- English

- Italiano

- Español

- Français

Learn to trade

Let us dig deeper into the CXO

Core Lithium Limited, short code CXO, is an exploration company developing lithium and diversified metals. The company was founded in 2010. CXO is focused on the development of the Finnis Lithium Project, located near the Darwin Port in the Northern Territory of Australia.

The company looks to provide the globe with high-grade and high-quality lithium, suitable for lithium batteries for electric vehicles and renewable energy storage.

On the 10th of October 2022, Core Lithium announced the official opening of the Finniss Lithium Mine. This puts the mine on track to export the first Direct Shipping Ore (DRO) by year end.

This comes on the back of a legally binding contract with Tesla to supply 110kt of Lithium spodumene concentrate over the next 4-years (ASX announcement on the 30th of September 2021).

A brief history

The company released a Definitive Feasibility Study and Scoping Study on the project in 2021. This report highlighted the project's capability of producing an average 173,000t per annum of high-quality lithium concentrate.

The company CFO Simon Lacopetta announced on Twitter on the 28th of September 2022 "Core Lithium was an early stage lithium developer with a fifty-million-dollar market valuation. Today, we're on the cusp of transitioning from construction to lithium production, with a market valuation of two billion dollars".

The rise of CXO shares

The chart says it all. CXO ASX has seen an astronomical rise (+3500%) from the 2020 base of 0.045 to a peak of 1.0685 in September 2022.

Figure 1 TradingView the rise of CXO

A look from a technical perspective

Where to now for CXO? From a technical analysis perspective, the outlook may not look so positive. Is this a case of ‘buy the rumour, sell the fact?’

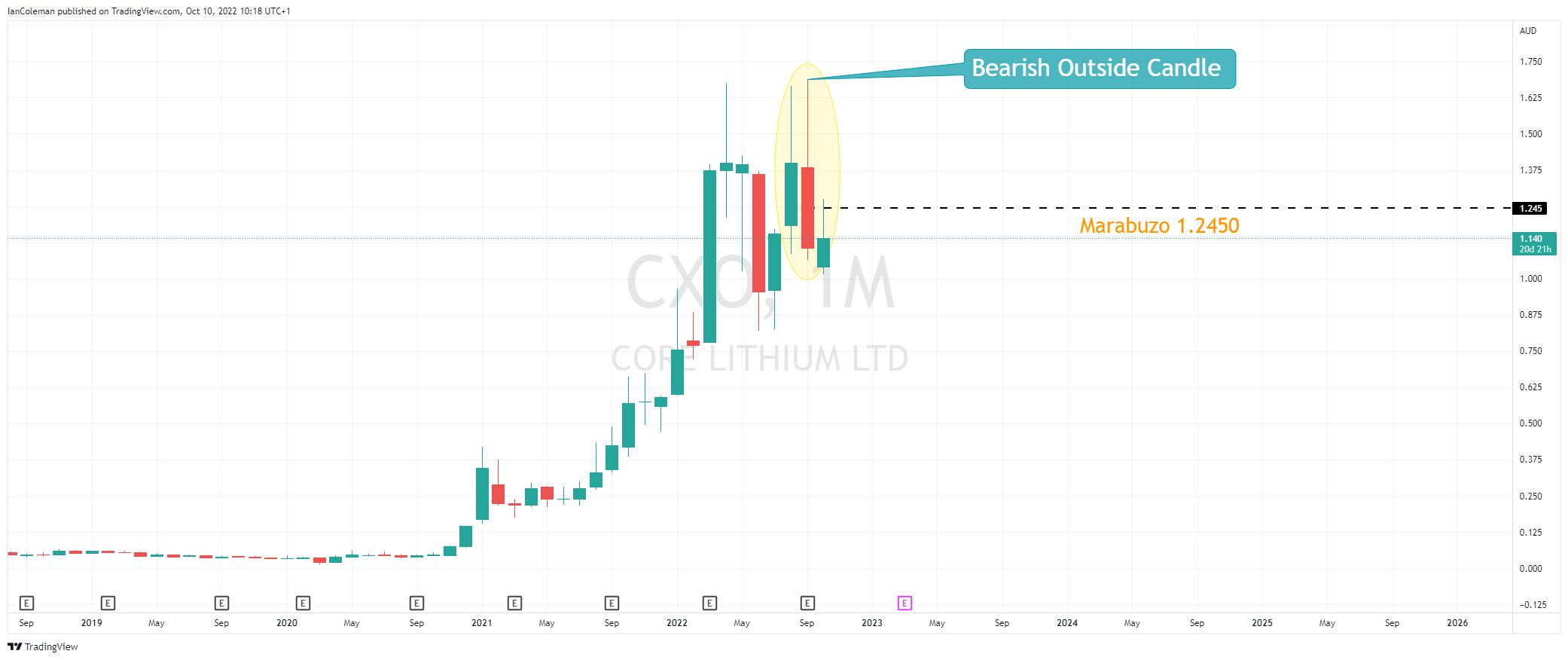

CXO Monthly Chart

The strong rejection of the all-time high 1.0685 has resulted in a bearish Outside Candle being posted. This candle is often seen at the top of a trend and can highlight the start of a correction to the downside.

The strong September selloff resulted in a *Marabuzo resistance level posted at 1.2450. This month has seen a rejection of gains above that barrier.

*Marabuzo level is the midpoint from the open and close of a strongly bearish candle.

Figure 2 TradingView CXO bearish outside candle

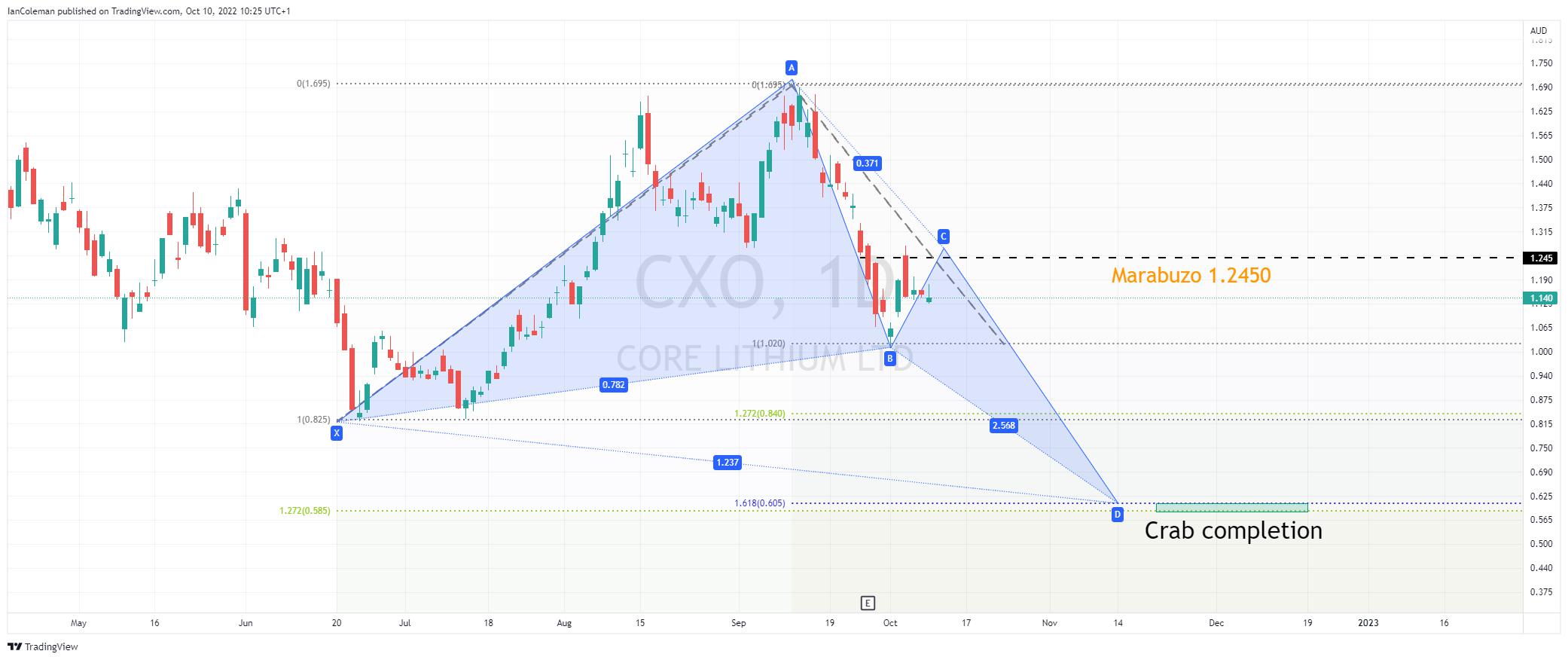

CXO Daily Chart

The daily chart suggests scope for a further correction to the downside offering support from a cypher pattern known as a bullish Butterfly formation. This pattern would complete between 0.605 and 0.585.

Figure 2 TradingView CXO Crab technical support

To learn more about technical analysis, click here.

Lorem ipsum typo

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.