- English

- Italiano

- Español

- Français

What is the NDQ ETF?

What does the NDQ ETF invest in?

An ETF is an Exchange Traded Fund. They look to track the performance of a basket of assets, commodities or, in this case, an index. The NDQ ETF tracks the performance of the Nasdaq 100 (US100).

Aimed at global investors looking to invest in the tech heavy US shares market. These include the FAANGs. Facebook, now listed as Meta Platforms (META), Apple, Amazon, Netflix and Alphabet (formerly known as Google).

Investing in an ETF is very similar to buying or selling shares. You can invest using Limit and Stop Orders. There is also no minimum investment .

Does the NDQ ETF pay dividends

An exchange traded fund buys shares in various companies on behalf of its investors. When the invested companies pay dividends, those monies are paid out to the ETF investors. In the case of the NDQ ETF, this is on a 6-monthly basis. Once in January and then again in July.

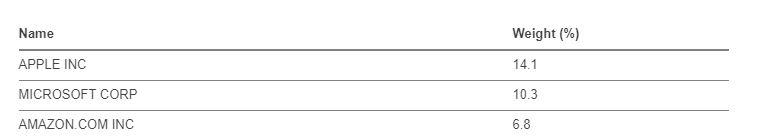

Weighted Investments

The ETF is heavily weighted in Apple Inc, Microsoft Corp and Amazon.com Inc, making up over 30% of the fund.

Figure 1 betashares.com 27/09/2022

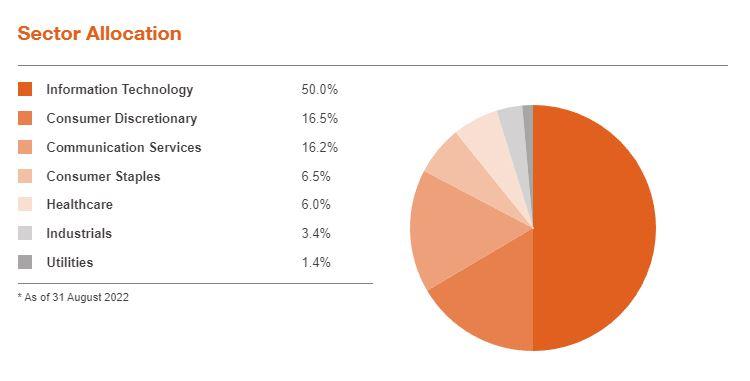

Invested Sectors

The NDQ ETF is information technology heavy, weighing in at 50%.

Figure 2 betashares.com

Is the NDQ ETF a good investment?

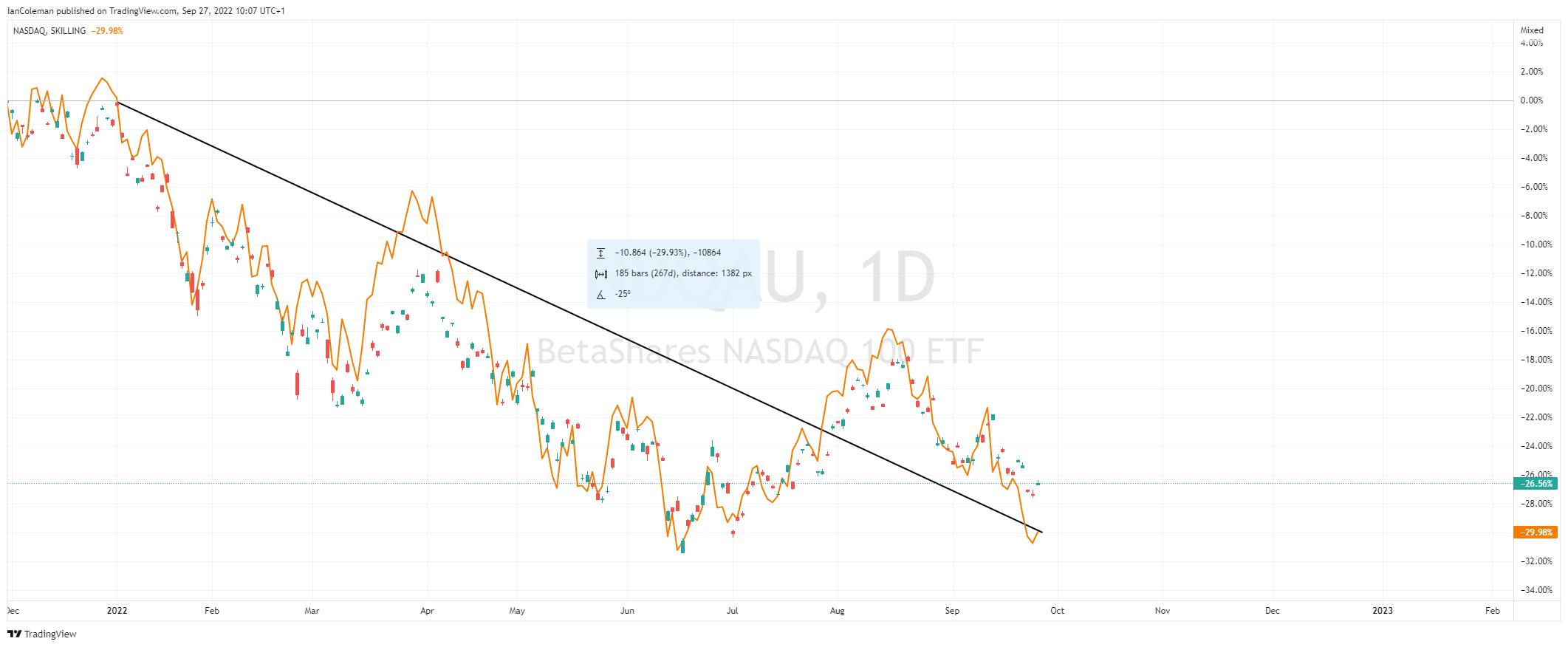

The US technology sector has been under pressure for the majority of 2022 with a net decline of over -29%. The move has been recently accelerated by high global inflation and a more aggressive Fed Reserve interest rate policy.

Figure 3 TradingView

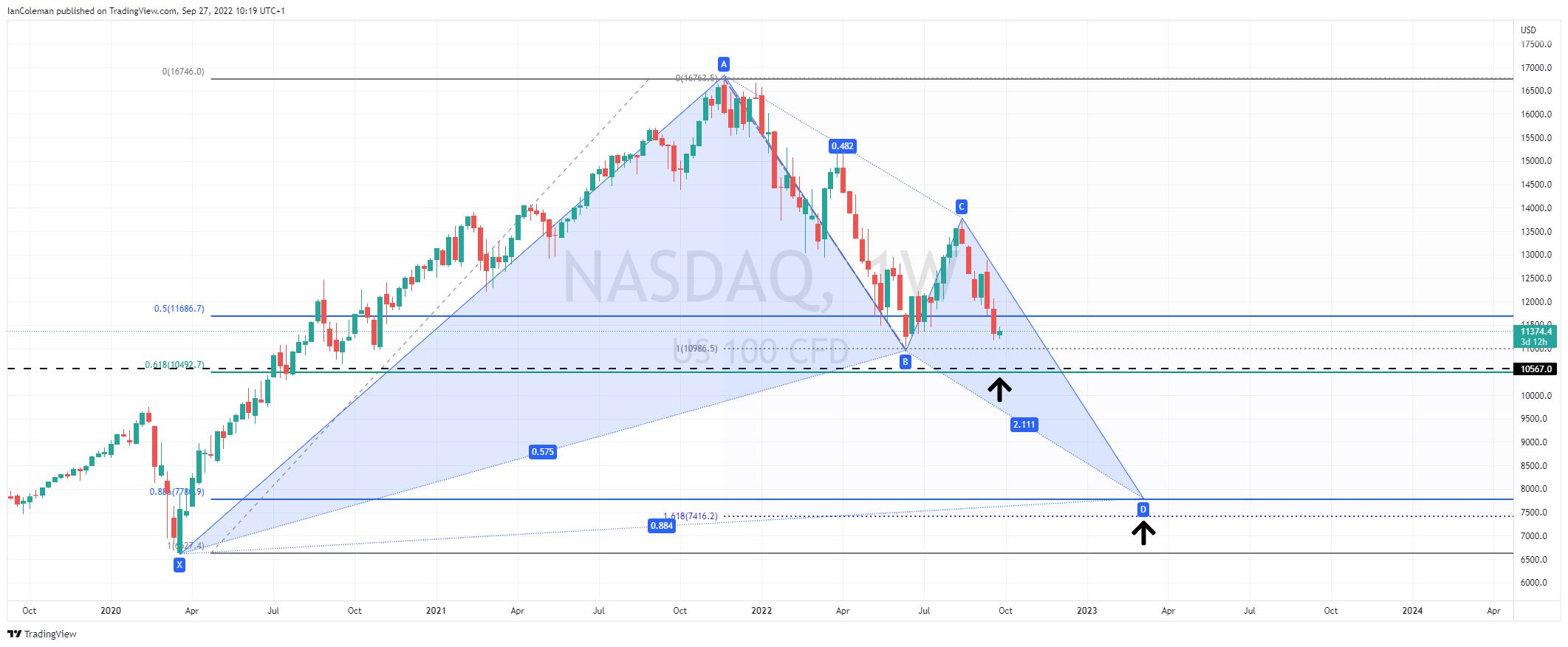

Where to now for the Nasdaq100?

The next significant downside barrier for the Nasdaq100 is at 10567. From a technical analysis perspective, a solid break there could see the index dropping further towards 7782.

- 10567 is -7% from the price of 11372

- 7782 is -31.4% from the price of 11372

The equivalent levels in the NDQ ETF are:

- 10567 Nasdaq is approximately 24.82 NDQ ETF

- 7782 Nasdaq is approximately 18.30 NDQ ETF

To learn more about investing in ETFs through Pepperstone, click here.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.