- English

- Italiano

- Español

- Français

Analysis

Robinhood IPO: Trade it with Pepperstone

With equities at all time highs, volatility subdued, and since yields in the corporate bold market are so low, it’s no surprise that Robinhood and others are taking full advantage of favourable capital raising conditions in markets. In fact, as it stands, 2021 is shaping up to be the biggest year on record for capital raisins via listing.

Just as Robinhood isn’t missing this opportunity, neither should traders.

Pepperstone will be offering Share CFDs on Robinhood the day it lists. Whether you think it's been underpriced and see good upside potential or you just can’t see it exciting the market, you can trade it long or short with Pepperstone, commission free, and with leverage.

Who is Robinhood?

The Robinhood of today, unlike in the medieval folktale, is synonymous with a few things:

- Pioneering the $0 brokerage fee structure and fractional shares

- Fostering a new culture of personal finance awareness among young people

- Bringing share, crypto and options trading to the masses

- Gamifying share trading through its sleek interface and mobile focus

- Being the primary conduit for short squeeze’s on meme stocks

In keeping with their vision to “democratize finance for all,” Robinhood is going as far as to reserve up to 35% of class A shares for individual investors. Not only will retail traders have a sizable stake in the company post-IPO (retail generally gets 10% or less, and even then you still need to be both connected & ultra wealthy), but they’ll be able to buy Robinhood shares through their new IPO access platform.

The Meme Revolution

If you’ve come across Robinhood before it’s likely due to their highly-publicised role in the recent phenomenon of so-called “meme stocks” - listed companies like Gamestop and AMC with substantial short interest who attract the attention of a massive group of retail investors that are out to get one over the investment banks.

Through their combined bidding power, they apply a short squeeze on these companies by buying up and holding shares, which leads the investment banks to take a loss on their short positions. The process of buying back shares in order to close out their short positions further catapults the price of the share, and within a matter of days, sometimes hours, the stock hits all time highs and is trading at a valuation that has very little correlation with its underlying fundamentals. Robinhood is where retail traders have made this happen.

Company Performance

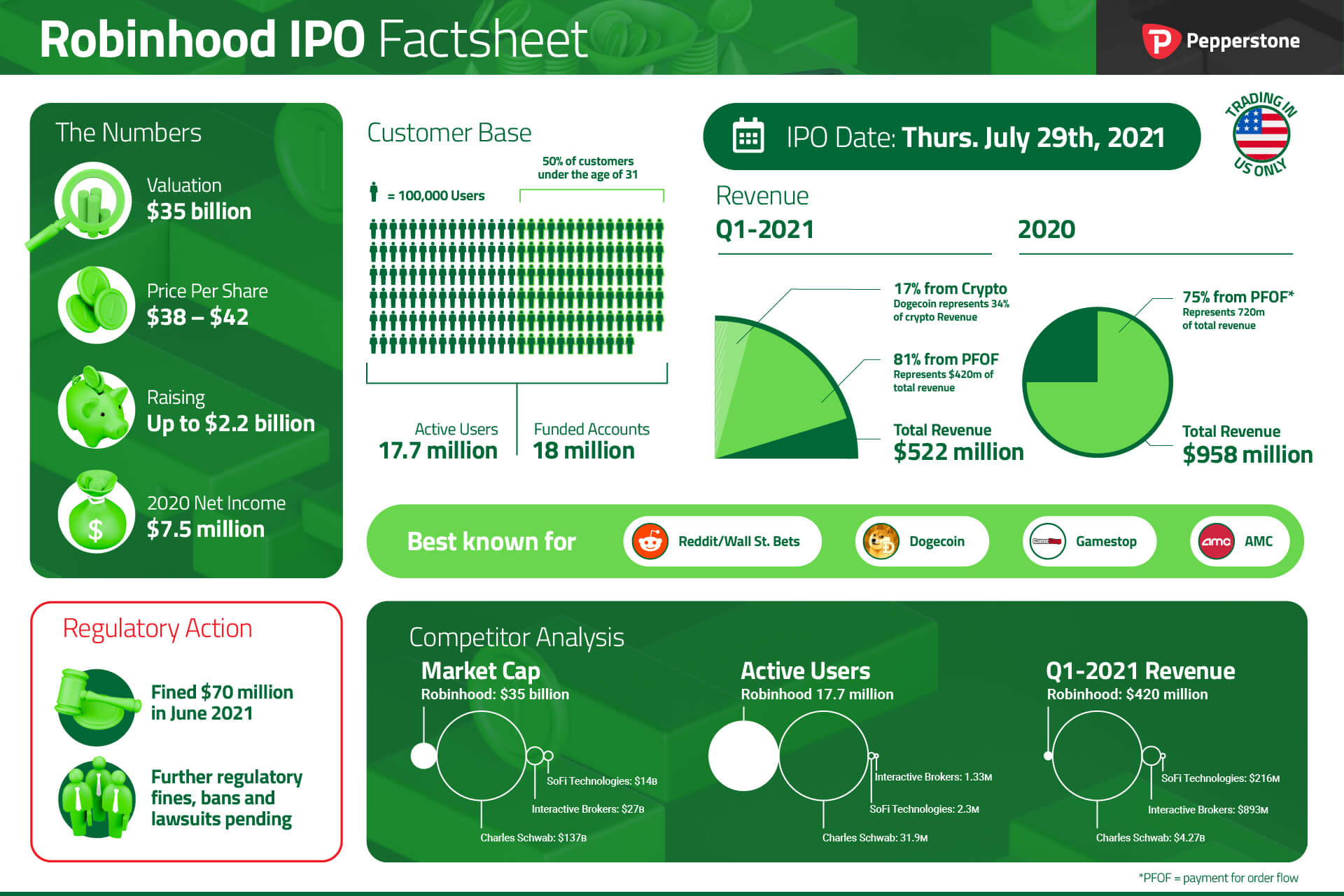

While they haven’t turned much of a profit in the relatively short time they’ve been around, their numbers are impressive. They have 18 million funded accounts, 17.7 million active accounts, and assets of $80 billion in custody ($11.6 of that in crypto). They’re massive.

But they’ve also drawn intense criticism, especially recently, for:

- Unfair and dodgy practices through its payment for order flow (PFOF) revenue model

- Restricting retail traders from trading in order to protect its LPs

- A lack of platform stability and transparency (especially in regards to margin trading)

- Lawsuits. A lot of them.

It’s not all rosy.

In 2020, 31% of Robinhood’s transaction-based revenues were PFOFs from one hedge fund alone, Citadel. Q1 saw it receive 27% of its revenue from Citadel, too. It's a relationship that has garnered considerable media attention given the potential implications for retail traders; they may be getting poor quality trade executions at the expense of greater revenue for Robinhood. Despite this, the average retail trader’s lack of knowledge in this regard has seen Robinhood continue to post record numbers.

Robinhood’s reliance on the PFOF model could see it’s bubble burst, and may even lead to its demise altogether. In fact, it explicitly references the risks it faces amid enhanced regulatory scrutiny in the coming months in it’s SEC filing;

“Because a majority of our revenue is transaction-based (including payment for order flow, or “PFOF”)” .... “any bans on, PFOF and similar practices may result in reduced profitability, increased compliance costs and expanded potential for negative publicity.”

“We could face a heightened risk of potential regulatory violations and could be required to make significant changes to our business model and practices, which changes may not be successful.”

To add to this, it just paid a $70 million fine to FINRA, the Wall Street regulator, for some of the issues mentioned above.

So the question begs; will the Robinhood model remain viable given the high regulatory risks it faces, or, ironically, will they become the next big meme stock?

Whichever direction you think it's heading in, take advantage of the post-IPO price action and trade it long or short with Pepperstone.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.