- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

One of the big issues is the lack of impetus from the government to go hard on the support levers. That needs to change, or Chinese equity markets will find sellers into strength and ultimately trend weaker. A bazooka-type stimulus is certainly not on the cards, but a coherent, coordinated, and structured stimulus is possible and progressively demanded by the market.

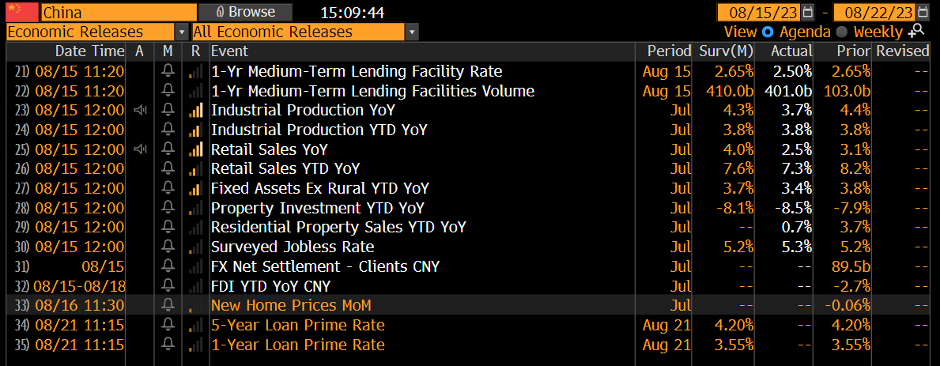

Today’s July high-frequency economic data showcases why the market lacks any conviction to buy anything China-related. Industrial production slowed to a 3.7% annualised run rate (from 4.3%) and missed consensus expectations by 60bp. Retail sales grew a meagre 2.5% (vs 4% eyed) and this seems the data point to view going forward, given we heard today from Cai Fang (a policy maker at the PBoC), detailing that the top priority now is to stimulate household consumption.

The incentive for a reversal in demand needs to happen; the sooner the better.

July property and residential sales were woeful (vs expectations) and again feeds into the need to do more on the property front.

The silver lining?

Media reports are doing the rounds that Country Garden is liaising with bondholders to extend repayments on a bond maturing 2 Sept by 36 months. We’ll see if can result in a lift in Country Garden’s offshore bonds, many of which are trading at 7 or 8 cents in the USD. The equity market will watch credit markets, as this pricing suggest a default is a done deal.

The PBoC are not waiting

We may be waiting for the fiscal measures to impact but the PBoC is not hesitating on the monetary policy side – on the day, we’ve seen a 15bp cut to the 1yr MLF (Medium Lending Facility) to 2.5%, as well as a 10bp cut to the 7-day repo rate to 1.8% - neither were expected today. Granted, the consensus view was that we’d see policy easing through Q3, but the PBoC has taken the decision to not hang about.

USDCNH has rallied to 7.3120 and despite the PBoC’s best efforts to limit the upside with a CNY ‘fixing’ 671p stronger than market estimates, few in the market are selling USDCNH. The market are desensitised to the daily CNY fixing (each day at 11:15 AEST) and have come to the view that if the PBoC really meant business in its quest to drive the yuan higher they could run down part of its $3.2t. I am happy to stay long this cross.

We’re also seeing solid outflows from China in HK through the Northbound ‘connect’ and this has been a consistent theme for the past six trading sessions – it's little wonder USDCNH is rallying as capital moves offshore.

Chinese equity isn’t buying into the monetary policy easing and we see a heavy tape. Fiscal is the main game in town and the market wants headlines to work with, right now. The governments call to stop publishing youth unemployment numbers today, is also weighing on international capital, as transparency concerns resonate. For index traders headlines matter – when they come, we look at signal vs noise… keep your eyes peeled.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.