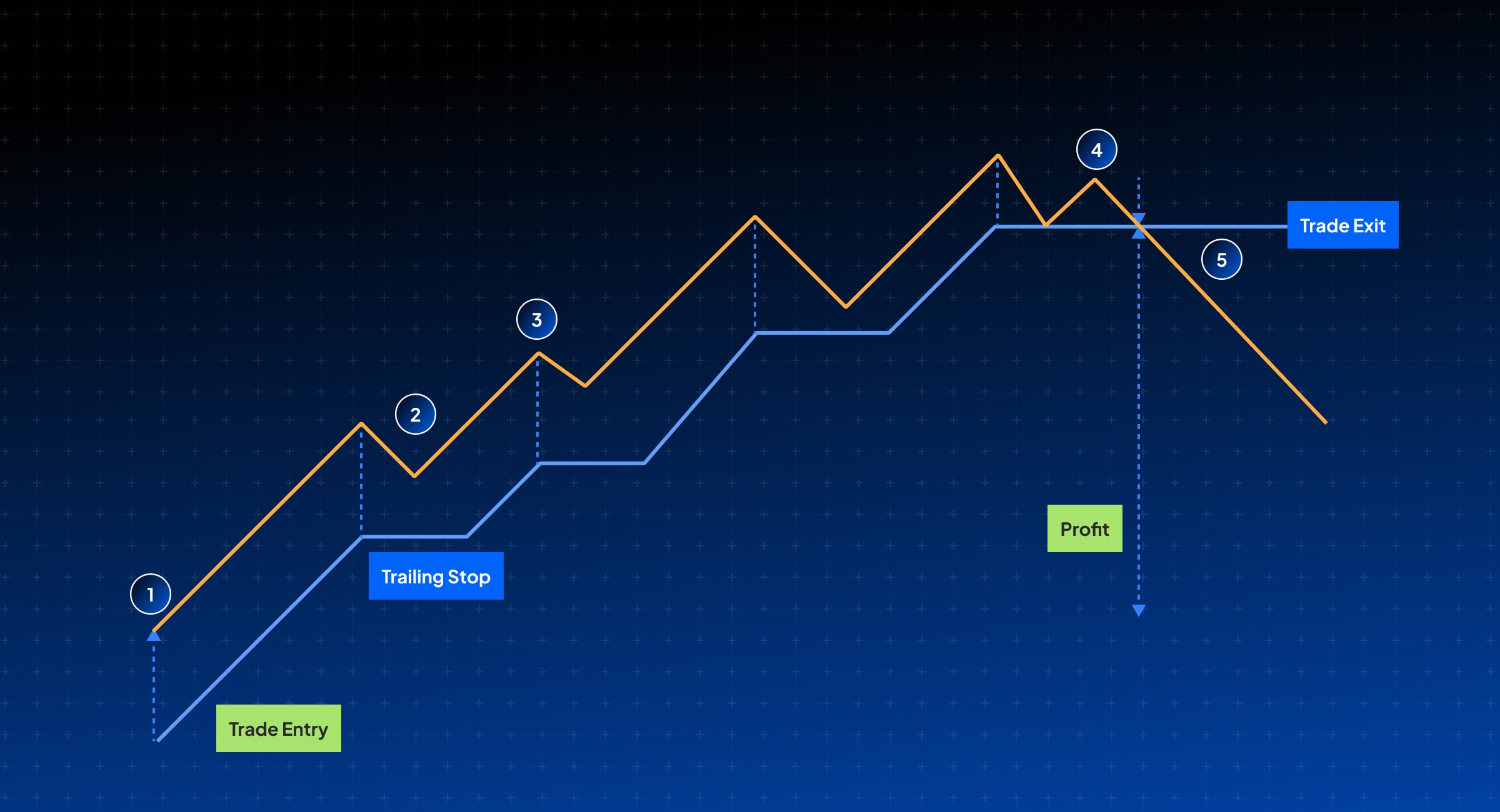

Trailing stops

These can follow positive market movements, at a set distance away from the current price. So,if the market moves in your favour and then reverses, you can lock in any gains.6

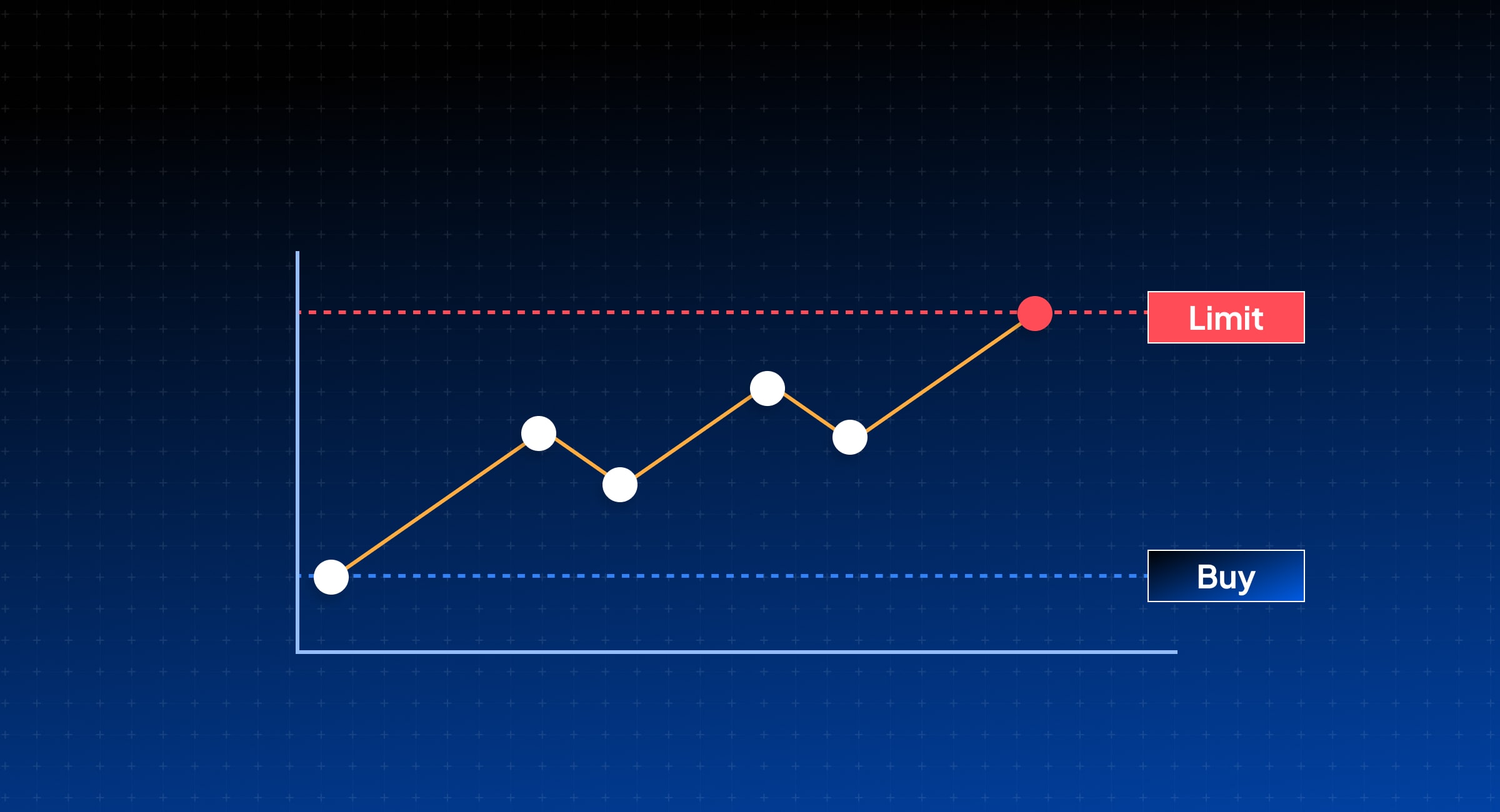

Take-profits

Choose where you’d like to close your position and realise any profit if the market moves in your favour. Protect against the risk of losing accrued gains, and free yourself from constantly monitoring the markets.6

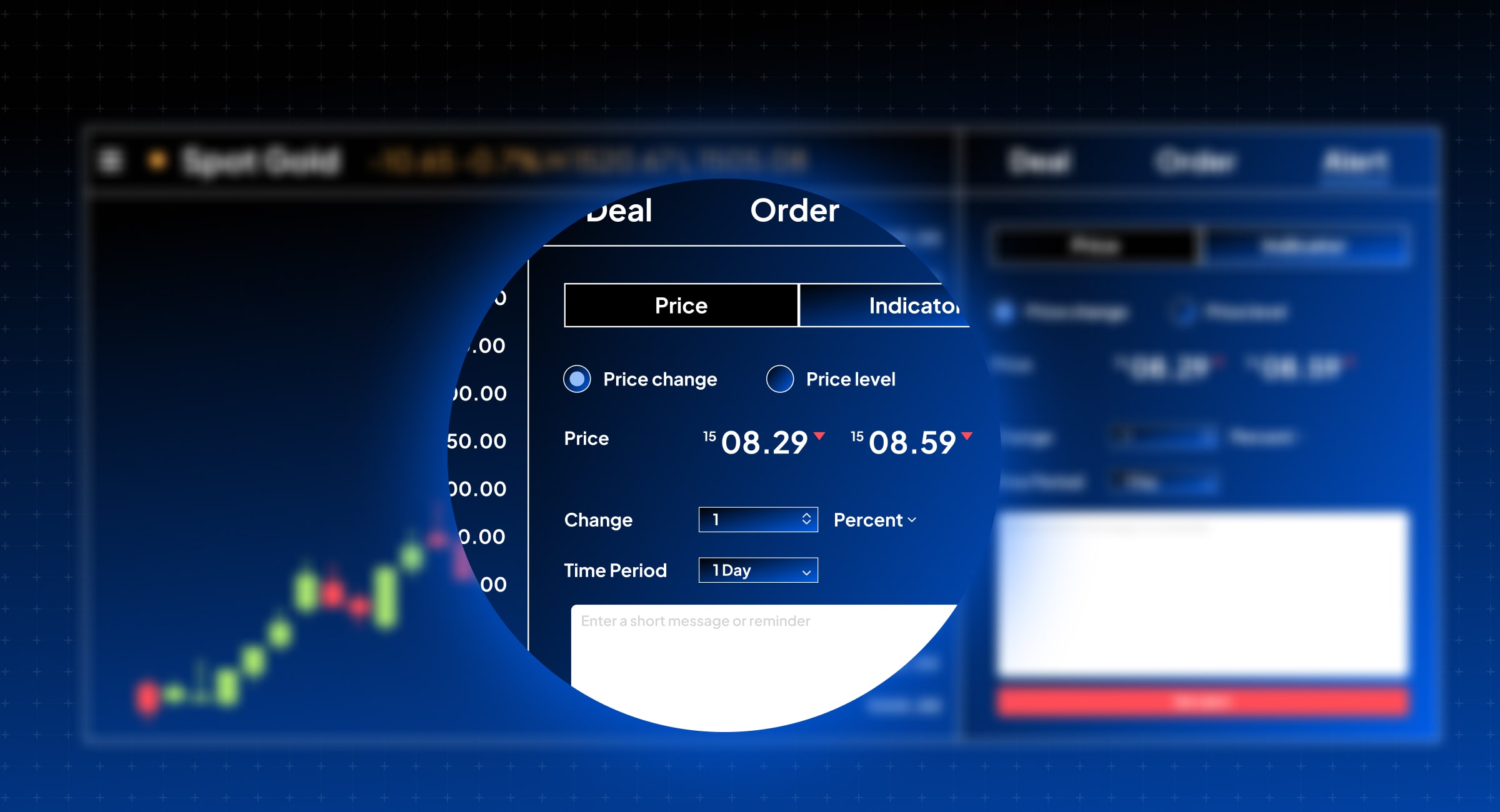

Alerts

Looking out for specific price action? Set alerts on one or more conditions and receive notification in the platform the moment they are met. You can also opt to set an expiration, and add a description for each alert.

Support when you need it

Our friendly, local client support team is here to help you 24 hours a day on weekdays and 18 hours on weekends. They’re only an email, call, WhatsApp or Live Chat message away from assisting you on your trading journey. Got a question about opening an account, funding, withdrawals or more? Find all FAQs, along with our contact details, on our support page.

Ready to trade better?

Switch to Pepperstone now and join our global community of over 750,000 traders.⁴ Apply in minutes with our online application process.

1

Register

Sign up with your email address and get a free demo.

2

Answer

We’ll check our products are appropriate for you.

3

Verify

Your safety is our top priority.

4

Fund

That’s it! You’re ready to trade.

Pepperstone trading account FAQs

We keep things transparent, so you’ll know which fees you’re liable for upfront. We don’t charge an inactivity fee, and if this ever changes we will of course provide advanced notice in line with our terms and conditions. There are no market-data fees.

With our Standard account, you will see our all-in spread for each executed trade, with the overnight funding and swap charges clearly shown in the instrument specifications.

We offer a number of in-house and third-party platforms to which you can connect your account.

These include:

- The Pepperstone platform and mobile app: our in-house platform, designed for traders who want to get to the markets fast

- TradingView: get access to the advanced charting tools and social network used by 90 million traders across the world. Not available on a Standard CFD account

- MT4: the world’s most popular FX platform, with robust charting tools and customisable interface

- MT5: the latest MetaTrader, for more features, more flexibility, and more opportunity to optimise your algorithms

- cTrader: a fast, streamlined interface for developing trading robots and custom indicators that can help automate your strategies

Find out more on our platforms page.

We offer over 2700 global markets, including FX, indices, shares, commodities and ETFs. All markets are available across all of our trading accounts.

Which market symbols can I trade on each account?

When you’re searching for a market on one of our integrated platforms such as MT4, you may see market symbols listed with certain suffixes such as:

- EURUSD_SB

- EURUSD.r

Please note the _SB suffix denotes a spread betting market, so you can only trade it on a spread betting account. The .r suffix denotes a retail CFD market, so you can trade it on a Standard or a Razor CFD account.

Overnight funding – also known as the swap rate – is the charge you pay or receive for keeping your spread bets or CFD positions open past 11.59pm server time (5pm New York time); we’ll make an interest adjustment to your account to reflect the costs we bear for holding your position through to the next trading day.

You don’t need to pay overnight funding for futures or forwards, because the cost is built into a wider spread.

Please see our costs and charges for more full details. You can find our latest swap rates on our trading platforms, although please do bear in mind that they are subject to change based on market volatility.

1 Other fees and charges may apply.

2 Data for the Pepperstone Group, correct as at Feb 2025

3 In the UK, spread betting profits are exempt from capital gains tax. Please be aware that tax treatment depends on your individual circumstances and tax law may be subject to change.

4 Voted ‘best CFD and Spread Betting provider for overall customer satisfaction’ at the Investment Trends 2024 UK Leverage Trading Report.

5 If you trade 0.01 lots on our Razor account, please note that commission will round up to £0.023 per 0.01 lot. MetaTrader 4 commission is calculated for both sides of the transaction upfront and then charged upon opening the trade.

6 If the market moves quickly or gaps, you may be stopped out at a worse level than the one you requested. This is known as slippage.