The tides are a changing - make or break for US equity markets

This week’s ‘The Trade Off’ is a must-watch. Blake and I review the picture on rates, the USD, and whether the balance of risk has shifted towards drawdown in risk assets – take a look.

After a 18.6% run since 17 June, the US500, NAS100, US2000 and US30 have all started to look a touch more vulnerable – the tone on social media is certainly more bearish - client flow has turned progressively more net short, with 60% of open positions now held short on the US500 – we can look at various oscillators like stochastic momentum and the 9-day RSI and see bearish signals – we see the 3-day ROC below zero, and I watch for the 3-day EMA to cross below the 8-day EMA.

Looking specifically at the US500 (we can draw similar conclusions on other key US indices) we can see the exhaustion in the buying flow – this comes at a time when we’ve seen the index run into a confluence of resistance levels, with supply coming in at the 200-day MA and early May highs – this comes ahead of the Jan downtrend and 61.8% fibo of the bear market drawdown.

The reasons why we got here are interesting in themselves, and while we can talk about a softer headline US CPI/PPI print and a somewhat more data-dependent Fed – for me, much of the move has to be credited with re-positioning from the suite of big money players – most who have moved away from a very bearish exposure, to currently sitting at a far more neutral stance. Notably, we’ve seen:

- Pension funds moving from a sizeable ‘underweight’ position in US and global equities to a more neutral stance.

- Options dealers had held sizeable short gamma exposure, which essentially meant when the S&P500 futures (as well as the NAS100, Russell 2k) fell then they would hedge their exposure by selling S&P500 futures – subsequently, as the index turned and rallied, they covered these shorts, pushing the index higher. Dealers are now long gamma, which means they short S&P500 futures on rallies and buy on weakness – this has the effect of lowering volatility and is part of the reason we see the VIX index at 20%.

- CTAs (Commodity Trading Advisors) – systematic trend following funds held a large short position in S&P500 futures – the market was trending lower, and their rules dictated they needed to be short. That positioning has reversed, and these big funds have covered moved to a small long position.

- Volatility-targeting funds have been buyers of equities – as 20-day and 30-day S&P500 index realised volatility has dropped, these players have been buyers of equities – their exposure to market risk is determined by volatility.

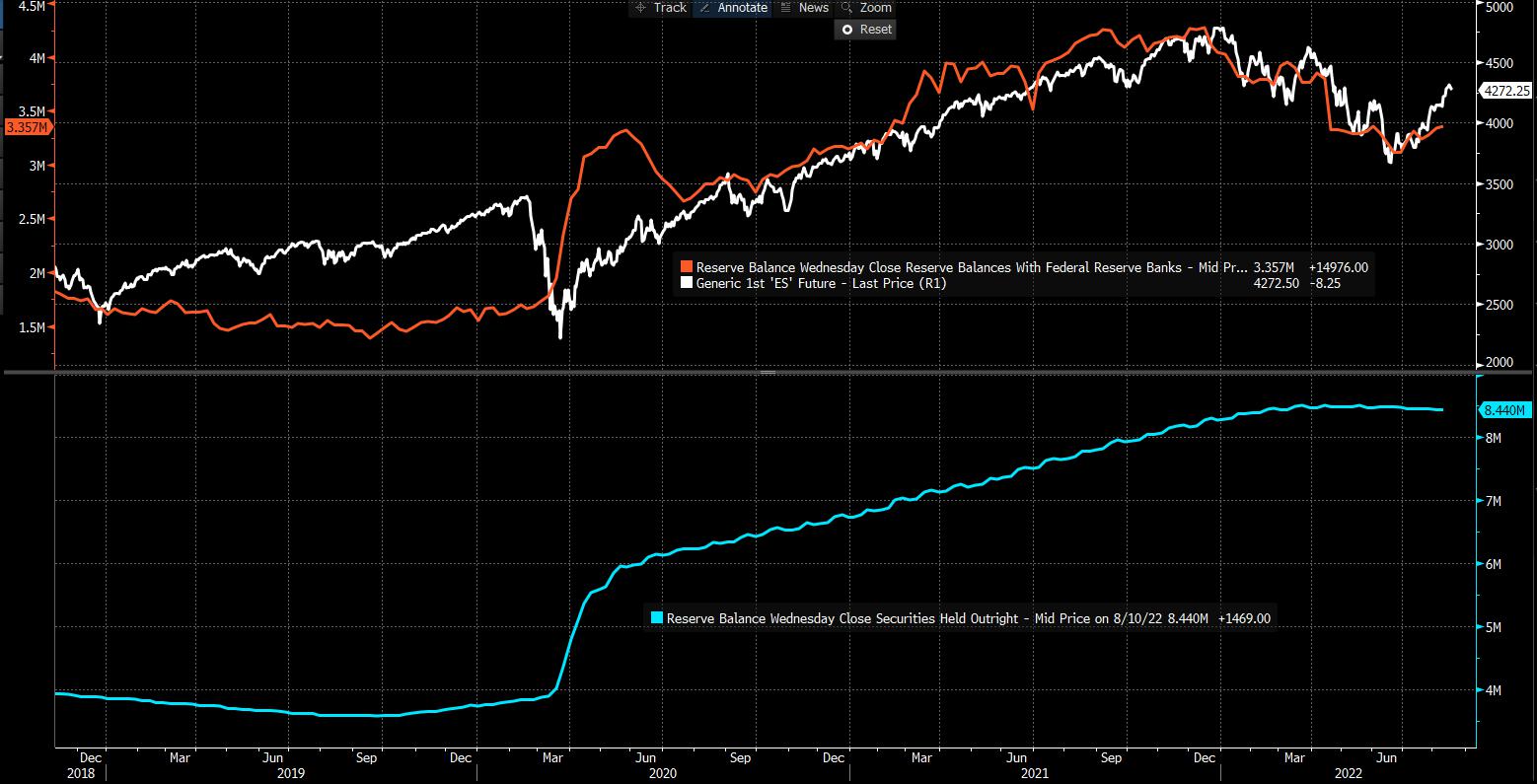

Top pane - excess reserves held with the Fed vs S&P500 futures

Lower pane - Fed's assets (US Treasuries/Mortgages)

It's not just the bearish positron re-adjustment – we’ve seen commercial bank's excess reserves they hold with the Fed – a liability for the Fed – increase by more than they sell down the securities held (an asset) under 'Quantitative Tightening (QT)' – the market sees this as 'Quantitative Easing (QE), and better liquidity equals risk-taking, which is part of the reason we’ve seen Bed Bath and Beyond, and memes more broadly, flying.

The question now we’ve moved to a far more neutral state, with increased supply coming in at multi-key resistance, the bears wrestling back some control (as seen in the evening star candle formations) – is has the balance of risk skewed itself sufficient to warrant a higher conviction on short positions? Clients are warming to this view – the USD, bond yields and volatility holds the key.

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e pertanto non dovrebbe essere considerato tale. Le informazioni, sia da terze parti o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto finanziario o strumento, o per partecipare a una particolare strategia di trading. Non tiene conto della situazione finanziaria o degli obiettivi di investimento dei lettori. Consigliamo a tutti i lettori di questo contenuto di cercare il proprio parere. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.